Ethereum Exchange Balances Hit 10-Year Low as Supply Dries Up

- ETH supply on centralized exchanges has fallen to 8.7 percent, the lowest level since Ethereum’s launch.

- Vitalik Buterin’s gas futures idea and Tom Lee’s $20,000 target highlight shifting supply, fee, and price dynamics for Ethereum.

Ethereum held on centralized exchanges has dropped to its lowest level since the network launched in 2015, tightening the pool of coins available for immediate trading.

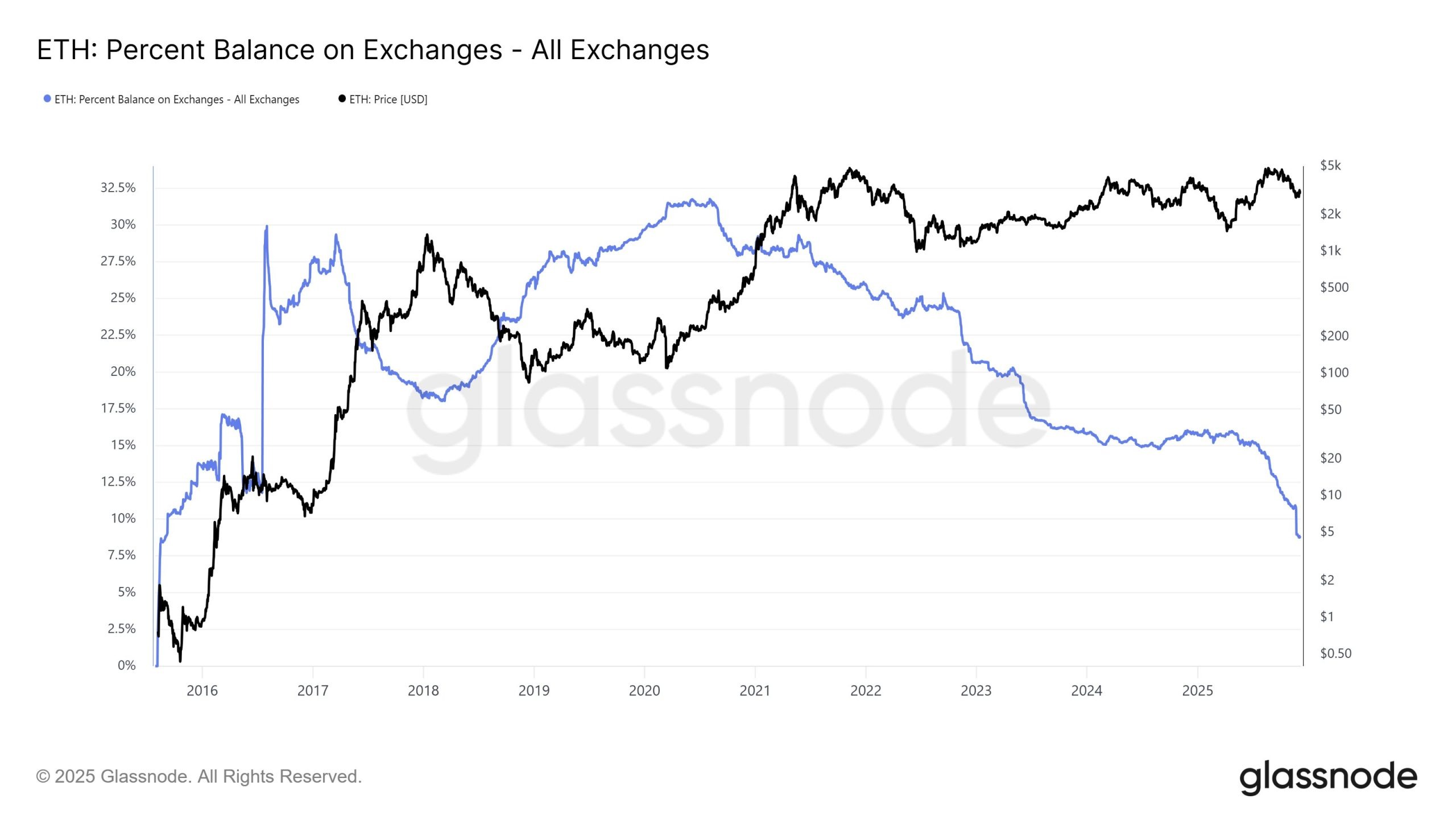

Onchain data from Glassnode show that only about 8.7 percent of the total ETH supply now sits on centralized platforms. In earlier cycles, that share climbed above 30 percent, as traders kept more coins on exchanges for active buying and selling.

The chart tracks the exchange share against Ethereum’s dollar price. It shows that, while price has moved through multiple bull and bear markets, the exchange balance has trended steadily lower since 2020.

Percent Balance on Exchanges – All Exchanges: Source: Glassnode on X

Percent Balance on Exchanges – All Exchanges: Source: Glassnode on X

Analysts say the decline suggests more ETH is moving into long term storage, staking contracts, or self-custody wallets, instead of staying in hot exchange accounts. As a result, the liquid float available to meet new spot demand continues to shrink.

Such structural shifts in supply do not set timing for the next major move. However, market watchers note that when demand increases into a thinner exchange order book, price swings can become sharper in both directions because fewer coins are immediately offered for sale.

Buterin Floats Idea for On-Chain Gas Futures Market on Ethereum

Meanwhile, Ethereum co-founder Vitalik Buterin has proposed a trustless on-chain futures market for gas to give users clearer visibility on transaction fees as network usage grows, as featured in our recent coverage.

Responding to questions about whether Ethereum’s roadmap can guarantee low gas costs, Buterin wrote on X that the ecosystem should explore a market that lets users lock in gas prices for future periods. He said such a system could be built around Ethereum’s base fees, which sit at the core of overall transaction costs and adjust with demand.

Fundstrat’s Tom Lee told Binance Blockchain Week attendees that a stronger Bitcoin cycle could pull Ethereum sharply higher, as mentioned in our previous news brief. He said a better market setup and friendly macro environment could put Ethereum in a strong position for the next rally. If that view proves right, Lee sees ETH trading above 20,000 dollars by early 2026.

]]>You May Also Like

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement

Dogecoin Rally Sparks Meme Coin Frenzy