Zcash (ZEC) Price Reaches a Key “Moment of Truth” – Is a Bullish Pennant Forming?

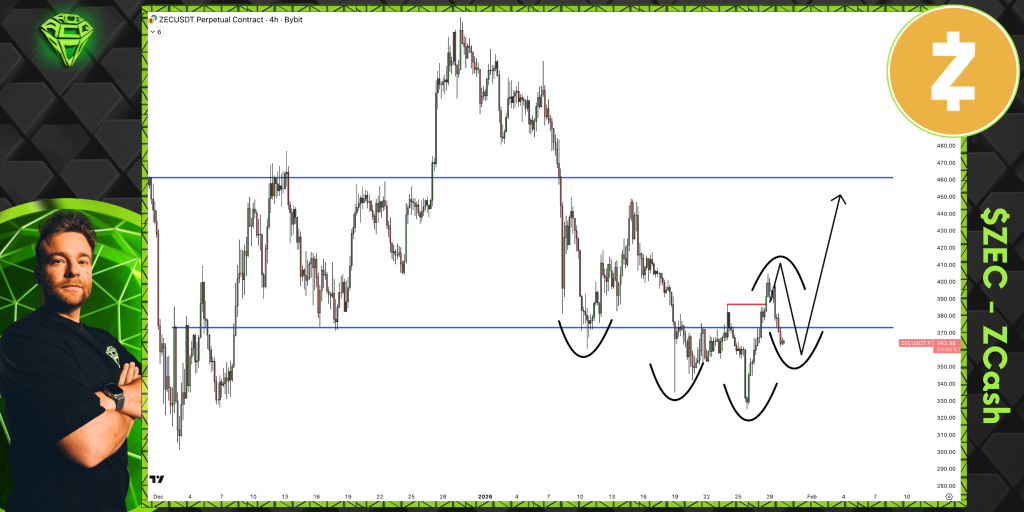

The charts are lining up around an important moment for the ZEC price. After weeks of sideways and choppy action, Zcash is now sitting at a level that could either support a rebound or lead to another move lower.

On the lower-timeframe chart, the ZEC price is hovering around the $360–$370 area, a zone that has acted as a pivot multiple times. This is where traders are watching closely to see if a higher low can form. Holding this range keeps the recovery structure in place, while losing it would shift attention back toward lower support zones.

Zcash Short-Term Levels That Matter Most

The 4-hour chart shared by Sjuul gives a clean roadmap. Support sits around $360–$370, which is where the ZEC price is currently trying to hold its ground. Above that, the next major hurdle comes in near $460, a level that has capped rallies in the past.

Source: X/@AltCryptoGems

Source: X/@AltCryptoGems

There is also a clear invalidation level on the chart. A breakdown below $320 would invalidate the higher-low idea and shift the structure back toward a more bearish setup. That does not mean price is headed there, but it is the line that separates recovery from failure.

For the bullish scenario to materialize, ZEC needs to recover $370 and follow through. If so, a move to the high $300s and then testing the $460 resistance level is not entirely far-fetched.

The ZEC Daily Chart Shows the Bigger Picture

Zooming out to the daily chart shared by BitcoinCensus changes the perspective. The Zcash price has been trading within a wide bullish flag-like formation over the past months after a strong rally in the earlier stages of the cycle. The price is still trading within the flag formation. Therefore, it is likely to experience some minor corrections.

Source: X/@Bitcoinsensus

Source: X/@Bitcoinsensus

The long-term projection from this pattern points toward $1,000, but that is clearly a macro target, and not something expected in the near term.

For that scenario to even come into play, the ZEC price would need to reclaim several major resistance zones and eventually break out of the larger structure with momentum.

Read Also: $KAS Price Prediction – $5,000 in Kaspa Now, How Much Could It Be Worth by 2027?

What to Watch Next for the ZEC Price

The big question in the short term is whether ZEC can continue to trade above the $360 to $370 level and keep the level around $320 at bay.

If that level continues to hold, the charts do indicate that ZEC could move back up towards the $400 level, perhaps facing resistance at the $460 level in the process.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Zcash (ZEC) Price Reaches a Key “Moment of Truth” – Is a Bullish Pennant Forming? appeared first on CaptainAltcoin.

You May Also Like

Spot silver falls below the $100 mark

Solana network saw its active addresses more than double to over 5 million in January, with daily transaction volume jumping to 87 million.