CZ Denies Binance Fueled Historic Crypto Liquidation Crash

Former Binance CEO Changpeng “CZ” Zhao has pushed back against claims that the cryptocurrency exchange played a significant role in the largest liquidation event the sector has seen. In a Q&A streamed on Binance’s social channels, Zhao rejected the notion that Binance was a primary driver of the October 10 wipeout, during which roughly $19 billion in positions were liquidated across the market. He described the accusations as “far-fetched,” a stance that Bloomberg highlighted in its coverage. Zhao, who stepped down as CEO in 2023 after pleading guilty to federal charges tied to anti-money-laundering violations, noted that he was speaking in his capacity as a Binance shareholder and user rather than as a corporate spokesperson. He was later pardoned by President Donald Trump in October, a development he referenced to emphasize his ongoing involvement in the industry.

Although he remains active in crypto, Zhao’s current activities include oversight of YZi Labs, an independent investment vehicle that grew from Binance’s former venture capital arm and currently manages around $10 billion in assets. The public dialogue around the Oct. 10 sell-off has kept Binance in the crosshairs of market participants and regulators, even as the firm’s leadership has shifted over the years.

Source: Muyao ShenAs the conversation around October’s shockwaves intensified, Zhao noted that he no longer runs Binance but maintains a stake in the business and continues to participate in the industry on a personal level. He clarified that his remarks were not a corporate statement, underscoring the ongoing tension between corporate responsibility and market-wide liquidity dynamics that affect traders, lenders, and validators alike.

Beyond his Binance-linked activities, Zhao’s profile in the ecosystem has evolved through his leadership of YZi Labs, an investment entity that emerged from Binance’s venture activities and now manages a sizable portfolio. That role places him at the confluence of fundraising, cross-chain tooling, and strategic bets on new protocols—areas where the industry is watching for longer-term resilience in liquidity and risk management.

October crash caused a brief USDe depeg on Binance

The market episode that reignited scrutiny of major exchanges centered on Ethena’s USDe stability mechanism. The stablecoin briefly decoupled from its $1 peg on Binance, slipping to around $0.65 during the whiplash of the sell-off. The incident was later attributed to a platform-specific oracle issue rather than a systemic flaw across the broader DeFi stack. Ethena Labs founder Guy Young emphasized that the price dislocation appeared isolated to a single trading venue, which relied on an internal index rather than the deepest available liquidity pool. He also noted that the venue experienced deposit and withdrawal frictions that hindered arbitrage activity and price convergence.

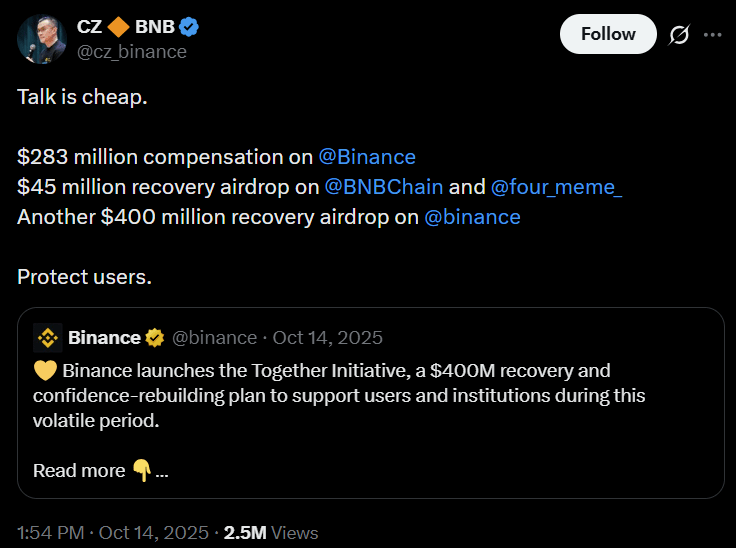

Binance subsequently compensated affected users about $283 million as part of a broader effort to address losses tied to the event. The compensation underscored both the immediate financial impacts on traders and the reputational stakes for a platform that carries substantial counterparty risk within a volatile, liquidity-driven market. In the weeks that followed, crypto prices struggled to reclaim prior highs; Bitcoin (Bitcoin at the time in market commentary was referenced as BTC) later traded with renewed volatility, underscoring how a single event can ripple through the market’s pricing and sentiment. The broader narrative of the crash and the ensuing recovery period contributed to ongoing debates about liquidity provision, exchange risk controls, and the role of stablecoins in volatile episodes.

