Best Altcoins To Buy For Next Bull Run: This Under $1 Crypto Gears Up For 186% ROI

Traditional investors are discovering that investing in top altcoins to buy now offers more than just volatile price movements. With Ethereum’s mature staking ecosystem now delivering steady returns of around 4% annually, institutional players have found their comfortable middle ground. Yet while these methodical gains satisfy pension funds and asset managers, a parallel gaming revolution is creating opportunities that dwarf conventional staking yields.

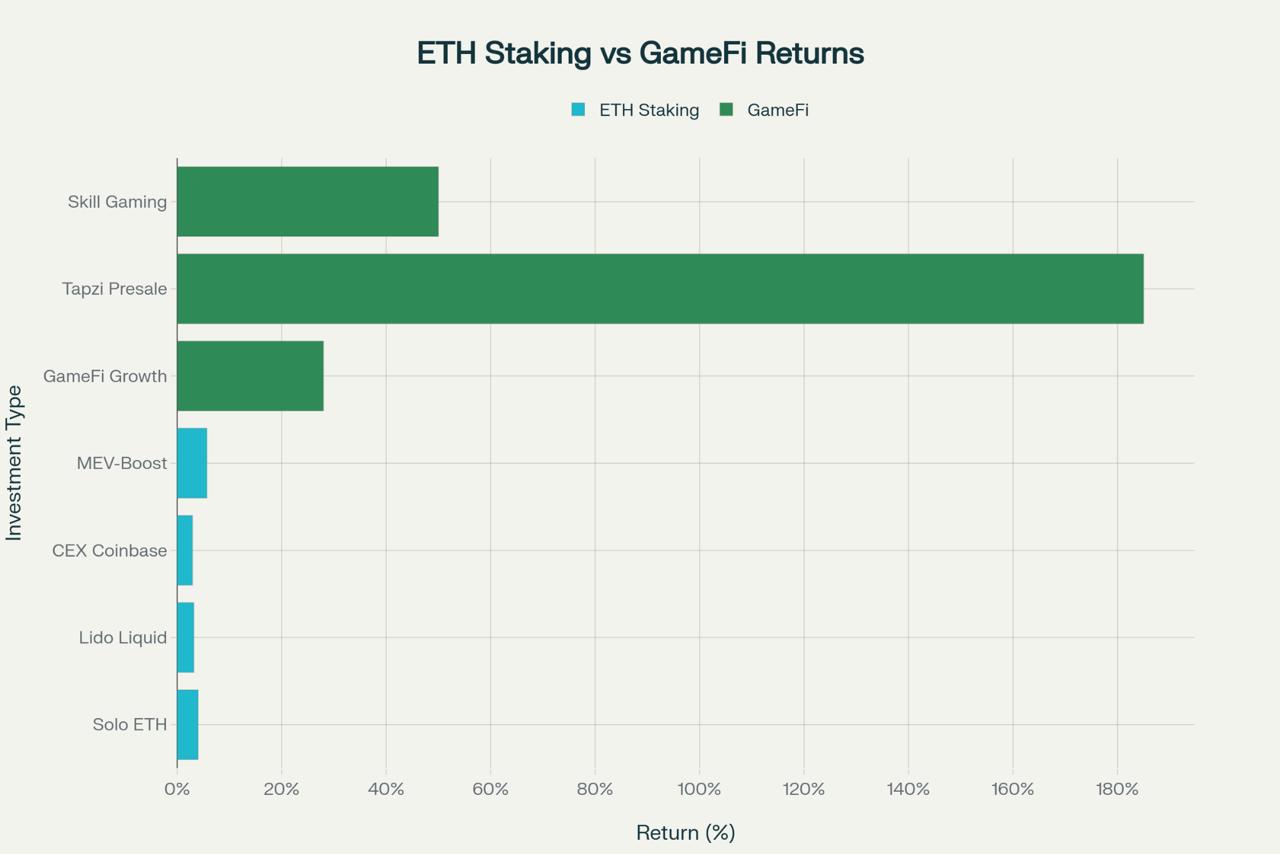

New crypto coins like Tapzi are carving out territory where skill-based gameplay can potentially deliver returns exceeding 200%, creating a new category of crypto investment that combines entertainment with substantial financial upside.

The blockchain gaming sector has matured far beyond early speculation. GameFi reached over 1 million daily users in Q1 2025, and industry projections suggest growth from $23.75 billion in 2025 to $219 billion by 2034. Tapzi and Ethereum remain investors’ picks as the best altcoins for next crypto bull run.

Ethereum Staking Landscape: Modest but Steady Returns

Ethereum’s transition to proof-of-stake has created a stable foundation for crypto yield generation. Current staking rewards across major platforms demonstrate the maturity of this market segment. Solo staking delivers approximately 4% APY, while liquid staking protocols like Lido offer 3.19% returns. Centralized exchanges typically provide lower yields, with Coinbase offering 2.93% annually.

