How to change the K-line layout in MEXC futures trading? Better serve your futures trading

Abstract of this article:

1. Benefits of multiple windows on the same screen

1.1 Improve the efficiency of monitoring the market

1.2 Improve the efficiency of multi-category token trading

1.3 Personalized customized transaction page

2. How to change the trading candlestick layout on the webpage

2.1 How to set up multiple windows on the futures trading page

2.2 How to display different tokens in different windows

2.3 How to trade quickly in multi-window mode

2.4 How to personalize different windows

Recommended reading:

- Why choose MEXC futures trading? Learn more about the advantages and features of MEXC futures trading to help you seize the opportunity in the futures field.

- How to participate in M-Day? Master the specific methods and skills to participate in M-Day, and don't miss the futures bonus airdrop of 70,000 USDT every day

- Futures Trading Operation Guide (App End) Learn more about the operation process of futures trading on the App end, so that you can easily get started and play futures trading.

Popular Articles

The Complete History of Bitcoin: When Did Bitcoin Start and How It Changed Finance

Bitcoin’s journey from an obscure digital experiment to a globally recognized financial asset represents one of the most remarkable technological and economic stories of the 21st century. What started

MEXC Weekly Report(Feb 3 – Feb 9, 2026)

New Listings · Top Gainers · Spot & Futures Trading OverviewData Period: February 2–9, 2026 Release Schedule: Weekly, every Thursday Data Sources: MEXC Platform, CoinGeckoLast week, the crypto market

When Is the Next Bitcoin Halving? Everything Explained

The Bitcoin network completed its fourth halving on April 19, 2024, reducing mining rewards from 6.25 BTC to 3.125 BTC per block.Understanding when the next Bitcoin Halving occurs helps investors plan

Bitcoin vs Ethereum: Which Cryptocurrency Is Right for You?

Bitcoin and Ethereum dominate the cryptocurrency landscape as the two largest digital assets by market capitalization.While both operate on blockchain technology, the difference between Bitcoin and Et

Hot Crypto Updates

View More

Tether Gold (XAUT) 7-day Price Change

The Latest Tether Gold (XAUT) price has shown significant movement over the past week. In this article, we'll examine its current price, 7-day performance, and the market factors shaping XAUT's

PAX Gold (PAXG) 7-day Price Change

The Latest PAX Gold (PAXG) price has shown significant movement over the past week. In this article, we'll examine its current price, 7-day performance, and the market factors shaping PAXG's trend

Ripple (XRP) 7-day Price Change

The Latest Ripple (XRP) price has shown significant movement over the past week. In this article, we'll examine the current XRP price, 7-day price performance, and the market factors shaping Ripple's

Binance Coin (BNB) 7-day Price Change

The latest Binance Coin (BNB) price has shown significant movement over the past week. In this article, we'll examine the current BNB price, 7-day BNB performance, and the market factors shaping the

Trending News

View More

Leading Suppliers of Power Inverters for Modern Home Energy Systems

“The real change in energy comes not just from making power, but from handling and directing it in a clever way.” — an idea often repeated by researchers who study

Illinois Sports Bettors Get New Crypto-to-Cash Option From DraftKing

DraftKings has introduced a new payment feature that could meaningfully change how sports bettors fund their accounts, especially in states where mobile wagering

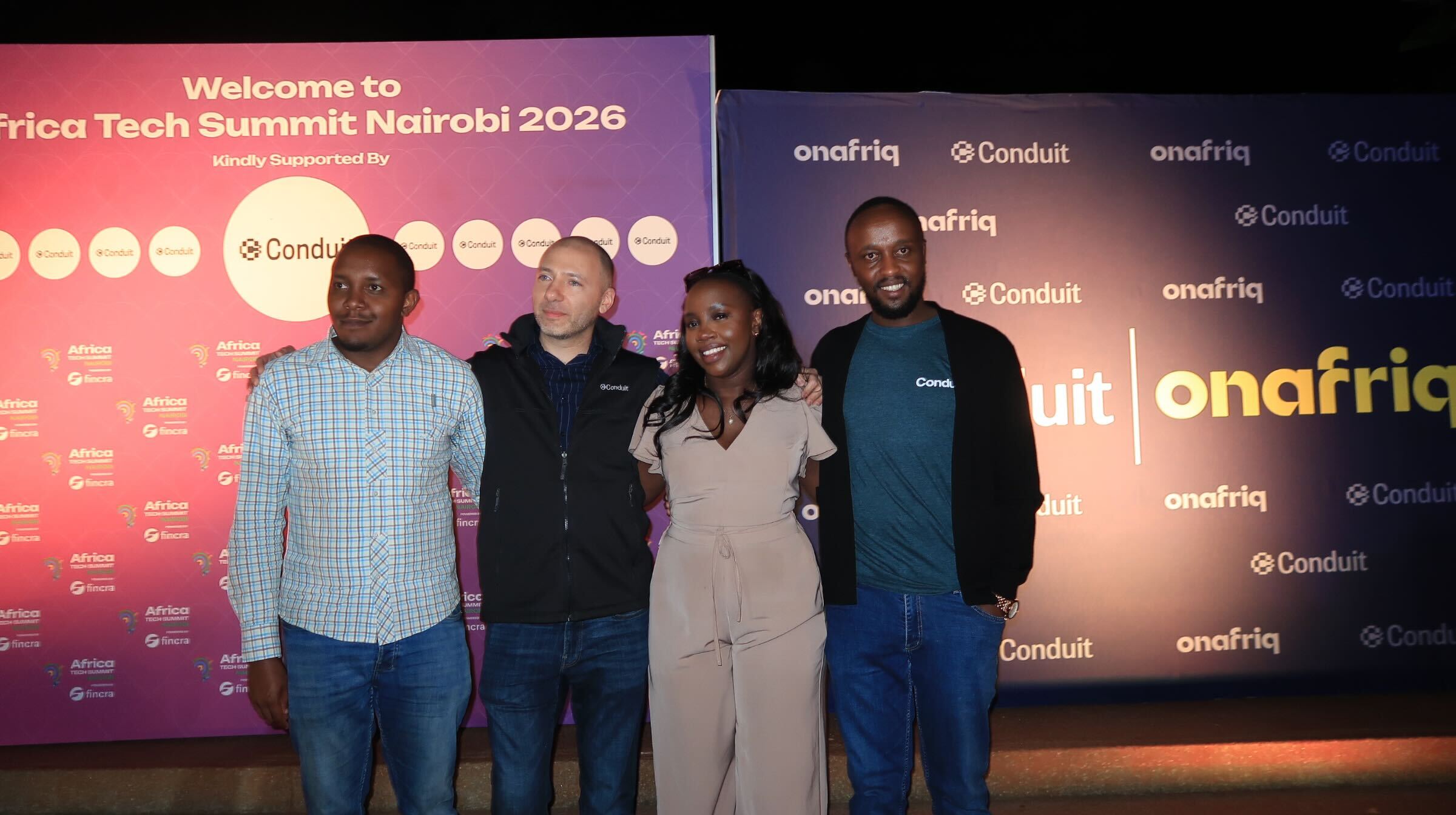

Onafriq joins Africa’s stablecoin shift in cross-border payments

Onafriq has partnered with Conduit in an alliance that will change how Onafriq manages liquidity and pays partners abroad.

Here’s what key metrics tell us about Curbline (CURB) Q4 earnings

The post Here’s what key metrics tell us about Curbline (CURB) Q4 earnings appeared on BitcoinEthereumNews.com. Curbline Properties (CURB – Free Report) reported

Related Articles

How to Open Futures Positions Using Spot and Flexible Savings Assets

1. Opening Futures Positions Using Spot and Flexible Savings AssetsWhen opening a Futures position, this feature allows users to automatically use assets from their Spot account or Flexible Savings ac

What Are Prediction Futures?

Cryptocurrency futures trading attracts countless investors with its high leverage and dual-directional profit potential. However, complex mechanisms—including margin requirements, leverage ratios, an

How to Trade Stock Futures on MEXC

Crypto U.S. stock futures represent an innovative financial derivative that seamlessly combines U.S. listed company stocks with the cryptocurrency market through contract-based trading. Investors can

Copy Trading Guide For Lead Traders

Copy Trading is an innovative cryptocurrency investment strategy that enables investors to automatically replicate the trades of experienced traders. For beginners lacking professional knowledge or tr