Altogether, the episode left an indelible mark on how market participants evaluate exchange safety nets, margin requirements, and the speed at which liquidity can evaporate during systemic stress. While Bitcoin price action has fluctuated, the asset’s path since October has been a reminder that even premier venues face challenges when liquidity tightens and risk appetite shifts in tandem with macro developments.

Source: CZ

Source: CZ

Even as the dust settles on the immediate episode, Zhao’s remarks reflect a broader debate about the responsibilities of centralized exchanges during market upheavals. The record shows that Bitcoin (CRYPTO: BTC) price dynamics, liquidity constraints, and the behavior of algorithmic traders all intersect in such moments, making it difficult to assign blame to a single actor. Market observers will be watching how exchanges improve resilience—through risk controls, clearer disclosure, and transparent handling of customer funds—so that future episodes do not repeat the most acute aspects of October’s sell-off.

Why it matters

The discussion around Zhao’s comments highlights a persistent tension in crypto markets: the balance between innovation and risk management within centralized platforms. As the industry matures, traders rely on exchanges not only for liquidity but for safeguards against extreme volatility. The Oct. 10 event tested that assumption and prompted a closer look at how margin calls, liquidations, and depeg episodes propagate through interconnected protocols. While the market will no doubt continue to experiment with new products and cross-chain technologies, sustained improvements in risk controls—especially around oracle feeds and price references—will be essential to maintaining confidence among participants and regulators alike.

Moreover, the episode has implications for policy and enforcement. Zhao’s public stance—framed as a personal perspective rather than a corporate statement—underscores how stakeholders navigate accountability in a sector where legal and regulatory frameworks are still evolving. For users, the takeaway is a reminder to diversify risk—not only across assets but across venues—until clearer standards emerge for how exchanges manage extreme events and compensate users when disruptions occur in price feeds or settlement processes.

From an investment perspective, the market’s longer arc remains uncertain but cautiously optimistic. While November and December brought renewed volatility, the broader trend in on-chain activity, liquidity provisioning, and institutional interest suggests a sector that is still finding its footing after a period of intense upheaval. The fact that Zhao continues to influence the space through his investment arm and ongoing public commentary points to the enduring relevance of vocal founders and their platforms as the crypto industry seeks to institutionalize best practices without stifling innovation.

What to watch next

- Regulatory statements or pending actions related to exchange liquidity risk and stablecoin disclosures.

- Updates from Binance or YZi Labs regarding risk management improvements, liquidity commitments, or governance changes.

- Any new insights into Ethena’sUSDe resilience and oracle architecture after the October depeg episode.

- Market liquidity indicators and capital inflows/outflows that could influence Bitcoin and broader crypto benchmarks in the coming quarters.

- Follow-up analyses on the October crash’s impact on market structure, including margin dynamics and exchange circuit-breaker practices.

Sources & verification

- Zhao’s comments during a Binance social media Q&A, as reported by Bloomberg.

- October 10 market crash and the $19 billion in liquidations reported in crypto coverage.

- Ethena Labs founder Guy Young’s remarks on the USDe depeg and its attribution to an oracle issue.

- Binance’s compensation of affected users totaling about $283 million.

- Subsequent price action of major cryptocurrencies, including Bitcoin.

This article was originally published as CZ Denies Binance Fueled Historic Crypto Liquidation Crash on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Will XRP Price Increase In September 2025?