Hyperliquid (HYPE) Price Prediction: Ascending Channel Points to $65–$70 Target Zone

Hyperliquid has been buzzing with activity as whales and funds continue to add up millions worth of HYPE, reinforcing confidence around the $55 to $56 zone. Despite heavy tug-of-war positioning between bulls and bears, the token’s steady support and ascending channel structure have kept optimism alive.

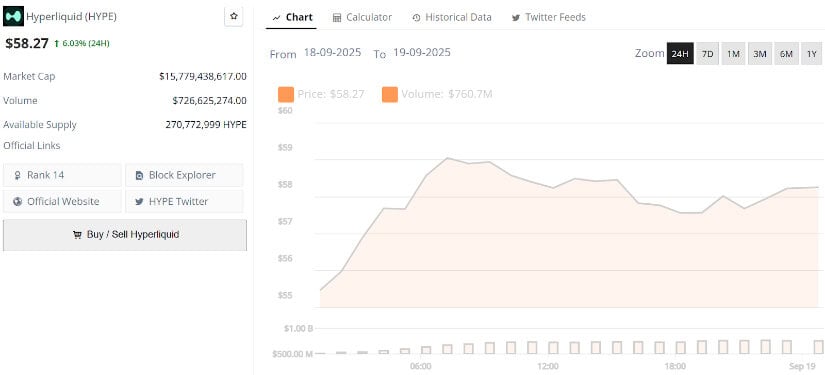

Hyperliquid’s current price is $56.19, up 3.98% in the last 24 hours. Source: Brave New Coin

Hyperliquid Positioning Split Between Bulls and Bears

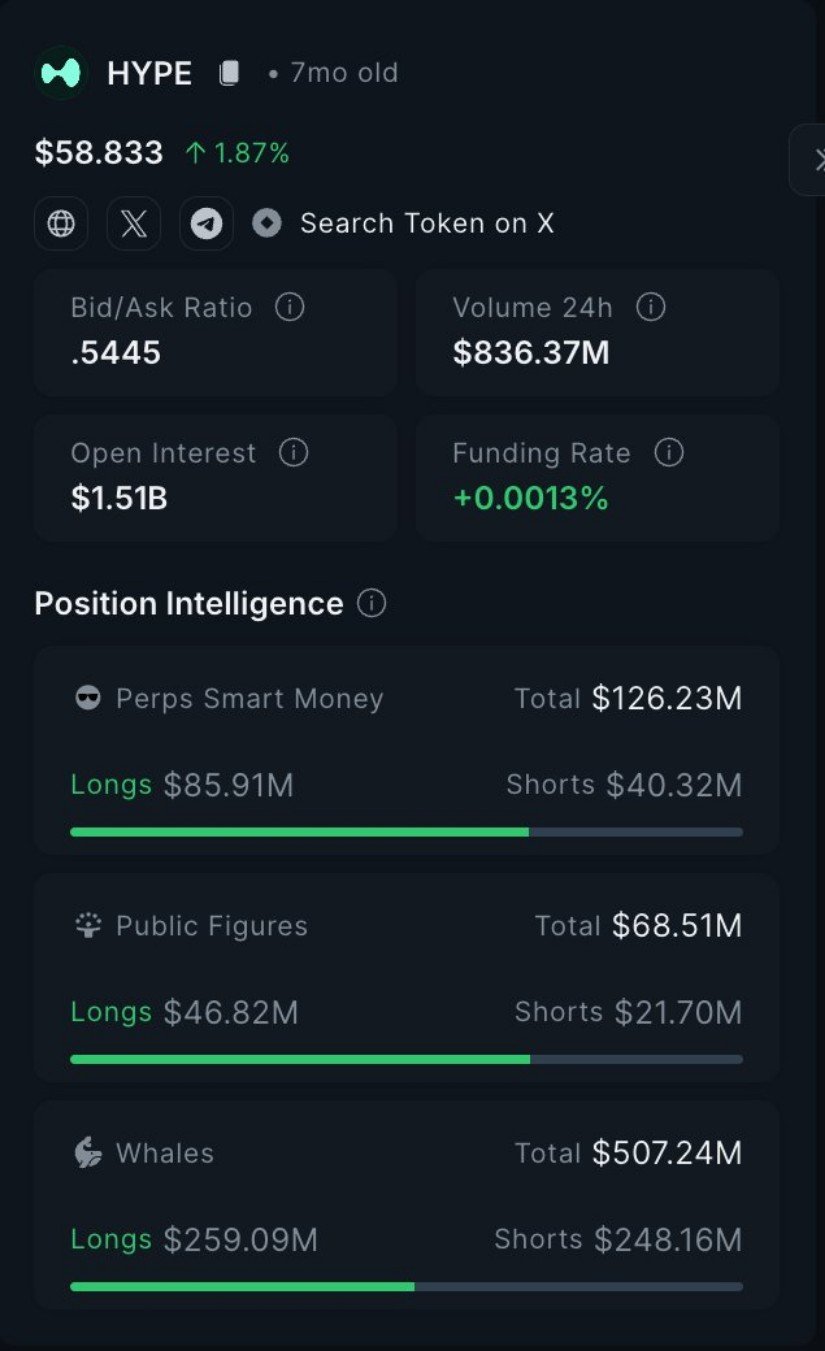

Hyperliquid is trading around $58.83, with open interest climbing to $1.51B, reflecting how active the derivatives market has become around the token. Data from Nansen shows that positioning is highly contested: smart money sits at $86M long versus $40M short, while public figures are $47M long against $22M short. Interestingly, whale wallets are almost perfectly split, with $259M in long exposure balanced by $248M on the short side.

This tug-of-war highlights just how polarized sentiment is at current levels. The near-even split between large players suggests neither side has firm control, and price could be sensitive to liquidations or sudden shifts in funding.

Hyperliquid’s open interest climbs to $1.51B as whale positioning remains evenly split between longs and shorts. Source: Nansen via X

With 24-hour trading volume topping $836M and funding rates slightly positive, the Hyperliquid Price Prediction leans towards cautious bullishness, but the balance of positions shows that volatility could intensify if either side gains momentum.

Hyperliquid Price Structure Remains Strong Within Ascending Channel

Hyperliquid continues to respect its ascending channel, currently holding near the midline after retesting support around $55. The chart highlights a clean structure of higher highs and higher lows, with momentum supported by Fibonacci retracements around $52 and $48 acting as key demand zones. As long as the price remains within this channel, the technical setup favors continuation, with the next resistance cluster seen near $65 to $68.

Hyperliquid holds steady within its ascending channel, with $52 and $48 acting as key demand zones, while $65–$68 as resistance cluster. Source: Otsukimi via X

Analyst Otsukimi notes that HYPE stands out not only for its consistent technical strength but also for its broader positioning in the market. With RSI still avoiding overbought extremes and momentum indicators pointing to steady accumulation, the outlook remains constructive. A sustained push above $60 with volume would open the path towards the channel’s upper boundary.

$56 Support Reinforced by Large Purchases

Fresh on-chain data highlights how large investors are steadily increasing their exposure to Hyperliquid (HYPE). One whale alone deployed $5.7M USDC over the last 24 hours, acquiring more than 101,000 HYPE tokens at an average price near $56. This buying activity builds on earlier deposits and signals that certain high-capital players see current price levels as attractive for long-term positioning.

-

Whale purchase: $5.7M USDC for 101,615 HYPE

-

Average price: ~$56.19 per token

-

Latest addition: $3.09M for 54,225 HYPE

At the same time, the Hyperliquid assistance fund has stepped in with a much larger move, purchasing over 31M HYPE tokens worth $633M, raising its total position value to $1.7B. This scale of institutional-style buying underscores the depth of confidence backing HYPE’s market structure.

Hyperliquid assistance fund boosts confidence with a $633M purchase. Source: Hyperliquid News via X

Bringing this into context with the recent positioning split between bulls and bears, the steady absorption of supply by whales and funds tilts sentiment in favor of buyers. While short-term volatility remains, these inflows highlight that deeper-pocketed players are aligning with the broader uptrend. If accumulation persists, it could serve as the foundation for a push towards the $65 to $70 resistance.

Hyperliquid Bulls Preparing for $60 Target

Hyperliquid is testing a critical zone, with traders watching the $55.5 support as a potential re-entry point. The 4H chart shows that the structure has been respecting higher lows, but momentum now depends on whether this level can hold. A bounce from here would validate the area as a demand zone and bring $60 back into play as the next upside target.

Hyperliquid bulls eye the $60 mark as $55.5 support becomes the key pivot for either continuation higher or a slide towards $50. Source: aTom_B via X

From a broader view, analyst aTom_B points out that a clean break below $55.5 could shift attention towards $50.58, which aligns with earlier consolidation zones. For now, the Hyperliquid price prediction hinges on this mid-range support: holding above strengthens the case for continuation higher.

Final Thoughts

Hyperliquid has reached a crucial crossroads, where both technical structure and whale accumulation are sending mixed yet fascinating signals. The ascending channel remains intact, volume flows are steady, and large purchases near $56 show that deep-pocketed players are still confident. At the same time, the tug-of-war between bulls and bears in positioning means short-term volatility is almost certain.

This blend of cautious optimism and underlying accumulation suggests the $60 mark will remain the key battleground for traders over the coming sessions.

Looking forward, the Hyperliquid price prediction will hinge on whether support levels continue to attract demand. If whales and the assistance fund continue to step in, the case for a breakout towards $65 to $70 strengthens considerably.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus