Bitcoin Won’t Hit $200K Until 2029, Warns Peter Brandt As Market Falls Below $3 Trillion

Key Takeaways

- Veteran trader Peter Brandt claims that Bitcoin will not hit $200K until 2029.

- The total cryptocurrency market capitalization has experienced a significant drop in November 2025, reportedly falling below $3 trillion.

- Bitcoin is currently trading below $90K and is valued at $83,515, indicating a 12% weekly drop at the time of writing.

Peter Brandt, a veteran trader and one of the prominent crypto experts, has forecasted that Bitcoin will reach the $200K price point only in 2029, ruling out the possibility of BTC breaking above $200K before Q3 2025. He denied the near-term expectations for BTC amidst the crash and made a bold statement regarding its future rally. On November 21, Peter Brandt made his statement through his official X account, challenging other experts and crypto leaders who believe in BTC’s capacity to hit an earlier major milestone.

Peter Brandt posted on his X account that he was a long-term bull on Bitcoin. He stated that the dumping was the best thing that could happen to Bitcoin. He mentioned that the next bull market in Bitcoin should take them to $200,000 or so and that it should be around Q3 2029.

In his recent X post, he challenged prominent figures in the cryptocurrency sector, Arthur Hayes and Tom Lee, who predicted earlier that Bitcoin would hit at least $200,000 by the end of this year. Brandt’s view clashes with predictions from Coinbase CEO Brian Armstrong and ARK Invest CEO Cathie Wood, who expect Bitcoin to hit $1 million by 2030, roughly five times above his estimate.

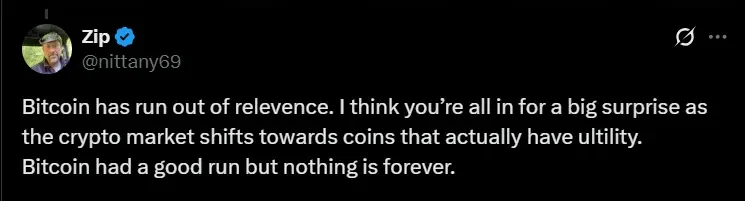

Cryptocurrency enthusiasts are monitoring market conditions, with some traders arguing that Bitcoin has lost its relevance. An X account named Zip commented on Brandt’s post that Bitcoin had run out of relevance.

He thought that they were all in for a big surprise as the crypto market shifted towards coins that actually had utility. He added that Bitcoin had had a good run but that nothing was forever. He also claimed that Bitcoin is bleeding out because it has no use and is not compatible with the new crypto.

Peter Brandt also forecasted XRP’s price back in October and posted on X. In his X post, he revealed that XRP could fall as low as $2.2, and he explained it using a price analytics chart by highlighting a classic descending triangle.

The altcoin failed to hold above $3 later despite ETF-driven optimism, and XRP is currently trading below $2.00, valued at $1.90 at the time of writing.

Bitcoin Is On The Verge Of Repeating The 1970s Commodity Pattern?

Brandt compared the current Bitcoin structure to the soybean market of the 1970s, which experienced a massive surge before it fell by 50%. The supply of soybeans overwhelmed the demand, and the market fell. In his comparison, BTC is also demonstrating the early stages of that historic drop suffered in the 1970s.

According to current market statistics, BTC is trading below $90K with a 12% drop over the past week. BTC price today is $83,515, currently reviving slowly from the $80,537 recorded on Nov. 21, the moment when holders panicked and mounted selling pressure.

The total cryptocurrency market capitalization has also experienced a significant downturn in November 2025. According to the latest information, in November, the total cryptocurrency market capitalization fell below $3 trillion, reportedly losing over $1 trillion in value since early October. The expert analysis concludes that multiple macroeconomic and technical factors are driving this decline.

His prediction has incited heated debates in the cryptocurrency market, and he even encountered retaliation from the crypto community. As a response, he posted on X stating that he was now done posting about Bitcoin to public for the time being due to the amount of trolls. He mentioned that X had become a toxic place to hang out and that he would now return to his first love, which was the futures markets he had traded for a living since 1975.

The post Bitcoin Won’t Hit $200K Until 2029, Warns Peter Brandt As Market Falls Below $3 Trillion appeared first on BiteMyCoin.

You May Also Like

How To Make Over $100,000 A Year As A Shepherd

Bitcoin Weekend Rebound May Mask Structural Risks After Historic Liquidations as Traders Buy Puts