Decentralization’s Dark Patterns: Why Open Networks Keep Rebuilding Gates

\ \ \ The bazaar is still lively; stalls are full, voices are loud, and deals are happening everywhere. But if you look closely, the gates are taller now, and guards at the entrances are quietly collecting fees. The place still looks like an "open market," but it feels more like going through a checkpoint than wandering freely.

Decentralization promised to remove bottlenecks, flatten hierarchies, and let us escape digital landlords. But now, we see new gatekeepers appearing, using the language of openness, offering the same old permissions in a fancier way.

If decentralization really won, why does power still feel so familiar?

\

The Mirror We Don’t Like

\

\ \ “Dark patterns of decentralization” are not errors in the code; they are habits in human systems that slowly guide open networks back to control points. These structures seem like open markets; free, many-to-many, and strong; but over time, they lean towards gates and tolls. Same setups, same messages, but with new controllers.

Think of it as decentralization theater: the protocol is neutral, but power builds up in everything around it, like interfaces, infrastructure, treasuries, and social councils. We convince ourselves it's okay because the base layer stays open. Meanwhile, our daily experience is managed by a small group of "coordinators" who simplify the hard parts (and charge for the easy parts).

So, let’s name the drift.

- Governance capture: low voter participation, recurring leaders, and proposal restrictions disguised as “process.”

- Token oligarchies: concentrated token ownership and treasuries that can influence narratives and outcomes.

- Cartelization at the edges: validators, sequencers, indexers, relays, few operators with too much power.

- UX centralizers: front-ends, RPCs, app stores, SDKs; convenience becomes a subtle control point.

- Social layer gatekeeping: foundations and councils that slowly change from caretakers to rulers.

None of this needs a conspiracy. It's just entropy. Coordination is expensive, convenience is attractive, and power, if unchecked, settles where it's easiest. This is why the decentralized internet can feel centralized even when the chain is working perfectly.

That’s the uncomfortable truth: if we only focus on “trust the protocol,” we ignore everything around it. The question isn’t if new forms of control will appear, they already have, in small ways. The real task is to recognize these patterns early and change them before “open” becomes just a label, not a reality.

\

Failure Modes: Where Power Re-Accumulates

\

\ \

Governance Capture

Decentralization doesn't end suddenly; it slowly shifts, meeting by meeting, vote by vote, into the control of a few well-known names. Low participation makes this easy: a small amount of token weight, permanently delegated, becomes the main decision-maker. Quorums are adjusted, proposal templates spread, and those who can keep up with every forum thread end up writing what others just agree to. The protocol stays neutral, but the agenda does not.

And because the process seems fair, gatekeeping can look like good management. "We're just maintaining quality." "We're protecting the treasury." Nice phrases; all true sometimes, until disagreement becomes a paperwork issue instead of a political one

Token Oligarchies

Token voting seems fair until you realize that money grows faster than participation. Premine, early allocations, strategic market makers, and programmatic buybacks aren't bad on their own, but together they create an imbalance. Treasury influence is more subtle: deciding who gets grants, pilot liquidity, and whose roadmap is highlighted at conferences.

At the same time, order flow isn't neutral. MEV, or maximum extractable value, turns blockspace into a marketplace where those with the best connections gain the most. It's not illegal or even necessarily wrong. It's just powerful, and power attracts allies

Cartelization at the Edges

Most networks don't focus on the center; they focus on the edges. Roles like validators, sequencers, relays, and indexers may seem similar but actually benefit from size, reliability, and special equipment (and patience with regulations). A few providers become very skilled, noticeable, and hard to replace.

Shared security and restaking can help small chains stay alive. But they can also lead to sameness; safe in the short term but more connected risks in the long term. The impact area gets bigger; choices become fewer

UX Centralizers

Users don’t interact with protocols; they interact with interfaces. These include front-ends, SDKs, wallet plugins, RPC gateways, and app stores. Each one is a convenience layer and also a possible bottleneck. Flip one switch (or follow one “temporary” policy), and a public network can suddenly act like a private platform.

Cloud makes this worse because it simplifies everything. One provider for hosting, CI/CD, logs, analytics, and DNS seems convenient, right? (Until a term of service change, an outage, or a legal request turn “why not” into “we can’t.”

Social Layer Gatekeeping

Every movement needs leaders. But leaders gain influence through communication, events, branding, and planning until it's hard to tell if they are speaking for the community or as the community. Groups like foundations, councils, and moderation panels are made to protect shared resources but can be tempted to control them.

Emergency powers, once given, often stick around "just in case." Eventually, "just in case" becomes the norm.

If this sounds familiar, that's good. The goal isn't to feel hopeless; it's to recognize these patterns early so we can prevent the need for strict controls late.

\

The Feudalism Early-Warning Dashboard

\

\ \ If you can't measure it, you can't protect it. Here's a quick dashboard with six indicators you can monitor to ensure "open network" doesn't become just a label.

Nakamoto coefficient & validator share. The Nakamoto coefficient asks: How many independent operators need to work together to stop or take over the network? A higher number is better, and trends are important. Check it alongside the validator/sequencer share by entity to see if block production is concentrating around a few names

Token Gini + float vs. insiders. Inequality isn't just a feeling; the Gini coefficient shows how uneven token ownership is (0 means evenly spread, 1 means one wallet owns everything). Keep an eye on this along with free float; the part truly in public hands compared to team/treasury/VC lockups, because "circulating supply" can hide who really controls things. Focus on the trend, not just one moment.

Governance turnout & delegate churn. Healthy systems don't just allow voting; people actually participate, and power changes hands. Track voter turnout for each proposal, and delegate churn (who's gaining or losing delegated weight over time). Tools like Snapshot make this visible; studies often highlight low participation as a major risk

Client/RPC diversity. Having different clients and providers is essential for backup. Keep an eye on the share of execution/consensus clients to prevent any single client from taking over. Use a variety of RPCs so that if one goes down, your "decentralized" app doesn't stop working. This has happened before, causing front-ends and wallets to freeze when a major provider failed.

Front-end independence. While protocols might be unstoppable, interfaces can be stopped. Host front-ends on content-addressed storage like IPFS or Arweave, pin them, map them with ENS, and make sure builds are publicly available. Check if the live site links to a CID and is pinned by more than one source, rather than just being stored in a cloud bucket

Censorship-resistance benchmarks. Neutral block building is a feature, not just an announcement. Monitor relay diversity, inclusion delay for sensitive transactions, and the percentage of blocks created by relays that use external blacklists. Public dashboards are available, so use them and choose non-censoring routes.

None of these metrics are flawless. Combined, they act as a warning system. When two or three indicators show issues, like increasing validator concentration, low participation, or front-ends relying on a single provider, you're not being paranoid. You're ahead of the curve

Design & Policy Fixes (The Builder’s Toolbox)