Comparisons of ETH Staking Returns vs Gamefi Potential Returns in 2025

The institutional appeal becomes clear when examining the numbers. Over 35 million ETH is now staked, representing roughly 30% of the total supply. This participation rate reflects confidence from major players who prioritize capital preservation alongside modest yield generation. MEV-enabled validators can achieve higher returns of around 5.69%, though this requires additional technical expertise.

Recent regulatory developments have accelerated institutional adoption. The SEC’s August 2025 guidance on liquid staking removed significant barriers, leading to staking-enabled ETF launches from major providers. Grayscale’s October staking launch marked a watershed moment, with analysts projecting that institutional flows could bring billions in new liquidity to Ethereum validation.

October 2025 specifically brought renewed optimism around Ethereum staking ETFs, with BlackRock’s approval deadline approaching. Analyst Axel Bitblaze expects final approval as early as October 2025, noting that “BlackRock’s ETH staking approval has a next deadline in October, and I believe approval is likely to happen”. This regulatory clarity provides traditional investors access to blockchain rewards without direct technical implementation.

GameFi Revolution: Where Skill Meets Blockchain Rewards

The gaming sector presents a dramatically different risk-reward profile compared to traditional staking. While Ethereum offers steady returns, blockchain gaming taps into a global industry projected to reach $400 billion by 2028. Web3 gaming specifically represents a subset growing from $25 billion in 2024 to nearly $125 billion by 2032.

This growth stems from fundamental shifts in gaming economics. Traditional games extract value from players through purchases and subscriptions. Blockchain gaming flips this model, enabling players to own assets, earn rewards through gameplay, and participate in platform governance. The result is sustainable engagement that drives long-term token demand rather than speculative trading.

Market data support this transformation. GameFi reached a $16.35 billion valuation in 2024 and projects growth to $257.93 billion by 2035 at a 28.5% CAGR. Unlike earlier play-to-earn experiments that collapsed due to unsustainable tokenomics, current projects focus on skill-based mechanics and deflationary supply models.

The Asia-Pacific region leads this adoption, driving approximately one-third of users and half of GameFi revenues. However, institutional interest is expanding globally as traditional gaming companies recognize blockchain’s potential for creating verifiable ownership and cross-platform asset transfer.

Tapzi’s Skill-First Approach is Redefining Web3 Gaming Economics

Tapzi represents the evolution of GameFi beyond speculation toward sustainable skill-based economics. The project launched its presale in July 2025 with tokens priced at $0.0035, targeting a $0.01 launch price that offers 185% returns before exchange listings. By October 16, 2025, over 80 million tokens had been sold, representing approximately 57% completion.

The platform differentiates itself through classic skill-based games, including Chess, Checkers, Tic-Tac-Toe, and Rock-Paper-Scissors. Players stake TAPZI tokens to enter matches, with winners claiming the entire prize pool. This player-funded system avoids the inflationary pressures that destroyed earlier GameFi projects, creating sustainable reward mechanics.

Tapzi’s tokenomics emphasize long-term value creation. The project features a fixed 5 billion token supply with only 20% allocated to presale. Remaining tokens support liquidity (20%), treasury (15%), and development (45%) with vesting schedules designed to prevent early dumping. Team tokens are locked for six months and vest over 18 months.

The platform’s alpha version already demonstrates functionality, allowing wallet connections for competitive matches with on-chain result verification. Future development includes mobile applications, NFT avatars, and software development kits for third-party integration, positioning Tapzi as infrastructure for skill-based Web3 gaming.

Traditional Staking vs Gaming-Based Returns

The contrast between Ethereum staking and GameFi investments reflects broader trends in cryptocurrency maturation. Staking appeals to risk-averse institutions seeking predictable returns with regulatory clarity. Current yields average 3-4% annually with minimal volatility beyond ETH price movements.

GameFi investments target higher risk tolerance with significantly greater upside potential. Tapzi’s presale offers immediate 185% returns upon launch, with analysts projecting 1000x+ potential if adoption aligns with broader GameFi growth. However, these returns require active participation and skill development rather than passive holding.

Recent market conditions highlight these dynamics. October 2025 brought volatility as Bitcoin dropped from $126,272 to below $105,000 before recovering. Ethereum staking remained stable throughout this turbulence, while GameFi tokens.

Tapzi launched a $500,000 $TAPZI token giveaway across nine prize tiers. Multiple winners will be selected from community participants. Entry link: https://tapzi.io/giveaway-500

Media Links:

Website: https://tapzi.io/

Whitepaper: https://docs.tapzi.io/

X Handle: https://x.com/Official_Tapzi

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Best Altcoins To Buy For Next Bull Run: This Under $1 Crypto Gears Up For 186% ROI appeared first on Coindoo.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

Kalshi debuts ecosystem hub with Solana and Base