Trump-Linked WLFI Approves Token Buyback Plan for Enhanced Value

In a move aimed at revitalizing its declining value, World Liberty Financial (WLFI), a crypto project associated with the Trump family, has successfully passed a governance proposal to implement token buybacks and burns. The initiative comes after the platform faced significant price depreciation since its launch, prompting community-led measures to stabilize and increase the token’s market appeal.

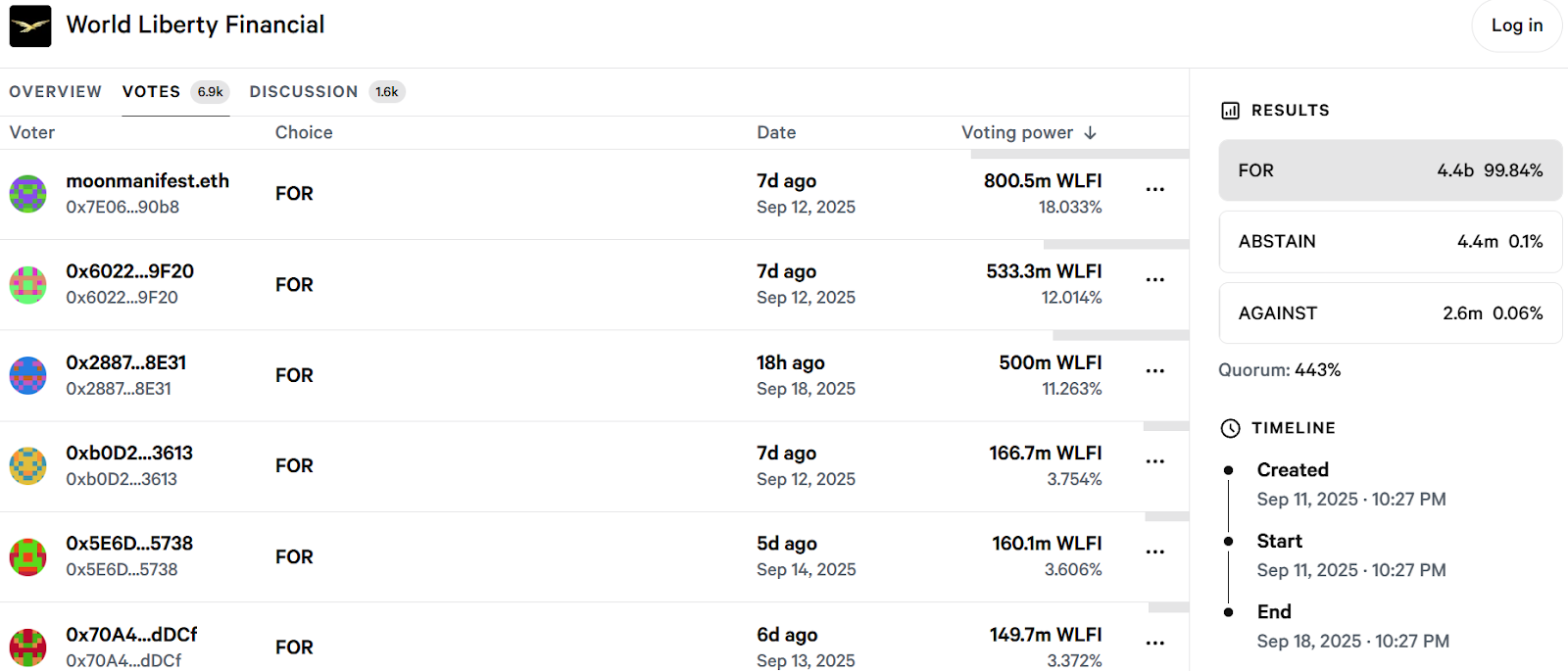

During Thursday’s voting, an overwhelming 99.8% of participants approved the plan, which dictates that 100% of the liquidity fees collected by WLFI will be allocated toward purchasing and permanently burning tokens. This approach is designed to reduce circulating supply and foster greater demand, a common strategy in the cryptocurrency space to boost token value. Only a minimal 0.06% community dissent indicates broad support for the move, according to data from WorldLibertyFinancial.com.

Once implemented, WLFI will gather liquidity across Ethereum, BNB Chain, and Solana, directing these assets toward open-market buybacks. The tokens acquired will then be sent to burn addresses, making them inaccessible and thereby reducing overall supply. However, specifics on the platform’s fee generation remain vague, complicating estimates of the potential impact on market capitalization and investor sentiment.

The vote followed the token’s launch on September 1, which was marred by a sharp 40% price drop in just three days—causing whales and retail investors alike to face substantial losses, as previously reported. Despite a burn of 47 million tokens on September 3, the price decline persisted, and WLFI now trades at around $0.2223, down more than 28% since debut, according to CoinMarketCap.

Exploring Additional Revenue Streams for Token Buybacks

The recent governance approval sets the groundwork for ongoing buyback efforts and marks the start of a broader strategy. WLFI also plans to diversify its revenue sources within the protocol to enable larger buybacks and further stabilization efforts.

Contacted for more details about future revenue strategies and buyback scope, WLFI did not respond before publication. The project’s developments continue to attract attention amid ongoing debates about regulation and market stability within the crypto industry.

Notably, high-profile investors such as controversial influencer and former kickboxing champion Andrew Tate have experienced significant losses on WLFI, with reported figures nearing $700,000 on decentralized exchanges. Despite setbacks, the Trump family’s crypto ventures seem to be financially lucrative overall, with their wealth reportedly increasing by approximately $1.3 billion in the week prior, driven by WLFI gains and the debut of their mining company, American Bitcoin.

For more insights into the intersection of politics and crypto, see our coverage on conflicts of interest and insider trading concerns surrounding prominent figures’ crypto ventures.

This article was originally published as Trump-Linked WLFI Approves Token Buyback Plan for Enhanced Value on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Michael Saylor Calls Current Crypto Winter Mild, Predicts Spring Is In The Air Followed By A 'Glorious' Summer

NZD/USD dives to near 0.6000 as RBNZ’s Breman downplays hawkish prospects