946 Exahash—Miners Push Bitcoin to New Computational Heights Despite Pay Drop

At block height 901,152 on Friday, the Bitcoin network logged its 12th difficulty adjustment of the year, slipping a slight 0.45%, which lowered the difficulty to 126.41 trillion. The next day, Saturday, miners pushed the network’s computational power to yet another peak, eclipsing the previous high recorded last month.

Difficulty Drops, Hashrate Soars, but Miners Still Feel the Heat

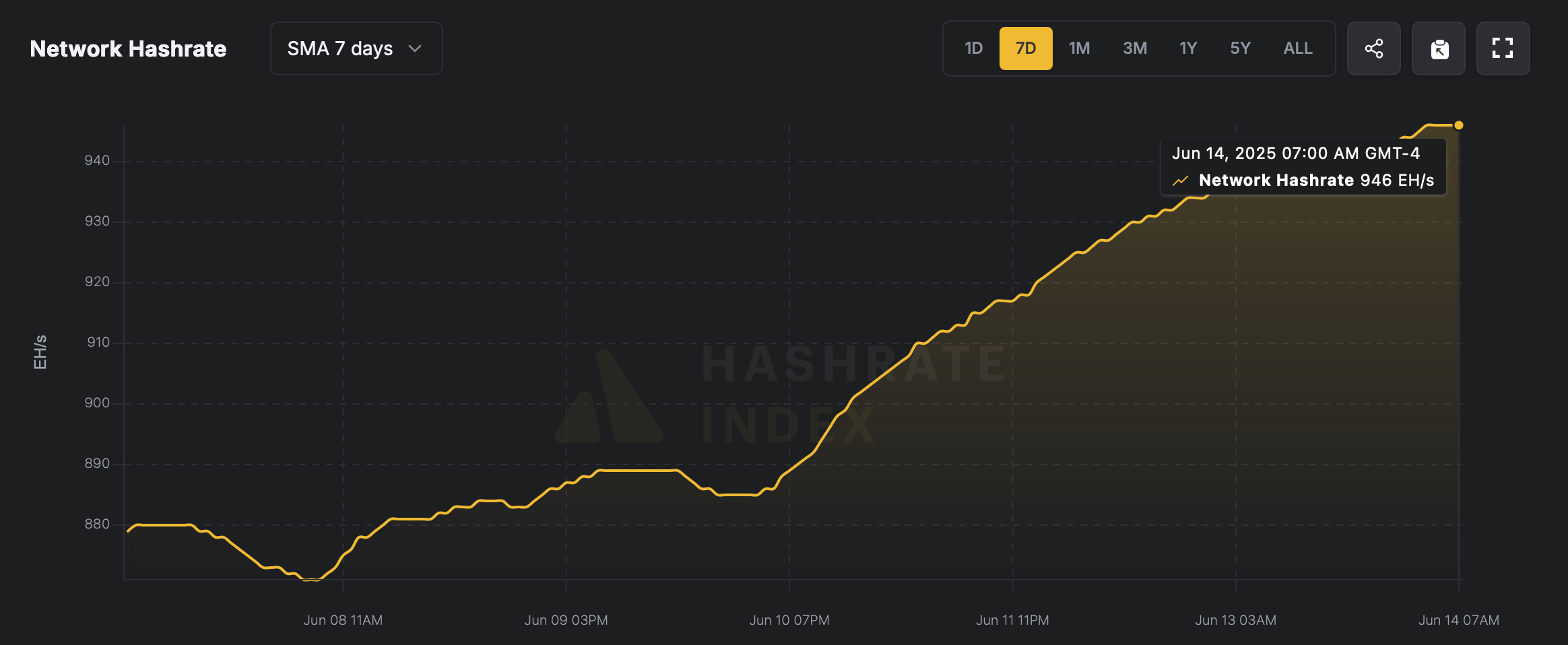

On June 14, 2025, Bitcoin’s hashrate carved out a fresh milestone, hitting a peak of 946 exahash per second (EH/s) based on the seven-day simple moving average (SMA). The prior all-time high (ATH) was set on May 31, when the network reached 943 EH/s. As of 8 a.m. Eastern on Saturday, the hashrate measured 944.84 EH/s.

Bitcoin hashrate on Saturday, June 14, 2025, according to hashrateindex.com.

Bitcoin hashrate on Saturday, June 14, 2025, according to hashrateindex.com.

This latest ATH arrived just after a slight difficulty adjustment, a 0.45% dip that nudged the metric down from 126.98 trillion to 126.41 trillion. Although this shift offered minor relief, the difficulty remains elevated—continuing to weigh heavily on miners. The next recalibration is projected for around June 29, 2025. Of the 12 difficulty changes so far this year, eight have been upward revisions while four marked downward moves.

Meanwhile, mining revenue has declined compared to levels seen 30 days ago, with the hashprice slipping from a daily yield of $55.53 per petahash per second (PH/s) on May 14 to the current $52.92 per PH/s. In the past 24 hours, miners earned an average of 3.17 BTC from both block subsidies and transaction fees combined, with fees contributing just 1.32% to the total haul.

At the moment, block times are lagging behind the ideal 10-minute average, and the next difficulty adjustment—slated for June 29—is tentatively projected to dip by about 7.74%. Naturally, that figure is fluid and likely to shift greatly by the time the change is implemented. Especially if the hashrate holds at elevated levels and block production begins to accelerate.

You May Also Like

Zcash (ZEC) Price Prediction: ZEC Defends $300 Support as Bullish Structures and Privacy Narrative Return to Focus

The 5000x Potential: BlockDAG Enters Its Final Hours at $0.0005 Before the Presale Ends