U.S’s Biggest Crypto Capture Impacts the Market

Takeaways:

- The U.S. government seized a record $15B in Bitcoin from a major international crime ring.

- The criminal organization allegedly used forced labor to run online fraud schemes.

- Bitcoin Hyper ($HYPER) is a new project aiming to solve Bitcoin’s speed and scalability issues.

Talk about a big haul. The U.S. government has just carried out the largest crypto forfeiture in history, seizing a jaw-dropping 127,271 $BTC, which is approximately $15B worth, from a major international crime ring. This isn’t just a big win; it’s a new record, blowing past even the famous Silk Road case.

The target? A guy named Chen Zhi, who heads up the Cambodia-based Prince Holding Group. According to the Treasury Department’s Office of Foreign Assets Control (OFAC), his organization was allegedly running a massive scam, using trafficked workers to run online fraud schemes that stole billions from people, including many Americans. They were literally forcing people to scam victims.

This criminal gang wasn’t exactly subtle, either. The Treasury states that it has sued over 100 fake companies to prevent them from laundering their dirty money. They had their hands in everything from Bitcoin mining in Laos to luxury resorts. The feds were able to trace the stolen Bitcoin wallets linked to these shady operations, and now it’s all in the hands of the U.S. government.

So, what happens to all that money? While the government hasn’t confirmed, it’ll likely be used for purposes such as funding law enforcement operations or establishing a fund to help victims recover some of their lost money.

There’s even a chance the government could simply hold onto the Bitcoin, adding it to a special U.S. Strategic Bitcoin Reserve. Whatever the final decision, this historic seizure is a powerful message that the long arm of the law is reaching deep into the world of crypto crime.

Bitcoin Hyper: The Ultimate Upgrade for the Crypto King

Bitcoin has long been the supreme ruler and undisputed king of crypto, a digital store of value revered for its security and decentralization. But using it for everyday transactions can feel like trying to pay for a coffee with a gold bar.

It’s slow, expensive, and wasn’t built for the fast-paced world of DeFi and modern dApps. That’s where Bitcoin Hyper ($HYPER) comes in, giving Bitcoin a much-needed upgrade.

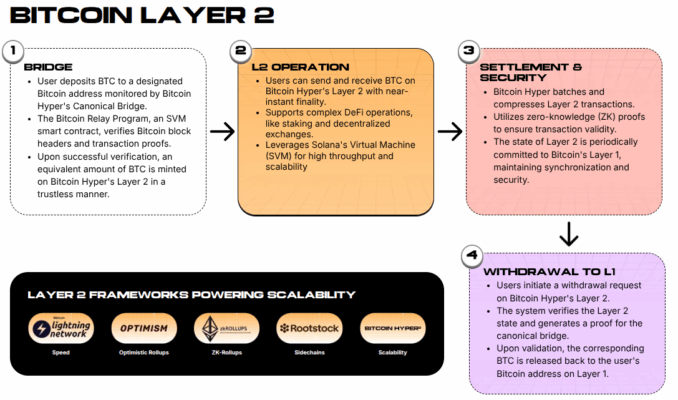

Bitcoin Hyper is a cutting-edge Layer-2 solution built on top of the Bitcoin network. It’s designed to solve Bitcoin’s biggest problems: speed and scalability. By leveraging the Solana Virtual Machine (SVM) and a secure Canonical Bridge, Bitcoin Hyper creates a lightning-fast express lane that sits right next to Bitcoin’s main highway.

You can move your regular Bitcoin onto this new chain and suddenly your slow and clunky $BTC becomes speedy, with near-zero fees. This innovative approach allows $BTC to become a dynamic, high-performance engine for a new global financial system, all while keeping the security and trust that make it so valuable.

The Power of $HYPER: A New Era of Bitcoin Utility

Bitcoin Hyper isn’t just about faster transactions; it’s about unlocking a whole new world of possibilities for Bitcoin. The use of the SVM means that developers can now build and deploy a wide range of decentralized applications directly on the Bitcoin ecosystem.

This includes everything from DeFi protocols and NFTs to gaming and beyond. The $HYPER token is the fuel for this new ecosystem, used for transaction fees, staking, and future community governance.

The excitement around $HYPER is massive. The presale has already raised over $23.6M attracting significant attention from whales who see the potential for a massive price surge. One whale bought over $32K yesterday.

The presale is structured in stages and offers a dynamic staking APY, currently sitting at 50%. This momentum, combined with a clear roadmap for mainnet launch and major exchange listings, makes Bitcoin Hyper ($HYPER) a project to watch.

It’s an opportunity to be part of a solution that could finally bring Bitcoin to the masses, transforming it into a truly useful and versatile asset.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post U.S’s Biggest Crypto Capture Impacts the Market appeared first on Coindoo.

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

FCA, crackdown on crypto