A7A5 Surges to Top Non-Dollar Stablecoin Despite Sanctions

Introduction:

In a surprising turn within the crypto markets, A7A5, a stablecoin backed by the Russian ruble and issued in Kyrgyzstan, has surged to become the largest non-US dollar stablecoin globally. Despite facing multiple sanctions, its market capitalization recently climbed sharply, signaling a notable shift in how crypto assets are navigating international restrictions and geopolitical tensions. The rise of A7A5 underscores the evolving landscape of blockchain-based currencies amid mounting regulatory scrutiny.

- A7A5, a ruble-backed stablecoin in Kyrgyzstan, has become the leading non-USD stablecoin worldwide, with a market cap nearing $500 million.

- Despite sanctions targeting its issuer and related entities, A7A5’s market value experienced a sudden increase of $350 million in a single day, surpassing competitors like EURC.

- The stablecoin’s growth is linked to its ties with Russian and Chinese entities, raising questions about regulatory compliance and sanctions evasion in the crypto industry.

- Its prominence at industry events like Token2049 has stirred controversy, bringing attention to ongoing challenges around crypto regulation and transparency.

A7A5: A brief timeline of sanctions

The A7A5 stablecoin was launched in February, purportedly secured by a diversified portfolio of fiat deposits in Kyrgyzstan’s banks. Pegged 1:1 to the Russian ruble, it promised users a daily passive income equivalent to half of deposit interest, and was issued on both Ethereum and Tron blockchains.

Initially seen as a digital currency alternative, A7A5 quickly became linked to controversial exchanges, notably Grinex — a platform viewed as the successor to sanctioned Russian Garantex. In mid-August, the U.S. Treasury announced sanctions against Garantex and affiliated entities, naming Promsvyazbank PSB, the Russian bank connected to the stablecoin’s issuer, as part of a broader crackdown. The UK also imposed sanctions, accusing Russia of using A7A5 to circumvent Western financial restrictions.

The U.S. Treasury Department announced sanctions against Garantex and affiliated entities on August 14, 2025. Source: Treasury.govA7A5’s meteoric market cap increase

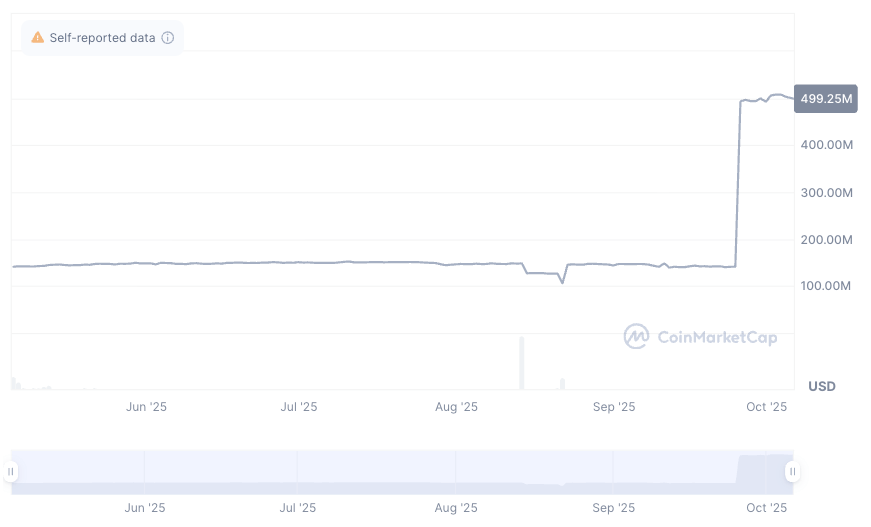

Despite the ongoing sanctions, A7A5’s market capitalization has remained resilient, fluctuating between $120 million and $140 million. Remarkably, on September 25, the stablecoin’s value skyrocketed by $350 million — a 250% jump in just one day — making it the largest non-dollar stablecoin globally, overtaking European-pegged EURC, which was valued at approximately $252 million at the time.

A7A5 (A7A5) market capitalization since May 2025. Source: CoinMarketCap

A7A5 (A7A5) market capitalization since May 2025. Source: CoinMarketCap

The timing of this surge coincided with A7A5’s appearance at Token2049, a prominent crypto industry conference in Singapore, where its executives, including Oleg Ogienko, featured prominently. This visibility sparked debate within the crypto community about compliance standards and the need to address regulatory loopholes that allow such projects to operate despite sanctions.

Investigations suggest that A7A5’s rapid growth is closely linked to its activities with China. The nonprofit organization Centre for Information Resilience (CIR) reported that approximately 78% of A7A5 transactions pass through Chinese jurisdictions and highlighted expansion into Africa, with offices established in Nigeria and Zimbabwe. The report indicates further research is necessary to understand the full scope of funding flows and potential links to Russian political interference schemes.

As authorities scrutinize these developments, the evolving case of A7A5 exemplifies the complex challenges facing the crypto industry in balancing innovation with regulatory compliance in an increasingly geopolitically charged climate.

This article was originally published as A7A5 Surges to Top Non-Dollar Stablecoin Despite Sanctions on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

FCA, crackdown on crypto