Building the cornerstone of the AI economy: How does AI reshape the stablecoin landscape?

Author: 0xJeff

Compiled by: Tim, PANews

Stablecoins are the most important infrastructure ever created in the crypto space. Without stablecoins, we would not have a stable unit of account for investors to temporarily store their assets (it would be difficult to build centralized exchanges, decentralized exchanges, perpetual contracts, money markets, and all other verticals).

Stablecoins are entering a period of rapid popularization. Between 2023 and 2025, the total supply, transaction volume and turnover speed (referring to the frequency of stablecoin exchange) of stablecoins will all surge, especially in areas such as payment and cross-border transactions.

Not only that, we also see that regulatory laws are clearer and institutions are further adopting stablecoins: for example, payment company Stripe has launched stablecoin financial accounts in 101 countries around the world; Societe Generale plans to issue a US dollar stablecoin; large banks such as Bank of America, JPMorgan Chase, Citigroup and Wells Fargo are planning to jointly issue stablecoins; many large companies are exploring the use of stablecoin payments to reduce transaction fees for Visa and Mastercard; and many more related developments.

Circle's recent initial public offering was a huge success, which also set off a new wave of stablecoin craze and attracted more stakeholders to enter the market.

With the in-depth application of traditional finance, stablecoin innovation in the field of artificial intelligence is also advancing, aiming to solve the challenges faced by service providers and users in the Web3 artificial intelligence ecosystem.

The first challenge

Although AI teams typically design AI tokens as core components of the AI ecosystem (covering payments, governance, utilities, etc.), they prefer to focus their resources on AI product development rather than decentralized finance.

For example:

- Virtuals utilize their VIRTUAL and AGENT liquidity pools, and while this helps achieve good value accumulation for their VIRTUAL tokens, it also makes it difficult for Agent teams and LPs to provide liquidity (due to the impermanent loss problem).

- Aethir uses $ATH as a payment method for computing services. Although this can create a strong flywheel effect for the token, it also brings the problem of price fluctuations in payment units.

- Bittensor pays dTAO (subnet tokens) to miners, validators, and subnet owners ➔ Participants must sell subnet tokens in exchange for stablecoins to maintain operating funds.

While both of these examples could be good flywheels for AI tokens, they would also discourage some key players from participating because the design itself would induce market volatility.

(By the way, the three cases mentioned above are excellent examples. Many AI teams now have very poor token designs, especially those "fair launch" projects)

The increase in the number of tokens and the less-than-ideal design have led to thin market liquidity, making it difficult to build DeFi ecosystem applications on them.

Projects that address this challenge

Maitrix: AI Stablecoin Layer

Maitrix launches an overcollateralized AI native stablecoin (AI USD) for each ecosystem, transforming the originally volatile (but high-yield) AI economy into an economic system with predictability, composability and vitality, achieved through AI native stablecoins.

Maitrix Key Components

Users deposit AI tokens and their derivative assets (liquidity staked or staked AI tokens) through CDP to mint and destroy AI USD.

- Stablecoin Launch Platform: AI projects can use native tokens and their derivatives to create their own AI stablecoins

- Curve ve(3,3) model incentives: MAITRIX tokens implement governance through a voting trusteeship mechanism (ve), transfer the direction of token emission, and adopt a bribery system similar to the ve(3,3) mechanism.

- Stablecoin automatic market-making model: Supports exchange between various AI USDs tokens

Supported AI USD Stablecoin Assets (To Date)

- Aethir USD (AUSD): A stable payment solution for computing services

- Vana USD (VanaUSD) : Data-backed stablecoin

- Virtual USD (vUSD)

- ai16z USD (ai16zUSD)

- 0G USD (0USD)

- Nillion USD

More participants can be discussed later.

There isn’t much detailed documentation out there about the use cases for each AI stablecoin yet.

I’ll get into the technical details later once the white paper comes out, but for now, Maitrix is the only team building this financial infrastructure layer for AI projects and has already established key collaborations with several top AI ecosystems.

The Maitrix testnet has received a warm response and the mainnet will be launched soon.

The second challenge

With the continuous development and popularization of artificial intelligence, the market demand for computing resources is increasing day by day. Data center and cloud service operators need to plan ahead and plan resource expansion strategies in advance to seize the opportunities in the future market.

Enterprise-level GPUs (such as NVIDIA H100/H200) are often expensive and require large-scale financing. Traditional financing methods (such as bank loans or equity financing) are lengthy and complex, making it difficult for data centers to quickly expand capacity to meet market demand.

This is where Gaib and USDAI come in.

Projects that address this challenge

Gaib: The first economic layer for AI and computing resources

Gaib helps data centers finance efficiently by tokenizing future cash flows from GPUs, while providing investors with income-generating assets backed by real-world assets (GPUs).

It works roughly like this:

- Cloud service providers and data centers package future GPU revenue cash flows as securitized financial products

- These cash flows are tokenized and are spread over a period of 6 to 12 months.

- Investors buy these tokens and start claiming regular rewards.

They call this AI-generated dollar “AID.”

Each AID token is backed by a portfolio of graphics card financing transactions and is allocated treasury bonds or other liquid assets as reserves.

