Young Platform PRO Launches: Advanced Trading Built for MiCA

The post Young Platform PRO Launches: Advanced Trading Built for MiCA appeared first on Coinpedia Fintech News

As Europe tightens crypto regulation under MiCA, exchanges are under pressure to prove they can combine professional-grade tools with regulatory confidence. Young Platform, Italy’s largest crypto exchange with over two million users, has launched Young Platform PRO, a trading platform designed specifically for advanced users who demand speed, precision, and compliance.

Built for Experts, Backed by Regulation

Young Platform PRO is aimed squarely at experienced traders. It supports 87 markets, offering advanced order types such as limit and stop-limit orders, real-time execution, and a constantly updated order book. Transactions are processed in milliseconds, supported by a scalable infrastructure optimised for high volumes.

Where global competitors face growing scrutiny, Young Platform PRO leans into Europe’s compliance landscape. The platform is aligned with MiCA regulations, recognised by major European authorities, and integrates tax management tools that cover not only crypto assets but also NFTs and DeFi holdings. Users can even access one-on-one support from crypto-specialised accountants to ensure filings are optimised and compliant.

Features That Stand Out

What sets Young Platform PRO apart is the combination of sophisticated trading functions with everyday usability:

- Minimal Fees & 0% Trading: A transparent volume-based fee structure without subscription costs or minimum portfolios. Members of Young Platform’s exclusive Clubs can trade with 0% fees.

- TradingView Integration: Advanced charting powered by TradingView, with access to over 80 technical indicators for precision trading.

- High-Performance API: Connectivity via API, WebSocket, or REST with IP whitelisting for secure and custom trading access.

- 1:1 Custody: Assets are never lent or reused. Security features include 2FA, biometrics, and multifactor risk management.

- Staking with Yields: Users can stake assets such as ETH, SOL, ATOM, and DOT to earn up to 20% APY, adding passive income to active trading.

Professional and Business Tools

For high-volume traders, Young Platform PRO offers dedicated account managers and continuous premium support. Institutional users benefit from OTC services for large spot trades with minimal slippage, as well as features like sub-accounts for managing teams and Euro-only conversion to hedge against volatility.

Corporate clients can also access training to integrate digital assets into treasury operations, a sign that the platform is positioning for both individuals and businesses moving into crypto.

Why Young Platform PRO Matters

Crypto adoption in Europe is moving past speculation into long-term integration. Traders no longer just want access to coins; they want speed, professional tools, security, and compliance. By combining advanced trading infrastructure with MiCA alignment, Young Platform PRO reflects where the European market is heading: crypto that is fast, regulated, and built for professionals.

That vision is reinforced by the company’s backing. Young Platform PRO is supported by partnerships with European banks, global providers, and institutional investors. Its cap table includes Banca Sella, Azimut, and United Ventures, underlining the confidence of established financial players in its model. In a market where trust is becoming as important as liquidity, these alliances position Young Platform PRO as a platform built for staying power.

You May Also Like

Hong Kong Backs Commercial Bank Tokenized Deposits in 2025

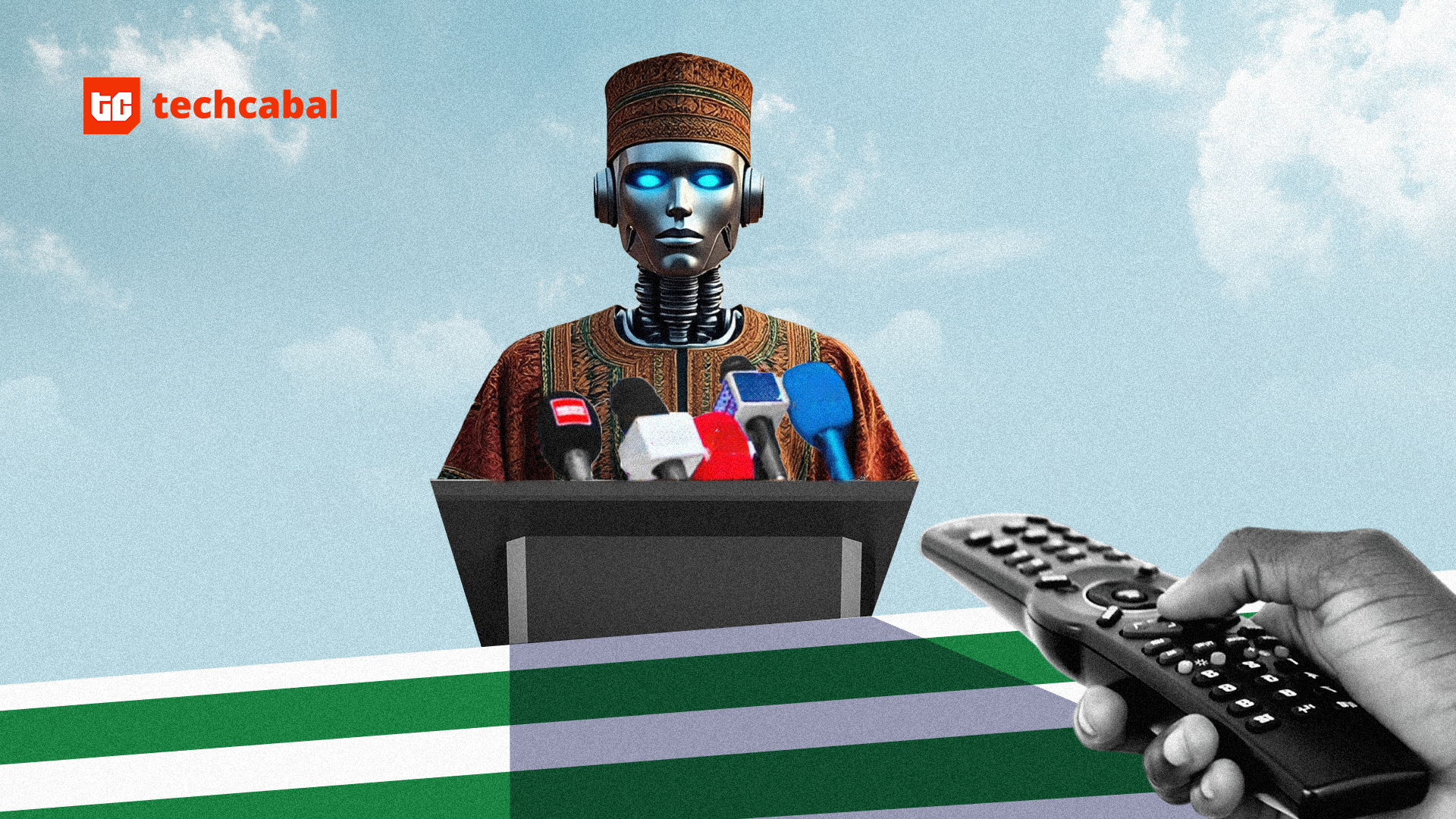

TechCabal’s most definitive stories of 2025