Toncoin (TON) Explained 2025: The Telegram-Backed Crypto Powering Web3

Table of Contents

Table of Contents

- What Makes Toncoin Unique?

- The Origins and Background of TON

- How Toncoin’s Technology Works

- The TON Ecosystem & Key Partnerships

- Real-World Use Cases of Toncoin

- TON Tokenomics Explained

- Latest Toncoin News & Developments

- Final Thoughts on Toncoin

- FAQ: 10 Unanswered Questions About Toncoin

What Makes Toncoin Unique?

What Makes Toncoin Unique?

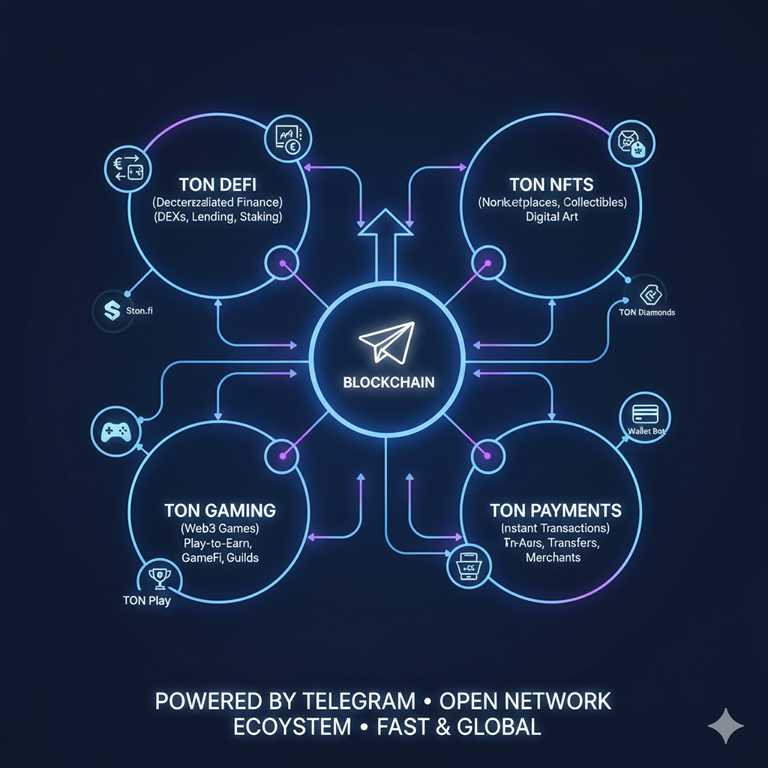

Toncoin is the native cryptocurrency of The Open Network (TON), a next-generation blockchain with deep integration into the Telegram ecosystem. With its extraordinary reach, TON focuses on ultra-fast payments, performance-driven DeFi, advanced NFT applications, and versatile Web3 integrations. Its seamless connection with Telegram positions Toncoin as a cryptocurrency designed for mass adoption.

The Origins and Background of TON

The Origins and Background of TON

TON traces its roots back to 2018, when Telegram launched the ambitious Telegram Open Network project. The vision was to integrate crypto payments directly into the messaging app, enabling mass adoption on a global scale. However, due to regulatory challenges with the U.S. SEC, Telegram withdrew from the project in 2020. Development was then transferred to the open-source community, leading to the formation of the TON Foundation, which now governs and develops the ecosystem. The idea of merging blockchain with messaging technology continues to shape TON’s strategy today.

How Toncoin’s Technology Works

How Toncoin’s Technology Works

TON is built on an advanced Proof-of-Stake blockchain with a sharding architecture, splitting the network into workchains and shardchains. This structure allows for near-infinite scalability, with thousands of transactions per second at minimal fees. The integration of a native Telegram wallet makes onboarding and payments accessible for millions of users. TON is optimized for fast payments, flexible smart contracts, NFT data architecture, and Web3 app deployment, with a unique emphasis on embedding blockchain utility directly into messaging and payment flows.

| Feature | Toncoin (TON) | Ethereum | Solana |

|---|---|---|---|

| Transactions per Second | 100,000+ | 30 | 65,000 |

| Native Integration | Telegram Wallet | External Wallets | Phantom, Solflare |

| Architecture | Sharded Proof-of-Stake | Proof-of-Stake (L2 scaling) | Proof-of-History + PoS |

The TON Ecosystem & Key Partnerships

The TON Ecosystem & Key Partnerships

The TON ecosystem spans payments, DeFi, NFTs, and gaming. Users can send and receive Toncoin directly within Telegram, while DeFi projects such as TonSwap and lending platforms expand financial opportunities. TON Domains and digital collectibles highlight the NFT sector, while Animoca Brands partnerships strengthen Web3 gaming. Official wallet bots inside Telegram make adoption effortless, exposing TON to hundreds of millions of users worldwide.

Real-World Use Cases of Toncoin

Real-World Use Cases of Toncoin

Toncoin has practical applications across different sectors:

- Payments: Direct peer-to-peer and merchant transactions via Telegram Wallet.

- DeFi: Swaps, lending, and liquidity pools accessible through the Telegram interface.

- NFTs: TON-based domains, digital art, and collectibles.

- Gaming: Web3 and play-to-earn gaming powered by TON integrations.

- Mini-Apps: Telegram mini-apps providing Web3 experiences directly inside the messenger.

TON Tokenomics Explained

TON Tokenomics Explained

The TON ecosystem is powered by Toncoin, with a maximum supply of around 5 billion tokens. Toncoin covers transaction fees, staking, and governance voting. Validators secure the network and earn rewards, while users participate in staking for yield. The Proof-of-Stake consensus ensures efficiency, security, and equitable distribution, making Toncoin’s tokenomics sustainable and designed for long-term adoption.

Latest Toncoin News & Developments

Latest Toncoin News & Developments

In 2025, TON expanded its ecosystem with a surge of Mini-Apps inside Telegram, boosting adoption to hundreds of millions of active users. DeFi and NFT integrations grew rapidly, supported by new gaming and payment partnerships. The TON Foundation accelerated governance upgrades and protocol improvements, aiming to establish Toncoin as a cornerstone currency of the Web3 ecosystem. By combining blockchain with messaging, TON distinguishes itself as a pioneer in merging financial tools with social platforms.

FAQ: 10 Unanswered Questions About Toncoin

FAQ: 10 Unanswered Questions About Toncoin

]]>You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm