South Korean payments firm Kakaopay tumbles 17% as regulators sound alarm on stablecoins

Shares of Kakaopay dropped sharply after volatile trading as regulators warn of risks tied to widespread stablecoin adoption.

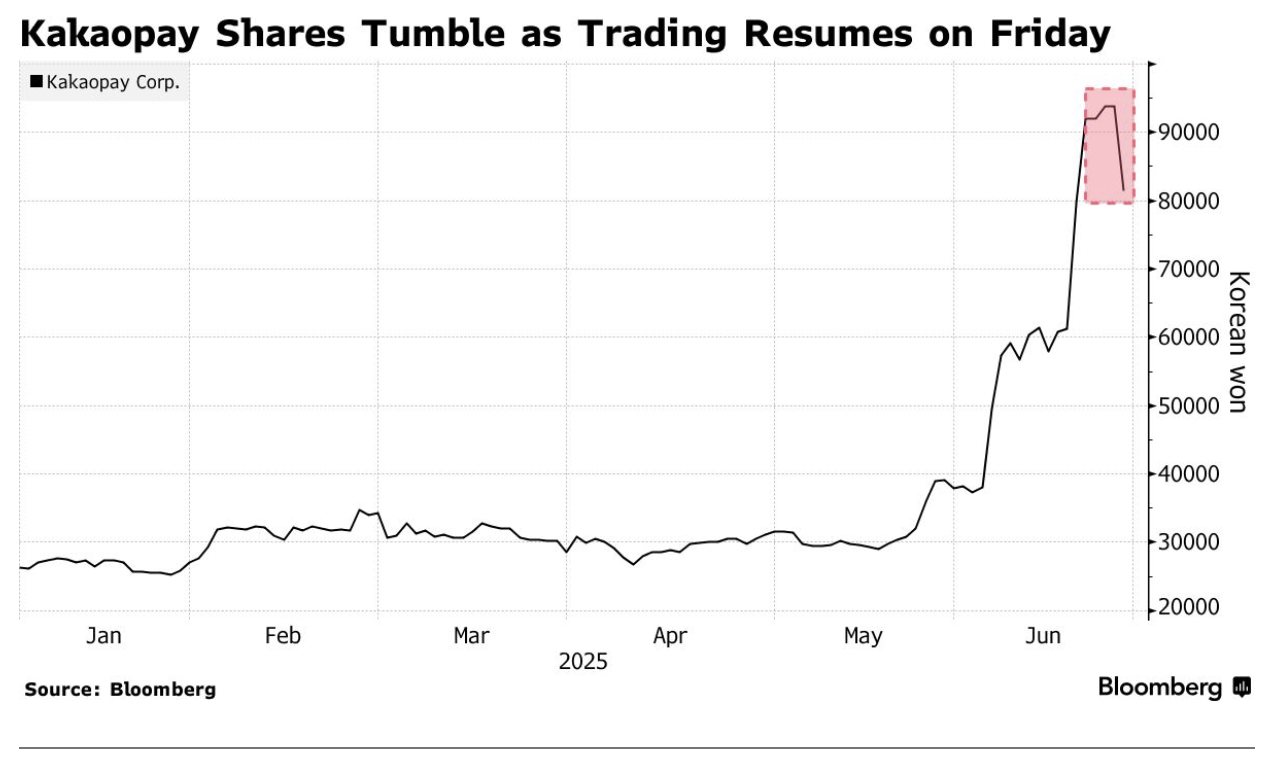

Shares of South Korean digital payments firm Kakaopay tumbled as much as 17% on June 27 after trading resumed Thursday, following a one-day suspension by the Korea Exchange, Bloomberg reported.

The halt came just days after an earlier suspension on Tuesday, triggered by a sharp rally that saw the stock surge around 50% in two sessions. Moreover, the stock has tripled in value over the past month, fueled by investor excitement over the company’s potential move into stablecoins.

The exchange suspended the stock twice due to its extreme price volatility, ultimately designating Kakaopay as an “investment risk.”

“Kakaopay was definitely overheated and went ahead of its fundamentals,” said Shawn Oh, an equities trader at NH Investment & Securities Co. in Seoul. “Going forward, the stock will face a reality check.”

As previously reported by the Korea Times, Kakao Pay recently filed 18 trademark applications. KakaoBank, another major Kakao Group affiliate, has also submitted multiple trademark applications related to its stablecoin business, covering cryptocurrency software, financial transaction services, and mining under brand names such as BKRW and KRWB.

“We submitted the trademark applications to proactively respond to developments in the stablecoin market,” a KakaoBank official said. “We will continue to carefully monitor relevant legal frameworks and market dynamics.”

These moves coincide with accelerated legislative discussions in South Korea’s National Assembly on the Digital Asset Framework Act, which, once enacted, would permit issuance of won-pegged stablecoins and open the market to major financial and fintech firms like KakaoBank and Kakao Pay.

However, the Bank of Korea recently cautioned that the widespread adoption of stablecoins could lead to risks including market instability caused by mass withdrawals (coin runs) and disturbances in the foreign exchange market.

Similarly, the Bank for International Settlements noted that stablecoins are not a substitute for traditional money, and their future role remains “unclear.”

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

Why This New Trending Meme Coin Is Being Dubbed The New PEPE After Record Presale