The floating yield is estimated to be around 40% annualized. This is highly dependent on the ratio of debt financing to equity transactions in the GPU portfolio (equity yield is 60-80%+ annualized, debt yield is 10-20% annualized).

The project, which has amassed around $22 million in total locked value to date, incentivizes users to make deposits through “Spice” points, which will make investors eligible for future airdrop rewards.

Earlier this year, Gaib partnered with Aethir to conduct the first GPU tokenization pilot project.

This pilot project is only a GPU tokenization and fragmentation solution, which is part of its roadmap and will be expanded to the GPU-backed stablecoin "AID" in the future.

If you are curious about how the protocol works and the anchoring mechanism and want to learn more, it is recommended to check out their Gitbook documentation.

USDAI (by Permian Labs): a yield-generating synthetic stablecoin backed by real-world assets

USDAI is very similar to Gaib in some ways, but also different in that it is a stablecoin backed by hardware assets as loan collateral (including graphics cards, telecommunications equipment, solar panels, etc.).

What is discussed here is a pure debt financing transaction: the borrower (asset holder) obtains a loan from USDAI and pays interest, and the income generated by this interest will belong to the USDAI token holder.

Permian Labs is the team behind the metastreet project. As a leading structured credit market platform, the project provides innovative financial services including NFT mortgages, structured credit products for illiquid assets and real-world assets (such as luxury watches and artworks), and NFT income token splitting solutions similar to Pendle PT YT.

USDAI has not yet been launched, but its goal is to set the annualized rate of return at 15-25%. The asset allocation will be gradually adjusted in three stages: initially 100% investment in US Treasury bonds, and eventually transitioning to 100% allocation of physical hardware assets. (Note: According to the supplementary field knowledge, "hardware" in the encryption field may refer to physical assets such as mining machines, which needs to be confirmed in conjunction with the project white paper)

USDAI uses CALIBER technology, which ultimately enables GPU on-chain operation by simplifying the loan and issuance process and complying with legal standards.

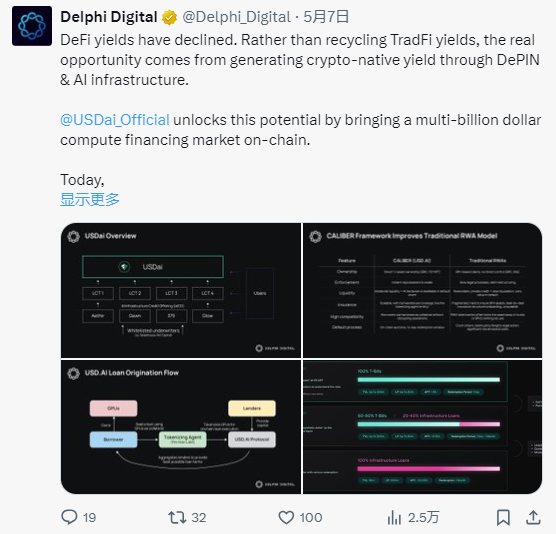

Here’s some more information on USDAI from Delphi Digital

OK, let's clarify the difference between the two: USDAI focuses on debt assets and provides a more diversified asset type. With its CALIBER model, they can cover a wide range of application scenarios (regardless of the demand), while Gaib focuses more on equity assets and provides a higher expected rate of return.

The private beta version of USDAI has been officially launched, with an initial locked value of 10 million US dollars.

If you are interested in being one of the first participants, you can fill out a form (they will provide additional incentives for early participants).

Other AI-related stablecoin products

Almanak recently launched alUSD (based on the ERC-7540 standard, which is an extension of ERC-4626). This is a tokenized AI yield optimization strategy that maximizes risk-adjusted returns by investing in stablecoins on platforms such as Aave, Compound, Curve, and Yearn.

The Almanak team is about to launch a points activity to introduce initial liquidity, while continuing to promote the construction of DeFi composability. In the future, users can use alUSD as collateral assets or conduct revolving loans to maximize their returns.

AixFi, interstable: This is a DeFi protocol vault that automatically deploys USDC assets. It will adopt a rule-driven model in the early stage, and gradually introduce an AI decision-making mechanism in the future. It is planned to be officially launched on the Virtuals platform this month.

What's next?

We may well see the rise of another Ethena-like protocol that focuses on leveraging GPU computing power to create high returns for users’ stablecoins. But what is more critical is how the protocol maintains its peg mechanism to ensure that the price can quickly return to the $1 value benchmark when a crisis breaks out.

We may see more tokenized AI strategies in the future. We have already witnessed AI’s remarkable ability to optimize returns, dynamically calculating variables such as gas fees, rebalancing fees, slippage, etc. (as shown in Giza’s ARMA strategy). If these strategies are tokenized into highly composable vaults, they can be used as collateral or to obtain returns through 5-10x leverage cycles. What kind of imagination will this open up?

We will see increased liquidity within the Web3 AI ecosystem. As players like Maitrix are building stablecoin infrastructure for the leading AI ecosystem, more AI-created value will become more composable and accelerate into the DeFi space, thereby enhancing the value capture capabilities of the entire Web3 ecosystem.

Although these teams are very interesting, in the field of stablecoins, risk, peg management, redemption, and liquidation mechanisms are crucial. Please make sure to fully read and understand all risk factors before deciding to invest.

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm