👨🏿🚀TechCabal Daily – Kuda goes national

TGIF.

At the start of every year, when resolutions are still intact, there’s a shared uncertainty about what lies ahead for Africa’s tech ecosystem. At TechCabal, we’re no different. However, we can ask some of Africa’s most experienced executives, investors, and journalists to help us make sense of what to expect in an ever-changing industry at a crossroads.

And that’s what we did.

This week, we’re launching our inaugural Predictions project, featuring forecasts on African tech from investors like Uwem Uwemakpan, head of investments at Launch Africa; operators such as Lendsqr CEO Adedeji Olowe; and journalists including Techpoint Africa’s Chimgozirim Nwokoma. They and others like them sent in what they expect will happen, why they believe it will, and what could derail those expectations. Look out for our Predictions!

- Quick Fire

with Eniola Taiwo

with Eniola Taiwo - Kuda wants to expand its experience centres

- Moniepoint’s transaction volume increases by 169.44%

- Who secured the bag?

- World Wide Web 3

- Event

FEATURES

Quick Fire  with Eniola Taiwo

with Eniola Taiwo

Eniola Taiwo, founder of Smartsave

Eniola Taiwo, founder of Smartsave

Eniola Taiwo is a digital innovator and the founder of Smartsave, a Nigerian fintech that pioneered a “phygital” (physical-digital) model to bridge the trust gap for cash-reliant users. Leveraging her background in accounting and data analysis, she scaled the platform to process over ₦210 million in transactions, achieving profitability through a focus on evidence-based, user-centric design. Beyond fintech, she developed Skill Bloom, a gamified educational prototype for children with social communication challenges, further cementing her reputation for architecting technology that addresses underserved social needs.

- Explain what you do to a 5-year-old.

Imagine your Aunty Tolu sells plantains in the market. Every day, she gets plenty of cash, notes, and coins. She wants to save for your cousin’s school fees, but she’s afraid to keep it at home, and the bank feels too far, or she feels so scared that if she keeps the money in the bank, it disappears overnight because she doesn’t trust anything called digital. So, what do I do? I helped build a magic box on her phone. But here’s the trick: she doesn’t have to start there. She can give her cash to Uncle Fayokemi, our trusted agent. Uncle Fayokemi uses his own phone to put her money safely into her magic box. Now, Aunty Tolu can see her savings on her own phone and use it to buy electricity or pay for TV, all without carrying cash, and this will happen after we have helped her to trust our app. My job is to build that bridge between the paper money in her hand and the safe money on her phone.

- You worked at Lloyds Banking Group as a Customer Service Advisor. What does that mean, and what did it teach you about building a fintech for Africans?

My job at Lloyds was simple: help customers who were confused, frustrated, or stuck with their money. I was the person you called when the ATM ‘swallowed’ your card or the app was working. The biggest lesson was this: people everywhere just want things to work without stress. At Lloyds, they kept making their app simpler, adding features for students, new parents, and retirees, meeting people where they were.

Building for Africa, I took that lesson and added our own spice. For many here, the problem isn’t just a bad app; it’s total distrust of anything digital with money. My time at Lloyds taught me to have infinite patience. So for Smartsave, we didn’t just build an app and shout “Come!” We built a system that starts with the familiar: the corner shop, the human face you know and greet every day. The tech sits quietly in the background, earning trust slowly. The app has to be so simple that an old person can use it.

- What is the biggest lesson you’ve learned from scaling a fintech product in Nigeria?

The biggest lesson is that scale will expose every single weakness you tried to hide. You can have 10,000 users and look like a star, but when you get to 100,000, every small wahala becomes a big fire.

Maybe your server wasn’t strong enough for a Friday evening when everyone is topping up airtime. Or your customer service team can’t handle the volume of questions. The market will test you for real. I learned that scaling isn’t about moving fast and breaking things. In Nigeria, if you break things, you lose people’s trust, and that trust is everything. It’s about moving carefully, building systems that don’t break, and knowing that your user’s patience is your most important asset. You’re not just scaling a company; you’re scaling trust.

- What is one thing you’re interested in but not particularly great at doing?

I love the idea of coding. I can sit with my tech team, and we can dream up a beautiful, logical plan for a new feature. I see the whole structure in my head! But when I try to write the code myself… eh, it is well.

Once, I spent a whole weekend trying to build a simple tool to automate a report. I finally got it to work! Proudly, I showed my lead engineer. He smiled, said ‘Good attempt,’ then, in about three minutes, he rewrote my entire code. My 100 lines became fifteen clean, efficient lines. It was like watching a master chef take your simple stew and, with two touches, turn it into a gourmet feast. I appreciate the art, but I’ve accepted my lane. I am the person who describes the delicious feast we need; I leave the cooking to the chefs.

Your 2026 demands disciplined financial operations

Fincra powers the payments infrastructure businesses rely on to collect, pay, and settle across local and major African currencies with confidence. Get started.

companies

Kuda wants to expand its experience centres

Image source: Kuda

Image source: Kuda

In January, Nigeria’s Central Bank (CBN) upgraded the licences of selected fintechs and Microfinance Banks (MFBs), including Moniepoint, OPay, and Kuda Microfinance Bank, to national licences. What this means is they now have perks (and plagues) their former unit, tier-one, or tier-two licences didn’t have, including a nationwide physical presence.

So, what happened now? It seems Kuda MFB has been flying with one wing tied behind its back, because three days after its unit licence leash fell off for a national one, it’s already announcing plans to open more experience centres for customer support and community engagement.

The upgrades come with obligations. Kuda must now meet the minimum paid-up capital threshold of ₦5 billion ($3.57 million), publish its annual accounts in a national daily newspaper, face stricter compliance requirements, and incur higher overhead costs from adding more branches and staff.

But it’s a crown Kuda is determined to carry: The MFB is now only waiting for the green light from the CBN to begin its rapid expansion, as opening a branch without the regulator’s approval carries a ₦2 million ($1,428) fine. As approvals roll in, more expansion announcements from other upgraded fintechs may follow. And if more branches mean more staff, then this might be a good time for job seekers to dust off their resumes.

Discover providers and manage logistics in one secure platform.

Logistics Marketplace helps key players in health, post tenders, discover providers & manage logistics in one secure platform. Free, backed by Global Fund & Gates Foundation. Join now with Access Code: WELCOME2026!

companies

Moniepoint’s transaction volume increases by 169.44%

Meme. Image source: Tenor

Meme. Image source: Tenor

Fintech unicorn Moniepoint has released fresh transaction data that shows how quickly Nigeria’s digital payments engine is accelerating. According to an internal company presentation reviewed by TechCabal, Moniepoint’s transaction volume has nearly tripled over two years, rising from 5.2 billion in 2023 to over 14 billion in 2025.

By 2025, Moniepoint was processing about 1.7 billion transactions monthly, nearly four times the 2023 level. The money moving through its system also reached ₦412 trillion ($294.03 billion), nearly double what it handled two years earlier. But a more interesting signal sits between the numbers.

A closer look at the numbers: Transaction volume grew by 169%, while transaction value rose by 96%. That gap suggests Moniepoint is growing much faster than it is becoming profitable. The growth is driven by frequent, low-value payments rather than large transfers, suggesting deeper penetration into everyday commerce and among merchants, including food sellers, convenience stores, transport operators, fuel stations, and market traders. It shows that the informal economy is doing more digital transactions more often than before, even if each payment isn’t dramatically larger.

Get clear guidance, support, and reporting tools that work.

Online Violence Has Offline Consequences

Online harm is real harm. Harassment and cyberbullying follow people into their homes, work, and daily lives. We all deserve safer digital spaces. Get clear guidance, support, and reporting tools that work. Visit kuramng.org to get started.

insights

Funding Tracker

Image source: TechCabal Insights

Image source: TechCabal Insights

Valu, an Egyptian fintech startup, secured $63.6 million in a short-term financing agreement with the National Bank of Egypt (NBE). (Jan 27)

Here are the other deals for the week:

- OneDosh, a Nigerian-founded fintech startup, raised $3 million in pre-seed funding from undisclosed investors. (Jan 23)

- KNOT Technologies, an Egyptian event tech startup, raised $1 million in pre-seed funding from A15. (Jan 27)

- WellsForAll, a Ghanaian clean-tech startup, raised $150k in community-governed funding. (Jan 27)

- NowPay, an Egyptian fintech startup, raised $20 million in investment from Tasheel JV. (Jan 27)

- Yakeey, a Moroccan proptech startup, raised $15 million in a series A round, led by Enza Capital (Kenya), with participation from IFC, Beltone Venture Capital, and CDG Invest. (Jan 27)

- Enakl, a Moroccan mobility startup, raised $2.3 million in a seed round from Azur Innovation Fund, Witamax, MFounders, Catalyst Fund, and Digital Africa. (July 28)

- Aya Data, a Ghanaian AI startup, raised $900,000 in a seed round led by 54Collective, with participation from other angel investors. (Jan 28)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go,here’s what we covered in the launch of our State of Tech in Africa Review for 2025. Find out more here.

Attend Africa Tech Summit, Nairobi

Africa Tech Summit Nairobi, powered by Fincra takes place on Feb 11 & 12, 2026. Connect with Binance, Moniepoint, VALRdotcom, Andela, Cardano, Wada, ConduitPay & more. Rates increase on 6 February

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| Bitcoin | $82,939 |

– 5.95% |

– 6.19% |

| Ether | $2,746 |

– 6.96% |

– 7.68% |

| BNB | $894 |

– 5.46% |

– 1.32% |

| Solana | $115.52 |

– 6.43% |

– 7.91% |

* Data as of 06.45 AM WAT, January 30, 2026.

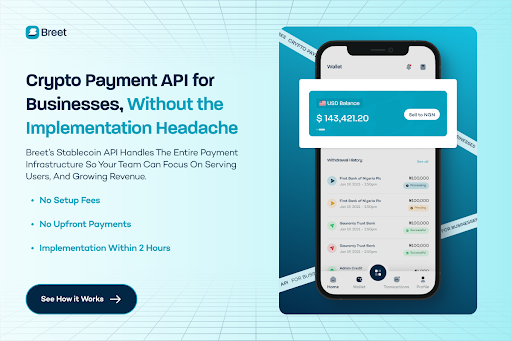

Breet runs the crypto layer end-to-end

No wallets to manage. No volatility to worry about. Breet runs the crypto layer end-to-end so your team can focus on product, users, and Growth

JOB OPENINGS

- Big Cabal Media — Associate Videographer/Video Editor (full-time); Senior Financial Analyst (full-time); Zikoko Citizen Reporter (full-time); Content Creator (contract); Journalist (contract); Project Associate (contract); Senior Editor (contract); Senior Writer (contract) — Lagos, Nigeria

- Piggyvest — Senior Accounting Associate, Customer Success Intern — Lagos, Nigeria

- Buffer — Senior Engineer, Growth Marketing — Remote

- Moniepoint — Several roles — Remote (Nigeria)

- FirstBank — Business Development Lead, eCommerce & Retail — Lagos, Nigeria

- Wave — Machine Learning Scientist — Nairobi, Kenya

- Pavago — Customer Success Manager — Remote (Kenya)

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

- Delve into AI: Papermap.ai wants your business-related questions in Pidgin, Twi, or French

- Agritech funding in Africa drops to $168 million in 2025 as investor interest shifts Almost four in five of Nigeria’s major roads now have mobile signal, NCC says

Written by: Emmanuel Nwosu, Zia Yusuf, and Opeyemi Kareem

Edited by: Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

You May Also Like

Red Dress Collection Concert Launches American Heart Month with Star-Studded Awareness Effort

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets