Vitalik Buterin offloads fresh bag of memecoins for $14k

Ethereum co-founder Vitalik Buterin is once again in the spotlight after offloading another batch of memecoins.

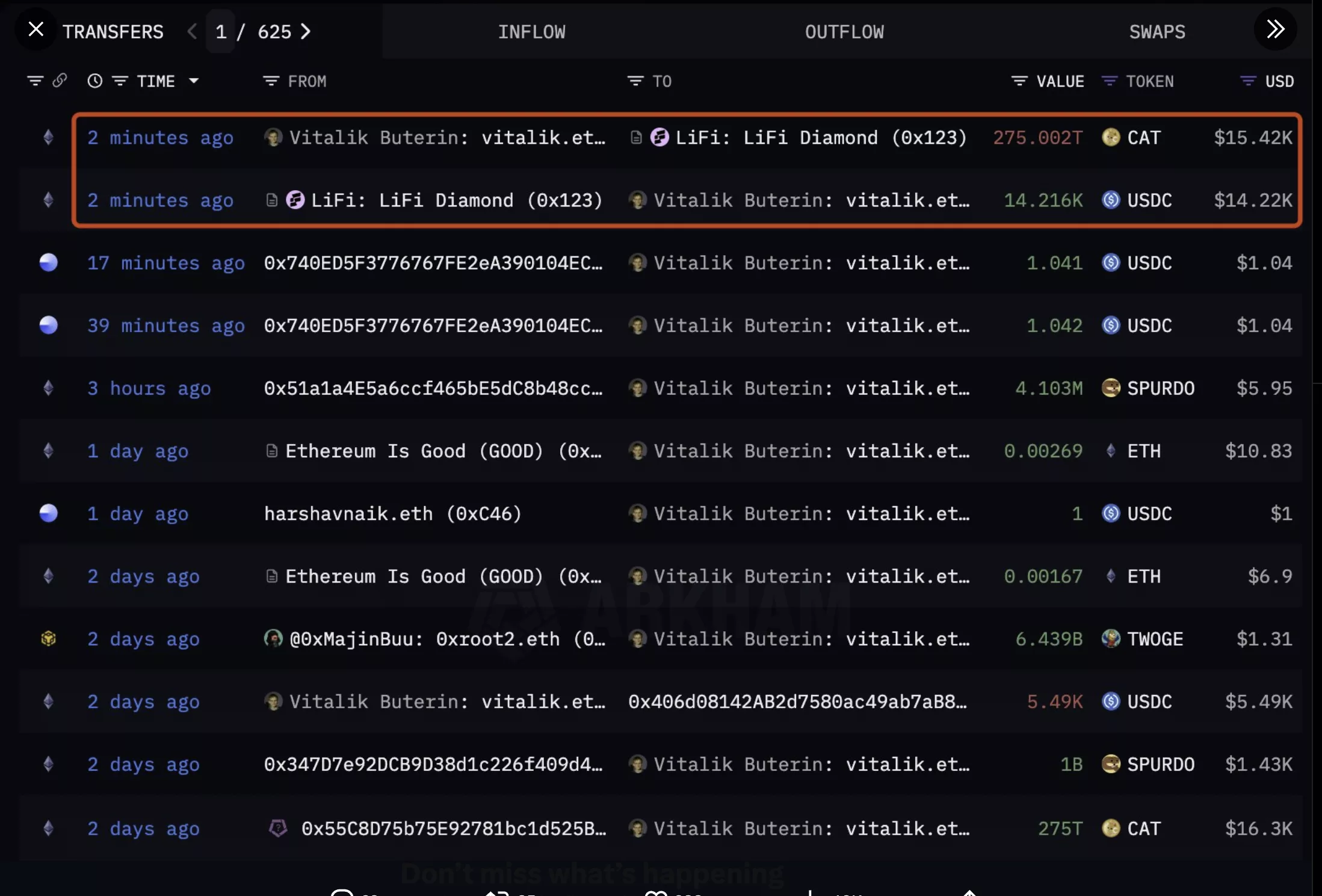

- Vitalik Buterin has sold 275 trillion CAT tokens for $14,216 on Lifi Diamond.

- The sale follows his pattern of dumping unsolicited memecoins sent to his wallet.

- The Ethereum co-founder also received other tokens like SPURDO and TWOGE this week.

- The broader crypto market remains bearish, with $812 million liquidated in 24 hours and Ethereum trading below $4,000.

Vitalik Buterin has once again cleared out a stash of unsolicited memecoins, converting them into $14,216 worth of USDC. The move continues a longstanding pattern in which Buterin sells off random tokens sent to his wallet, often without prior notice or consent.

According to on-chain data, the sale involved 275 trillion CAT tokens, which Buterin offloaded via Lifi Diamond, a multi-chain liquidity aggregator. The tokens were reportedly sent to his wallet just two days earlier. In typical fashion, the transaction sparked a dip in CAT’s price, which is down 0.81% in the last 24 hours.

Meanwhile, the CAT memecoin was not the only asset to hit Buterin’s wallet this week. Blockchain records show he also received 1 billion SPURDO and 6.439 billion TWOGE tokens, likely another publicity stunt by small-scale projects aiming to leverage Buterin’s reputation to gain attention.

While Buterin has not publicly disclosed the motive behind the latest sale, such liquidations have previously been followed by donations to charitable causes. Earlier in October, he converted a batch of assorted memecoins totaling $96,000 ETH, which added to speculation about his consistent disinterest in holding memecoins.

Vitalik Buterin’s memecoin history

Amid the recent dump, Buterin has repeatedly voiced concerns over memecoins, labeling them as digital assets without value and urging projects to stop sending them to his wallet. Despite these warnings, his public wallet remains a frequent target for token airdrops, often used to create artificial hype.

Notably, the memecoin sale comes amid a broader downturn in the crypto market. Over $812 million in positions have been liquidated in the past 24 hours, and total open interest has dropped by 1.28% to $161 billion. Ethereum’s price has dipped below the $4,000 mark, struggling to regain momentum as bearish sentiment lingers, even in the face of a U.S. Federal Reserve 25bps rate cut.

While Vitalik Buterin’s latest sale may seem small in value, it reinforces his ongoing stance against memecoins and the market’s persistent attempts to exploit his name for visibility.

You May Also Like

Solana Hits $4B in Corporate Treasuries as Companies Boost Reserves

FedEx (FDX) Q1 2026 Earnings