Bitcoin Hyper L2 Proves Vital Amid 32 Nations Embracing $BTC Adoption

But as the crypto leader continues to gain traction, the Bitcoin network on which it’s held often struggles with low speeds and subpar scalability.

Thankfully, the Bitcoin Hyper Layer 2 solution is launching this quarter to address such woes. And its native token, $HYPER, has rapidly raised $18M to back it up.

27 Nations Worldwide Already Hold $BTC

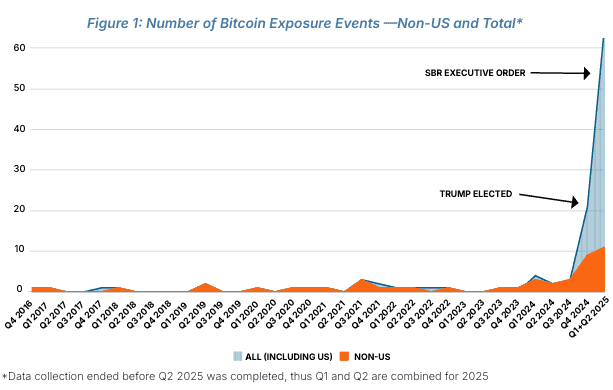

According to the report, 27 countries already have active $BTC exposure, whereas 13 have introduced legislative or policy proposals to gain exposure.

The US is a major driver for these shifts. And it’s no wonder. A Trump-era executive order directed the federal government to retain seized $BTC instead of selling, marking the establishment of the first formal Strategic Bitcoin Reserve.

By the first half of 2025, the number of government-level Bitcoin exposure events climbed to nearly 60, presenting a sharp acceleration in adoption.

Source: Bitcoin Policy Institute

Also bolstering $BTC’s stance was Senator Cynthia Lummis introducing a bill to acquire $1M in BTC for a national reserve.

Following this, several US states took the lead over Washington, with Arizona, New Hampshire, and Texas passing laws establishing Strategic Bitcoin Reserves.

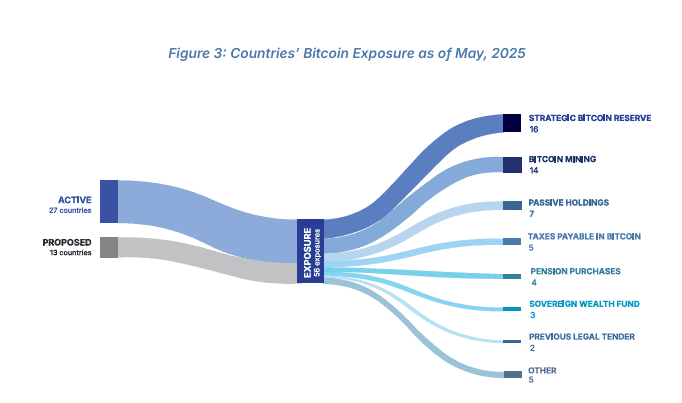

Additionally, the report discusses how countries outside the US are gaining exposure to $BTC, whether through reserves, sovereign wealth funds, government-backed mining, or even tax collection in Bitcoin.

It found that a commendable 16 countries have pursued exposure through strategic bitcoin reserves, followed by Bitcoin mining (14) and passive holdings (7). As an example, take the Philippines. It proposed a bold $10K $BTC national reserve last month.

Source: Bitcoin Policy Institute

Above all, the report confirms one thing for sure: $BTC has evolved beyond its roots as a speculative asset and is becoming a global macroeconomic tool.

However, as adoption continues to grow at a rapid pace, the network’s bottlenecks are likely to become increasingly apparent.

Here’s how Bitcoin Hyper plans to address the Bitcoin network’s largest pitfalls.

Bitcoin Hyper Layer 2 to Fix Bitcoin’s Biggest Woes

While Bitcoin is arguably the most significant crypto, its blockchain struggles with some severe limitations.

Right now, the network can only facilitate 4.56 transactions per second (tps), which is 75.98% lower than Ethereum’s 18.99 tps.

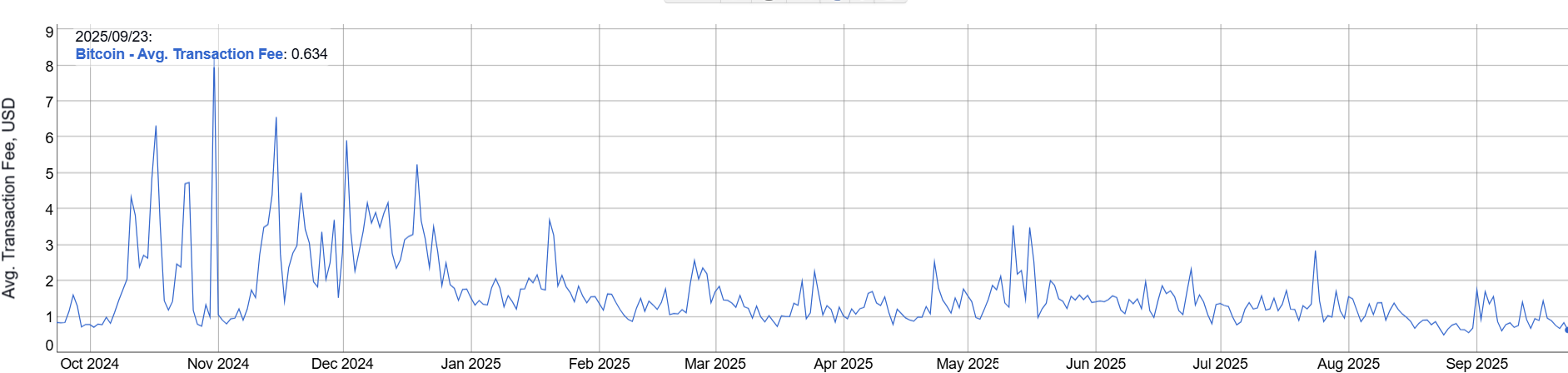

Also working against Bitcoin are its steep costs, particularly during peak demand. In November, for instance, average fees exceeded $8 per transaction.

Yes, Bitcoin’s transaction fees have since cooled to an average of just $0.63. However, they’re still significantly more expensive compared to blockchains like Solana, where fees typically remain below $0.05.

Source: BitInfoCharts

This is where Bitcoin Hyper shines bright. As a Layer 2 solution built on the Solana Virtual Machine (SVM), it’s designed to uplift Bitcoin with Solana-level performance.

In doing so, it should be able to facilitate thousands of transactions per second and lower its fees.

Also helping its scalability is a Canonical Bridge. It’ll enable you to easily move $BTC in the Hyper ecosystem for faster, cheaper transactions.

Not forgetting that it’ll unlock entirely new use cases on the Bitcoin network, including DeFi, dApps, and even meme coins.

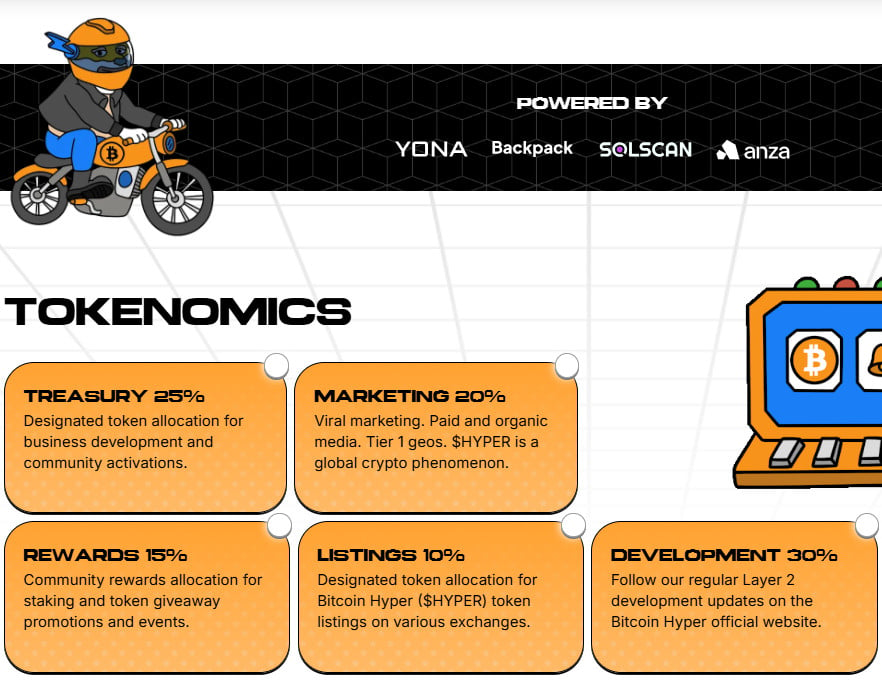

$HYPER helps make all this possible, with 30% of its total token supply earmarked for development.

Source: Bitcoin Hyper

It also powers transaction fees on the L2, offers holders the chance to earn staking rewards at a 65% APY, and grants governance rights within the ecosystem.

You can support the L2’s growth and unlock these exclusive perks by purchasing $HYPER on presale for $0.012965. And there’s no better time to do precisely that – it’s due for a price increase in less than five hours.

Join the Bitcoin Hyper presale today.

You May Also Like

VanEck Targets Stablecoins & Next-Gen ICOs

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?