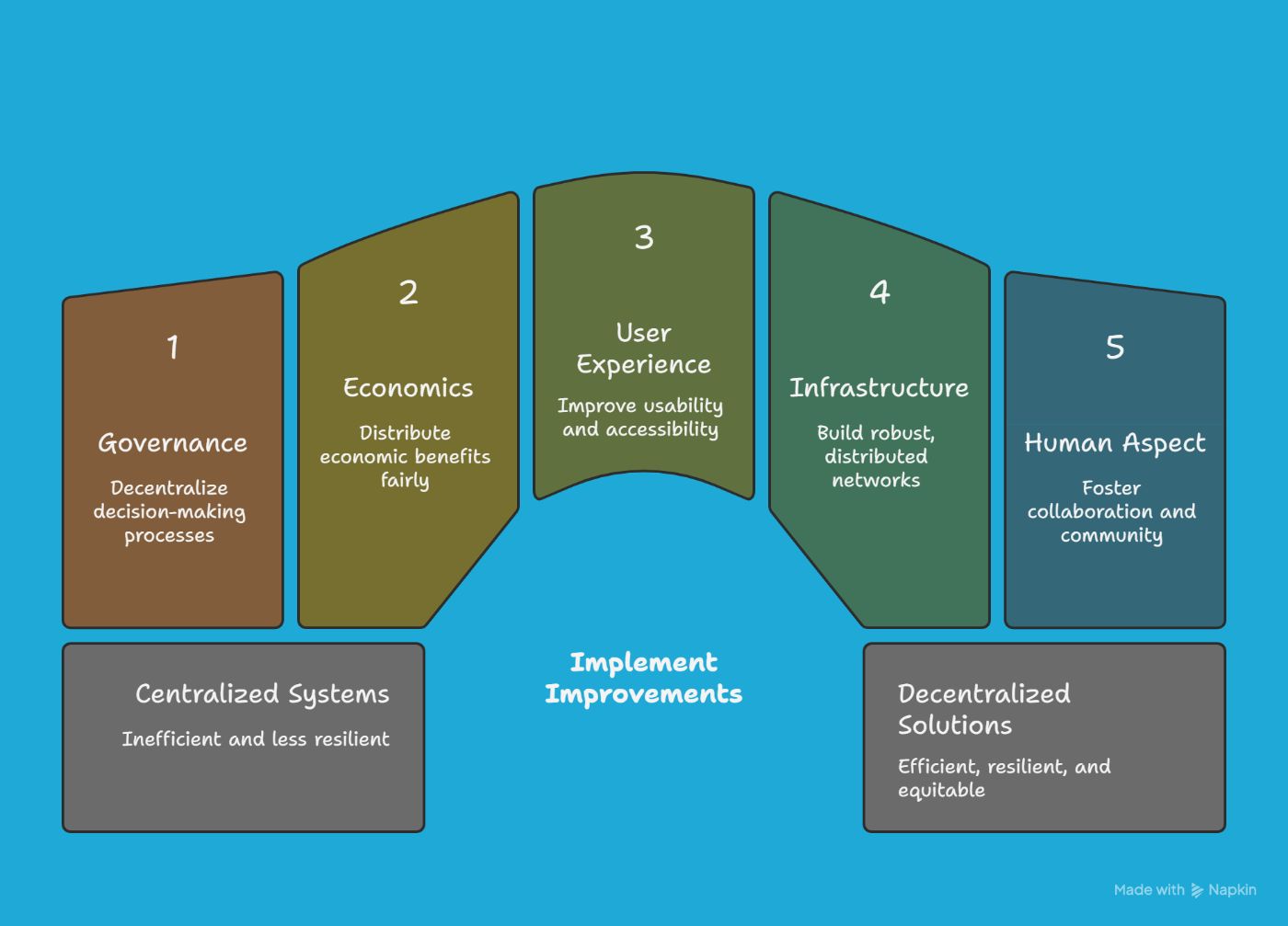

We don’t just argue against centralization; we design better solutions. Here are some improvements you can implement, starting with governance, then economics, then user experience and infrastructure, and finally the human aspect that connects everything.

\

\ \

Governance reforms

- Quadratic voting (and similar methods). When one-token-one-vote becomes one-big-investor-one-plan, change the voting method. Quadratic voting allows participants to show how strongly they feel by paying the square of the votes they buy, reducing the influence of the wealthy and preventing group takeovers. This method is discussed in Vitalik’s writings and RadicalxChange’s guides. Use it carefully, considering identity and collusion, but it’s a powerful tool.

- Mandatory time delays. Implement a strict timelock for proposals to give everyone time to react. Compound introduced a minimum two-day delay between approval and execution; proposals are queued and then executed, allowing for review and, if necessary, opposition. Make this a standard part of your governance process.

- Rotating juries by random selection. For disputes, grants, and quality decisions, don’t rely on a fixed council; randomly select members. Systems like Kleros choose jurors at random (based on stake/availability), refreshing perspectives and reducing the formation of cliques. Use random selection where judgment is more important than simple voting.

Tokenomics tweaks

- Fair unlocks, visible to all. Clearly and early, show vesting and float details. Focus less on who owns and more on who can actually vote or exit.

- Recurring user rewards (after the fact). Retroactive funding rewards proven impact, not just promises. Optimism’s RetroPGF is a working example: badgeholders distribute funds to public-goods contributors from protocol surplus, showing that user value leads to ongoing benefits.

- Limit treasury voting power (and diversify voices). If your treasury can control every vote, it's not governance; it's management. Consider limits, non-transferable citizen badges, and mixed groups to reduce coin-voting dominance, aligning with critiques to “move beyond coin voting.”

UX resilience

- Multi-provider (and self-hosted) RPCs. Don't rely on just one gateway for your app. Run your own if you can and set up automatic switching between providers. The 2020 Infura outage stopped wallets and dapps, teaching us a lesson

- Open-source front-ends, content-addressed deploys. Serve the UI from IPFS/Arweave and link it with ENS. Pin the CID in several places to prevent access issues during a takedown or outage. Uniswap’s IPFS interface and IPFS docs offer a useful example (pin to more than one node/provider).

- Local-first defaults. When possible, make sure important functions work without needing a central server (then sync later). Research by Ink & Switch and Kleppmann et al. shows how CRDT-based apps keep user control and work offline.

Infrastructure hardening

- Reliable hosting. Use content-addressed storage for UIs/docs; Arweave's permaweb and IPFS pinning services help avoid relying on just one provider and ensure verifiable deployments.

- Multi-cloud / multi-region hygiene. If you have to use the cloud, plan for failures: spread across regions/providers, practice switching over, and manage quotas in advance. Major cloud reliability guidelines emphasize this.

