Ethereum Price Holds $3,000 Level as Vitalik Confirms Fusaka Upgrade Success

Ethereum ETH $3 123 24h volatility: 0.2% Market cap: $377.15 B Vol. 24h: $30.87 B price moved above the $3,000 mark on Thursday, Dec. 4, as investor sentiment strengthened following the successful completion of the Fusaka upgrade on Dec. 3.

In a statement shared on X, Vitalik Buterin, co-founder of Ethereum, declared PeerDAS in Fusaka will now enable consensus on blocks without requiring any single node to see more than a tiny fraction of the data. He noted that this mechanism remains resistant to 51% attacks.

Vitalik added that sharding has been a dream for Ethereum since 2015, and that data availability sampling has been researched since 2017, all now actualized by Fusaka. However, he highlighted three areas where Fusaka’s sharding implementation remains incomplete. The first concerns throughput on transactions on Layer-2 networks (L2s), but not on the Ethereum L1.

Vitalik listed a proposer–builder bottleneck as the second limitation and the lack of a sharded mempool as the third missing component which still needs to be developed.

Despite these gaps, Vitalik described Fusaka as a fundamental step forward in the blockchain’s initial design. He said the next two years will be devoted to refining PeerDAS, increasing its scale, ensuring stability, using it to expand L2 throughput, and eventually turn it inwards to scale Ethereum L1 gas, once ZK-EVMs mature.

Vitalik’s rhetoric rang through the market. Derivatives showed a cautious undertone among speculative traders, keeping an eye on the weak macro sentiment keeping Bitcoin BTC $92 118 24h volatility: 1.0% Market cap: $1.84 T Vol. 24h: $71.59 B price pinned below $95,000 since the breakdown below $83,000 late in November.

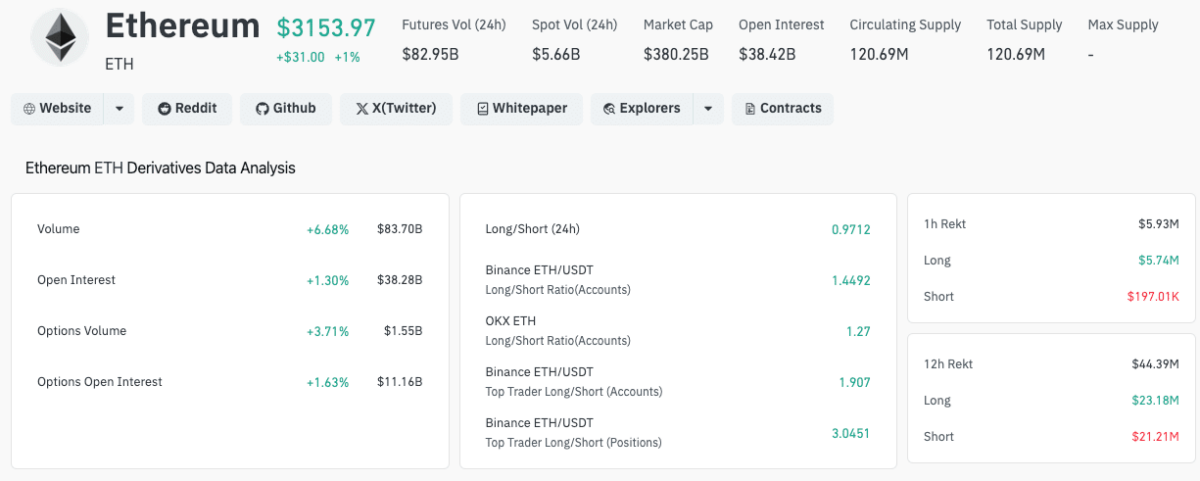

Ethereum (ETH) Derivative Market Analysis | Source: Coinglass

While the Fusaka announcement helped drive a 3% spot price increase, Coinglass data showed limited appetite for leveraged long positions. Trading volume rose 6.68% to $83.70 billion, but open interest increased only 1.30% to $38.28 billion. The muted response signals reluctance among derivatives traders to chase the rally.

The long/short ratio at 0.9712 shows that most of the incremental open interest came from short positions, indicating that traders are positioning for the possibility of an early pullback despite the technical breakthrough above $3,000.

Ethereum Price Forecast: What Next for ETH Price After the Fusaka Upgrade?

ETH price consolidating $3,100 with strong support at $2,880–$2,950 support channel, as traders in recent sessions recorded high profitability of over 63%. The win–loss ratio on short-term holders flipped positive for the first time this week, confirming improved spot participation following Vitalik’s Fusaka commentary.

Ethereum price is now attempting to break above the mid-range resistance at $3,080. A clean candle close above this level exposes the upper band of the ascending channel near $3,160, which aligns with the R1 pivot.

A move past R1 would bring the next upside target at $3,240 into view, representing a 6.8% upside from current levels. The R2 pivot at $3,310 is the eventual bullish target if momentum accelerates and short-squeeze conditions emerge.

Ethereum (ETH) Technical Price Analysis | TradingView

The RSI sits in a balanced mid-50s range, indicating room for expansion without entering overbought territory. This suggests ETH can sustain gradual appreciation without immediate exhaustion. Profitability trends remain supportive: with the majority of holders in green but not excessively so, the market is not near a mass-distribution risk zone.

If ETH maintains momentum and derivatives shorts fail to gain traction, Ethereum could retest $3,160 in the near term. Sustained bullish flows into next week could put $3,240 in sight. But elevated short participation and weak macro sentiment suggest this outcome remains unlikely.

Bitcoin Hyper Presale Crosses $28 Million as Traders Bet on Ethereum Rebound

As the Ethereum price rebounds this week, early stage projects like Bitcoin Hyper are drawing attention.

In addition to staking rewards of up to 40%, Bitcoin Hyper (HYPER) promises lightning-fast and low-cost transactions aimed at expanding Bitcoin’s use cases for payments, meme coins, and dApps.

Bitcoin Hyper Presale

HYPER has raised over $28.9 million, with its presale price currently set at $0.013235 per token. Prospective investors can visit Bitcoin Hyper’s official presale website to get in early before the next price tier unlocks.

nextThe post Ethereum Price Holds $3,000 Level as Vitalik Confirms Fusaka Upgrade Success appeared first on Coinspeaker.

You May Also Like

Renowned Author Robert Kiyosaki Addresses Controversy Over Bitcoin Statements

Perp Traders Prioritize Capital Efficiency As On-Chain Infrastructure Matures