Altcoin Season Radar: Momentum Builds for a Market Jolt

With ether brushing up against the $4,000 mark on Friday and a host of other alternative digital assets racking up hefty gains, the Altcoin Season Index (ASI) data points to a climb toward the much-talked-about stretch of altcoin dominance.

ASI Jumps, 565 X Posts Hint at Brewing Altcoin Fever

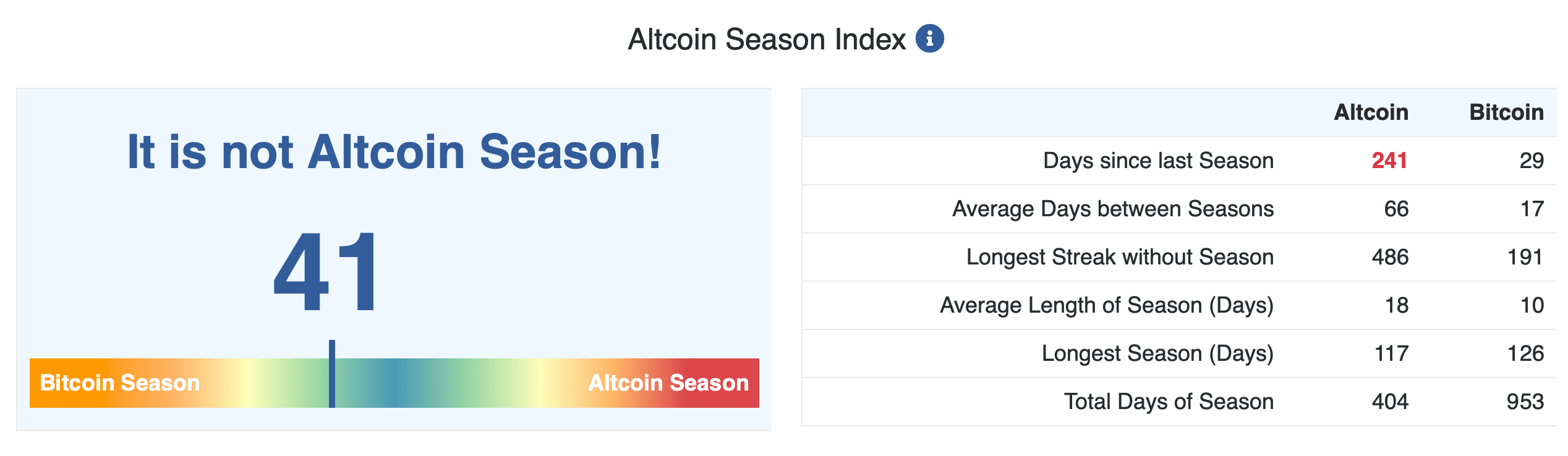

Plenty of market watchers believe the fabled altcoin season could be around the corner. It’s been a lengthy 241 days since the last one—well beyond the usual 66-day gap—leaving traders wondering if this next run might be worth the wait. In essence, the Altcoin Season Index (ASI) on blockchaincenter.net acts as a market barometer, revealing whether traders are leaning toward altcoins or staying loyal to bitcoin. It tracks the performance of the top 50 cryptocurrencies, leaving stablecoins out of the mix.

Altcoin Season Index via blockchaincenter.net.

Altcoin Season Index via blockchaincenter.net.

If 75% or more of those coins outpace bitcoin, it marks the start of altcoin season. When 25% or fewer outperform bitcoin, it’s labeled bitcoin season. Anything in between sits in a neutral zone, offering no clear leader. In short, the index delivers a quick read on where market momentum is headed. While 241 days is long, the record dry spell for altcoins stands at a whopping 486 days, while their average run lasts just 18 quick days. For much of mid-2024, the index hugged the lower end, signaling bitcoin’s grip on the market.

Late in the year, however, altcoins staged a sharp rally, briefly pushing the index well above the 75 mark — officially into altcoin season territory — before retreating. In early 2025, the pendulum swung back toward bitcoin, with the index dipping near the 25 threshold. Most recently, we saw a spike up to 59 in late July, flirting with altcoin territory but falling short, before sliding back to the current 41 reading. With ethereum hitting the $4,000 mark today and a wave of other altcoins posting double-digit gains, plenty of traders are convinced the long-awaited season may finally be arriving.

The chatter is heating up, too. The artificial intelligence (AI) chatbot Grok found 565 unique X posts using the exact phrase “Altcoin Season” between Aug. 1 and Aug. 8, 2025. “ ETH almost at 4k and altcoin season seems so far away…,” one user wrote, adding, “2021 please come back.” Another asked, “Now can we start Altcoin season?” Over the past 90 days, the crypto leaderboard has seen some dramatic moves, with a few tokens blasting off while others took a nosedive.

Leading the charge is PENGU, rocketing an eye-popping 157%, leaving the rest of the market in its wake. HYPE (+56.9%), ethereum (+52.6%), WBETH (+52.1%), and ENA (+50.3%) rounded out the top five gainers, with solid double-digit climbs from familiar names like uniswap (+48.7%), cronos (+46%), and stellar (+43.7%). Even bitcoin managed a modest +8.9% rise, hanging in the green.

On the flip side, it was a rough season for pi, which tumbled a steep 52.5%, and render, down 30.6%. Other heavy hitters in the red included GT (-26.3%), polkadot (-25.9%), vechain (-24.8%), and aptos (-23.6%). Meme coin favorite shiba inu slipped 23.6%, while dogecoin shed 8.9%. The scoreboard shows a classic tale of crypto’s wild rides—some rockets launched straight to the moon, while others crash-landed hard.

If momentum keeps shifting in favor of altcoins, the market could be on the brink of a decisive breakout. Traders are already positioning for potential upside, but as history shows, sentiment can flip fast. Whether this becomes a fleeting rally or a sustained run could very well hinge on how bitcoin reacts in the coming weeks.

You May Also Like

Hoskinson Says XRP and Cardano Projects Lead Tokenization Race

Sharplink CEO: Stablecoins, RWA, and sovereign wealth funds will drive Ethereum's TVL to grow tenfold by 2026.