What is MEXC Futures Grid Trading?

1. What Is Grid Trading?

2. How Grid Trading Works

- When the price drops to $96,500, the system automatically places a buy order;

- When the price rises back to $97,000, it automatically places a sell order, earning a $500 profit from the spread;

- As the price continues to fluctuate, the system repeats this buy-low, sell-high cycle.

3. What Types of Traders are Best Suited for Futures Grid Trading?

3.1 Short-Selling Traders

3.2 Leverage Users and Risk-Averse Traders

3.3 Passive and Time-Constrained Traders

3.4 Beginner Traders

4. Advantages of Grid Trading on MEXC

- Low Entry Threshold: Start with as little as 10 USDT.

- High Leverage Options: Maximize capital efficiency and seize more trading opportunities.

- 24/7 Automated Execution: Once set up, the bot runs continuously, executing trades without emotional interference.

- Low Trading Costs: No fees for strategy setup or management, plus low Futures trading fees.

5. How to Use MEXC Futures Grid Trading?

5.1 Transfer Funds

5.2 Create the Bot

- Neutral: No initial position is opened when the bot is created. It opens short positions when prices rise and long positions when prices fall. Best suited for sideways (range-bound) markets with no clear trend direction.

- Long: Only long positions are opened. As the price rises, long positions are closed; as the price falls, more long positions are opened. Ideal for gradually rising markets with upward fluctuations.

- Short: Only short positions are opened. As the price rises, more short positions are added; as the price falls, short positions are closed. Suitable for gradually declining markets with a step-like downward trend.

- Required Fields: Price range, number of grids, investment amount, and leverage.

- Optional Fields: Activation price, upper stop price, lower stop price.

5.3 Activating the Bot

5.4 Add/Remove Funds

5.5 Stopping the Bot

- Liquidation: If the position is liquidated, the bot will automatically stop.

- Delisting Stop: If the trading pair is delisted while the bot is running, the bot will be stopped.

- Stop Price Triggered: If you've set an upper or lower stop price in Advanced Settings, the bot will stop automatically once the market price reaches the specified stop level.

5.6 View Bot Assets

6. MEXC Futures Grid Trading Rules

Popular Articles

Why HYPE Coin Surged Today? (Jan 27, 2026)

January 27, 2026 — The crypto market has witnessed a textbook example of a "Fundamental Pump" today, driven by real utility rather than hype.According to MEXC Spot Market data, the Hyperliquid native

Who Owns the Most Bitcoin in the World? Largest Holders Revealed

Bitcoin operates without a central owner, making the question "who owns Bitcoin" more complex than it appears at first glance. While no single entity controls the Bitcoin network itself, certain indiv

Setting Take-Profit and Stop-Loss for Futures Trading

In the cryptocurrency markets, price movements can be extremely volatile, and profits or losses can occur in an instant. For Futures traders, take-profit and stop-loss orders are not only essential to

What is USAT? Complete Guide to Tether's US-Regulated Stablecoin

The stablecoin landscape shifted dramatically when Tether unveiled USAT in September 2025, marking the company's first fully US-regulated digital dollar. This guide explores USAT's compliance framewor

Hot Crypto Updates

View More

2026 Ultimate Guide to Gold Gifting: Which Offers Better Value—PAXG, XAUT, or Physical Gold Bars?

Discover why smart gifters in 2026 choose tokenized gold (PAXG, XAUT) over physical bars. Learn about fractional ownership, instant transfers, transparent verification, and why MEXC offers the best

XRP Price Prediction 2026: Why Seasoned Traders Choose MEXC to Position for XRP's Next Bull Run

In-depth XRP price prediction analysis for 2026 reveals why smart traders choose MEXC. Zero trading fees, deep liquidity, and 100x leverage help you capture XRP's potential growth from $2 to $5. Key

Why Are Sui Whales Secretly Accumulating BEEG? In-Depth On-Chain Data Analysis for 2026

Comprehensive analysis of BEEG on-chain data and whale movements. Discover why smart money is accumulating BEEG, explore whale tracking techniques, deflationary mechanisms, and why MEXC is the best

2026 BEEG Holders Already Rich! On-Chain Data Reveals: How "Smart Money" Positioned 3 Months Early in Blue Whale? Complete Whale Tracking Guide

Exclusive! Track BEEG early investors' on-chain footprints, revealing how they positioned before the surge. Complete whale wallet analysis + strategy to copy smart money. Trade BEEG on MEXC with zero

Trending News

View More

Binance BEP20 Suspension: Essential Maintenance Update for January 23

BitcoinWorld Binance BEP20 Suspension: Essential Maintenance Update for January 23 Global cryptocurrency exchange Binance has announced a temporary but essential

Ethereum Staking Breakthrough: Buterin’s Crucial DVT Proposal to Slash Validator Penalties

BitcoinWorld Ethereum Staking Breakthrough: Buterin’s Crucial DVT Proposal to Slash Validator Penalties In a pivotal move for the world’s leading smart contract

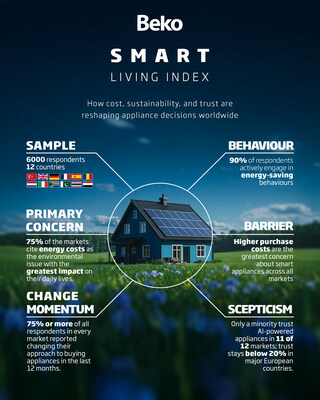

Beko’s Smart Living Index finds Economic Pressure Drives Surge in Sustainable Living

ISTANBUL, Jan. 22, 2026 /PRNewswire/ — Beko, the leading global home appliance company, today unveiled its proprietary Smart Living Index (SLI). The study revealed

XRP Price Prediction: Can Ripple Really Become A $10 Crypto or Are Smart Whales Diversifying to More Lucrative Opportunities?

Few debates in crypto spark as much emotion as XRP price prediction. For years, Ripple supporters have argued that a $10 XRP isn’t just possible; it’s inevitable

Related Articles

Setting Take-Profit and Stop-Loss for Futures Trading

In the cryptocurrency markets, price movements can be extremely volatile, and profits or losses can occur in an instant. For Futures traders, take-profit and stop-loss orders are not only essential to

How to Trade Stock Futures on MEXC

Crypto US Stock Futures are innovative financial derivatives that bridge US-listed company stocks with the cryptocurrency market through futures contracts. Investors can use cryptocurrencies (such as

How to Trade Futures on MEXC App: Complete Beginner's Guide

MEXC Futures trading offers MEXCers an advanced way to trade cryptocurrencies. Unlike Spot trading, Futures trading has its own unique logic and order-opening mechanisms. This article is designed to h

Spot Trading vs. Futures Trading: A Beginner's Guide to Determining Which is Right for You

As the cryptocurrency market continues to mature, the diversification of trading tools has become a key factor in building robust investment strategies. Among global mainstream crypto exchanges, MEXC