Cardano whales buy the dip as doubts among retail investors persist

- Cardano ticks lower, pausing its weekly increase and putting into question a potential morning star pattern.

- On-chain data indicate that large investors are acquiring ADA while retailers are shedding it.

- The derivatives data shows a spike in Open Interest.

Cardano (ADA) takes a modest dip of under 1% at press time on Wednesday, losing steam after a Doji candle formed in the previous session. The on-chain data show growing support from large investors, commonly referred to as whales, while the holding of retail Cardano investors declines, suggesting a decrease in risk appetite.

The ADA open interest spike suggests increased inflows due to heightened buying activity, rising chances of a leverage-driven uptrend.

Cardano retail investors offload holdings

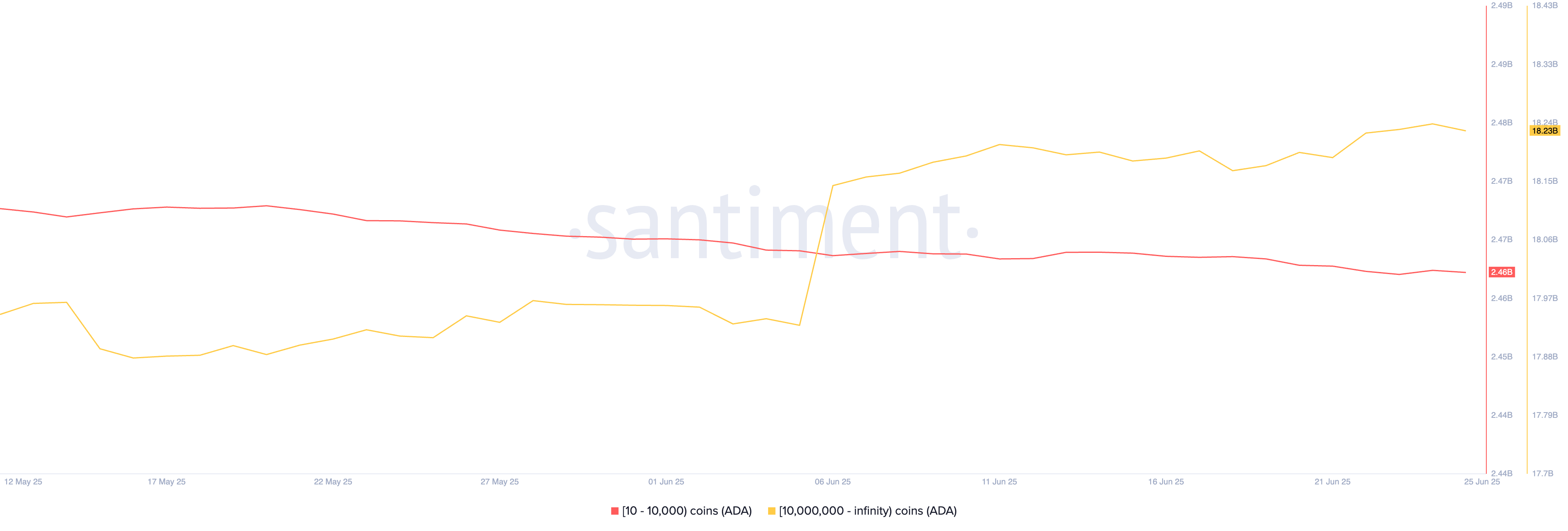

Santiment data shows that investors holding 10 to 10,000 ADA have offloaded 10 million ADA tokens since June 1, as their holdings have reached 2.46 billion ADA. Typically, the holding size relates to retail investors for a token trading below $1.

Turning to large investors with more than 10 million ADA in holdings, they have purchased 270 million ADA tokens in June, inflating the holding size to 18.23 billion ADA from 17.96 billion ADA.

Cardano supply distribution. Source: Santiment

The growing confidence of large investors in Cardano promotes a long-term optimistic outlook. However, the declining holdings of retail investors align with their lack of holding capacity, increasing their chances of missing out on the next recovery run.

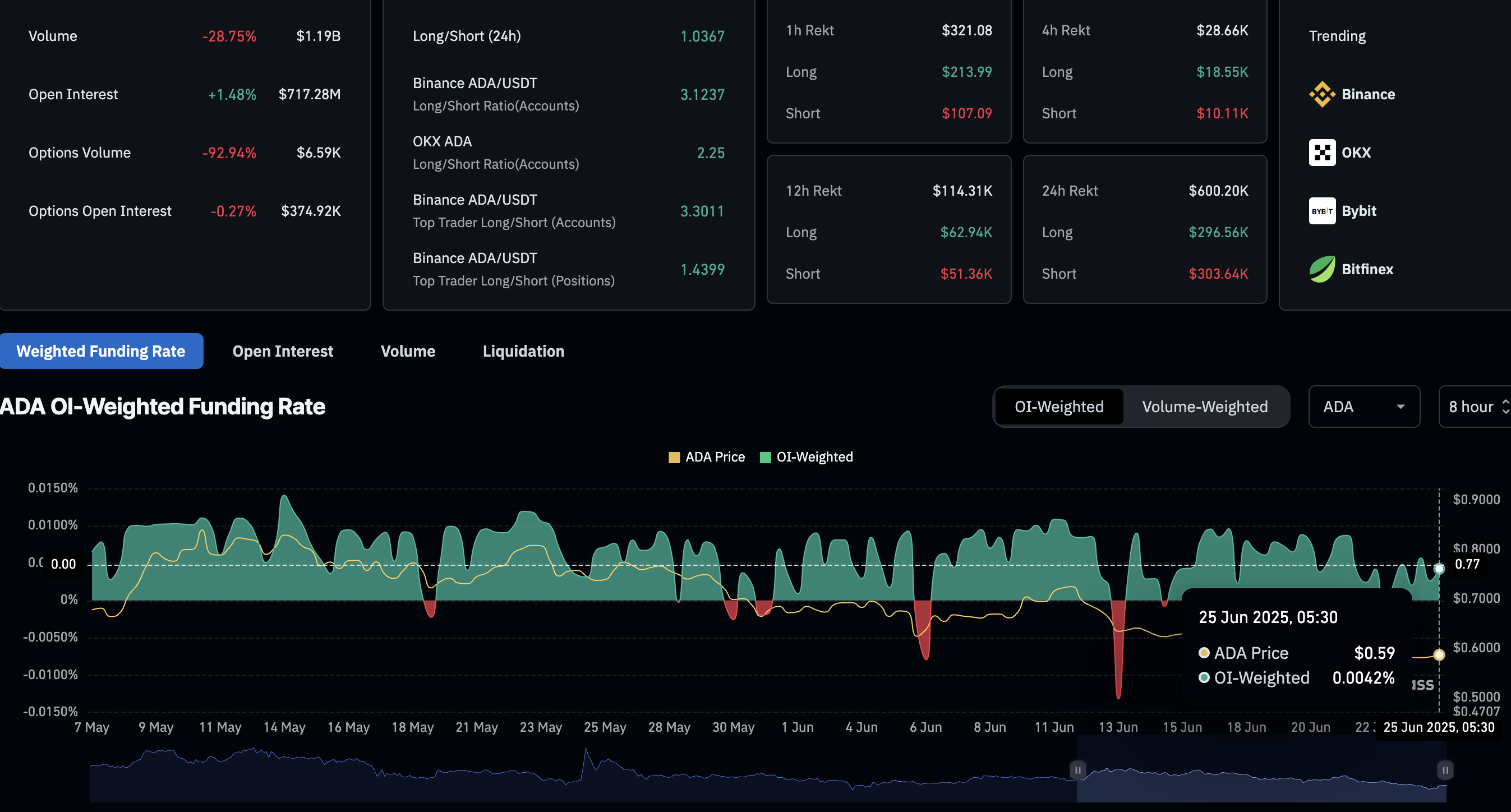

ADA's Open Interest holds above $700 million

CoinGlass data shows ADA Open Interest rising by 1.48% in the last 24 hours to reach $717.28 million. An increasing OI reflects heightened buying activity driving capital inflows in the derivatives market.

Alongside the OI spike, the OI-weighted funding rate at 0.0042% cements the buying activity, outpacing bearish-aligned positions. Funding rates, if positive, are paid by bulls to maintain a balance between swap and spot prices.

The long/short ratio of 1.0367 indicates a neutral stance with a marginally greater number of long positions. To put this into perspective, the long positions wiped out in the last 24 hours account for $296.56K, while short liquidations account for $303.64K.

Cardano derivatives data. Source: Coinglass

Cardano Price Forecast: ADA eyes falling channel’s upper boundary line

Cardano ticks a modest drop at press time on Wednesday, holding to over 7% gains registered on Monday. The recovery stems from a local support trendline formed by lows on May 18 and June 22.

Price action projects a falling channel on the daily chart, connected by swing highs on May 23 and June 11. The recovery aims towards the upper trendline near $0.64. A potential closing above the trendline could extend the uptrend towards the Pivot Point at $0.7309.

The Moving Average Convergence/Divergence (MACD) indicator shows the MACD line nearing its signal line for a crossover. A decline in the red histogram indicates a drop in selling pressure. Investors could consider the surge of green histogram bars from the zero line upon the crossover of the MACD and signal lines as a buy signal.

The Relative Strength Index (RSI) rebounds from the oversold region to 38, indicating a gradual decline in selling pressure.

ADA/USDT daily price chart.

However, if Cardano records a bearish closing on Wednesday, a reversal could retest the S2 at the $0.50 psychological support level.

(This story was corrected on June 25 at 09:35 GMT to mention S2 level, not Pivot Point.)

You May Also Like

Cathie Wood's Ark Bets Big On Solana Treasury Play: Makes $162M Investment In Brera Holdings As Stock Explodes 225%

A Reality Check Pi Holders Might Not Want to Hear