Social guardrails

- Conflict-of-interest disclosures. Require leaders, delegates, and reviewers to share any financial or role conflicts. This is a standard practice for corporate governance, adapted for DAOs. The OECD guidance is a good starting point for what to disclose and why.

- Term limits and role rotation. Avoid having "forever delegates." Regularly change authorship committees, review boards, and communication leads.

- Sunset clauses for emergency powers. Special permissions should automatically end unless renewed. This is a common democratic safeguard to prevent emergencies from becoming normal. Build the expiry into the code and charter.

These are not perfect solutions. However, together they help ensure that the system naturally resists centralization before it becomes part of the culture, then policy, and finally something we feel we can't change.

\

Field Notes (Mini-Caselets)

The RPC chokepoint, one morning. On November 11, 2020, Infura had a glitch, causing many "decentralized" apps to stop working. Apps like MetaMask, MakerDAO, Uniswap, and Compound stalled, and exchanges paused ETH withdrawals due to conflicting node views after an outdated client hit a consensus bug. The issue was fixed, but the lesson was clear: if one gateway can stop everything, it's not a marketplace, it's just a lobby.

Takeaway: Run your own nodes when possible and set up automatic failover with multiple independent RPC providers.

Compliance at the flick of a switch. In March 2022, users in sanctioned regions found that "decentralized" sometimes means "not reachable," as MetaMask's default provider, Infura, blocked access in certain areas. A misconfiguration briefly affected Venezuelan users too, before being fixed. The blockchain stayed open, but the main access route did not. Interfaces and the infrastructure behind them can be stopped.

Takeaway: Consider interfaces as conveniences, not guarantees, and provide users with at least one non-custodial, self-hostable option.

When the front-end shapes the “decentralized” experience. Uniswap, the protocol, kept running smoothly. Uniswap Labs, the main web interface, tightened what it shows. Starting in 2021 and continuing with policies updated through 2025, the Labs-managed front-end limited access to certain tokens and can block specific contracts or addresses due to changing regulations. However, the company emphasizes that the underlying smart contracts remain open to everyone. The message is subtle but clear: UI policy isn't the same as protocol policy until it affects most users.

Takeaway: Create content-addressed, open-source front-ends (and mirror them), so “can’t click here” never turns into “can’t use it at all.”

Neutrality under pressure in the block-building era. After Ethereum’s Merge, validators widely used MEV-Boost relays; many popular relays promised to follow OFAC rules, and for a while, more than half of the blocks were built through censoring paths. Community efforts with non-censoring relays and monitoring tools have since reduced that number at times, but the risk is clear and ongoing: censorship can sneak in through economically smart middleware.

Takeaway: Choose non-censoring relays, track inclusion delays, and make neutrality a measurable goal, not just a statement.

The DAO that learned what “ratification” means the hard way. In early 2023, Arbitrum's first governance package upset the community when the foundation used tokens that the DAO thought were still being voted on, leading to backlash and a promise to separate proposals and redo the process. The blockchain stayed intact, but the community trust was briefly broken, showing that control can be about procedures, not just technology.

Takeaway: Set clear timelocks, keep budgets small, and make sure that “advice and consent” can't be changed later to just “approval.”

\ \

“What Good Looks Like” (a scorecard)

Here’s a quick check you can read out loud in a stand-up meeting and save for later. It’s not a strict rule, just a quick test. Green means “keep going,” yellow means “watch this closely,” and red means “you’ve created a problem; take responsibility and fix it.”

Start by looking at the Nakamoto coefficient and how block production is shared among entities. Aim for the coefficient to be in double digits and increasing, with no single operator able to stop finality or reduce activity on their own. If two or three entities can work together to disrupt things, you’re becoming centralized. Check the actual distribution, not just the brand names: different legal entities, different infrastructure, different failure risks.

Next, look at token distribution using a simple Gini index and, more importantly, the ratio of freely available tokens to those held by insiders and the treasury. A healthy situation shows a decreasing Gini over time, more freely available tokens, and clear token releases that don’t surprise the market or governance. If insiders and the treasury can often decide outcomes by themselves, recognize this and limit it by design. If community ownership is only increasing in name, it will show in voting results.

Check governance participation and rotation. Generally, the median turnout should be respectable, with a significant portion of eligible voting power involved in important proposals. The top delegates shouldn't be able to easily control the majority for long periods. If the same few wallets decide most proposals and delegate weights never change, it's not governance; it's a board meeting.

Audit client and RPC diversity as if uptime depends on it; because it does. No single client should dominate to the extent that one bug could cause a chain-wide issue. Your default setup should include at least one self-hosted option and multiple independent RPC providers with automatic failover. If one outage can shut down your app, recognize it as a platform risk disguised as a protocol issue.

Evaluate front-end independence carefully. A strong project offers open-source interfaces, reproducible builds, content-addressed deployments that lead to stable CIDs, and at least two independent pinning and hosting options linked to a human-readable name. If your only entry point is a single DNS record in one cloud account, you already know the outcome.

Measure censorship resistance as an ongoing goal, not just a phrase. Monitor how long it takes for "sensitive" transactions to be included, check the percentage of blocks created through censoring versus non-censoring methods, and share relay and builder diversity like you would with latency. The goal is zero, but the trend is what matters; if the censoring share is significant and increasing, consider it a serious cultural and structural issue.

If you can read this checklist without discomfort, you're doing well. If it makes you uncomfortable, congratulations, you've identified the work that needs to be done.

\

Why This Matters Now

The contest isn't looking for praise of decentralization; it's asking if the web we're building can avoid old problems like censorship, network effects, and algorithmic control without just making the same mistakes again. The prompts are clear: how do big-platform algorithms influence what we see, how do network effects keep people stuck with big companies, and can a decentralized internet really stop censorship, or do new control methods appear anyway? In other words, find the weak spots and show you can work around them.

Regarding censorship, the tough truth is that while protocols can be "permissionless," the paths most people use is not. This is why the #decentralized-internet track exists: to explore designs where speech and access don't fail when a front-end changes its rules or a provider makes a change. The brief is clear: investigate whether decentralization actually lowers the risk of suppression at the infrastructure level, not just in theory but in reality.

When it comes to network effects, the benefits grow as more people use a platform. This makes it hard to switch because both your habits and connections are tied to it. Studies in management and law see these feedback loops as key to why platforms become dominant. Any "free" alternative needs to create its own loops or get absorbed by the main platform. This isn't just about feelings; it's about how things work.

For algorithmic gatekeeping, we've shifted from human editors to machine-ranked feeds that decide what gets seen. Research shows that automated systems now play a big role in deciding what gets attention and even influences public opinion. This isn't necessarily bad, but it is very powerful. If our decentralized systems end up with the same hidden ranking controls, we'll just be swapping one controlled space for another.

This is also why a brief nod to the physical layer isn’t optional. The contest partner’s pitch leans into DePIN; decentralized physical infrastructure as a way to diversify how packets move in the first place, proposing a constellation of small satellites and on-chain coordination to reduce reliance on terrestrial chokepoints. You can agree or disagree with the approach, but the direction is the point: add independent paths, or accept that “the internet” is only as free as its narrowest pipe.

And it isn’t just theory. Bitcoin’s satellite broadcast shows how redundancy looks when you mean it; blocks beamed globally, independent of local internet connectivity. Community meshes show the same ethic at street level. neighbor-run backhaul, neutral routing, open peering. Even mainstream LEO constellations, while not decentralized, broaden the set of available paths and, in doing so, blunt single-jurisdiction leverage. More routes, fewer choke points. That’s the entire game.

Yes, this is important now because the time to set norms is limited. The #decentralized-internet challenges us to show that our designs can resist censorship without adding new filters, compete with network effects without becoming dependent on them, and replace hidden gatekeepers with transparent, accountable systems. If we can address this in code, policy, and culture this time, this month, we're not just joining a contest. We're testing if the bazaar remains open and free.

\

Call to Action

Choose a project you love, like a wallet, L2, rollup, DAO, or marketplace, and run the dashboard on it today. Check the validator and builder distribution, look at the token Gini and free float, see if participation is genuine or just routine, try a different RPC, resolve the front-end to a CID, and monitor inclusion delays for anything "sensitive." Share your findings publicly. If you can't measure it, you can't protect it; if you won't share it, you likely already know the answer.

If you're building, make one change against central control in the next sprint. Add a real timelock you can't bypass, rotate a committee by random selection, limit treasury voting power, mirror the UI to IPFS or Arweave and link it through ENS, replace a single-provider RPC dependency with an automatic backup that includes something you manage. None of this is just theory; it's all changes you can implement.

If you moderate or manage, publish conflicts, set term limits, and end the emergency powers you said were temporary. If you're a user, ask for these things openly, and move your usage and funds to places that follow these practices. Votes are important, but so is engagement.

Do the audit. Report on the issue. Implement the fix. Then do it again next month.

Keep the bazaar a bazaar.

You May Also Like

VanEck Targets Stablecoins & Next-Gen ICOs

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?