Bitcoin Jumps on Fed Rate Cut Odds at 96% — Best Altcoins to Buy Before $120K BTC Breakout

Bitcoin’s climb past $116K has reignited interest in altcoins. Traders hunting the best crypto to buy are now looking closely at MAGACOIN FINANCE, a rising altcoin still priced under $0.0005 that many expect to surge faster than Bitcoin as capital rotates.

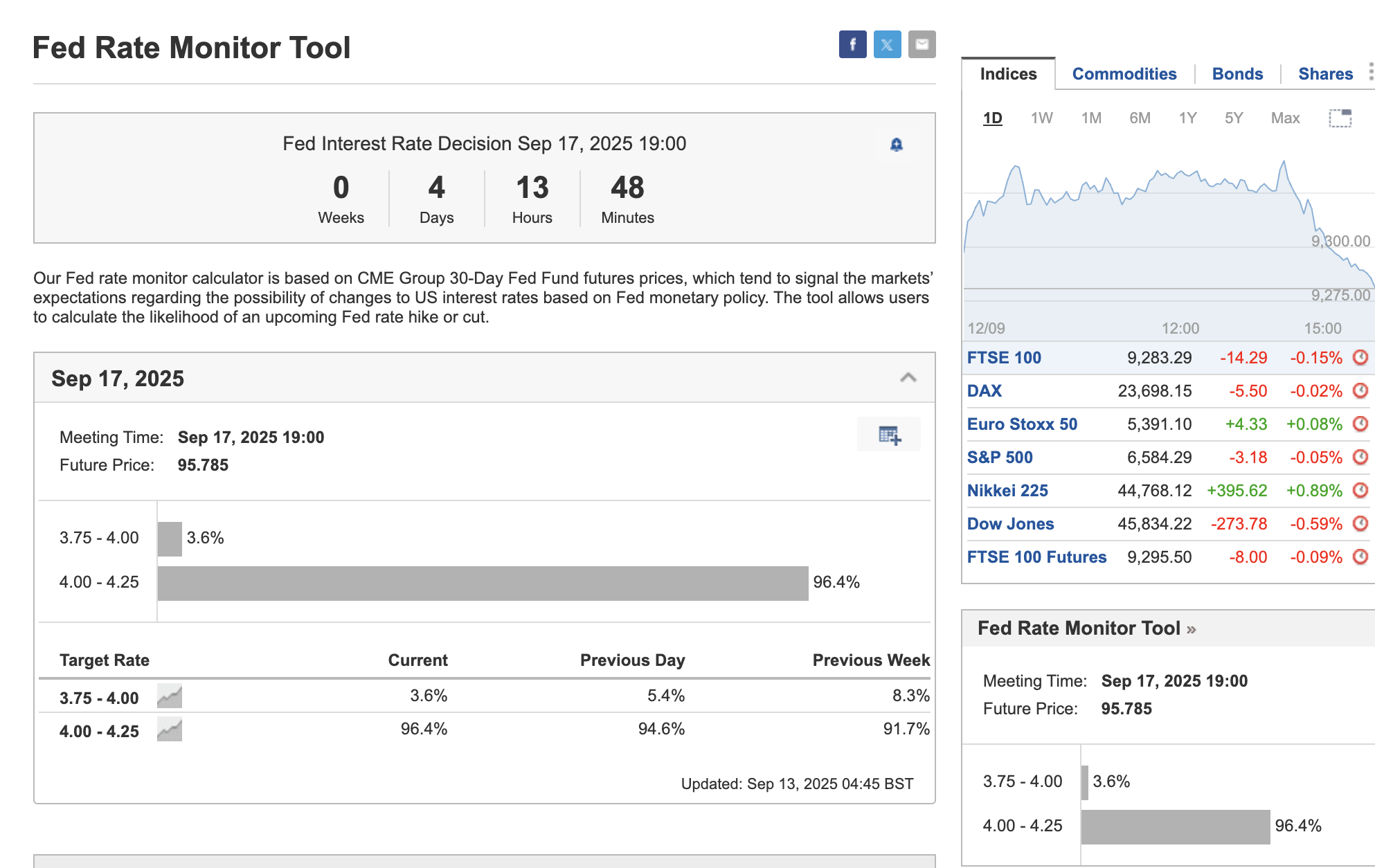

Fed Rate Cut Odds Boost Bitcoin’s Rally

As of September 13, 2025, futures markets show a 96.4% chance of a 25-basis-point Fed rate cut at the September 17 meeting. If delivered, the federal funds target range will move to 4.00–4.25%.

Traders also see a 73.6% likelihood that rates fall further to 3.50–3.75% by December, setting the stage for cheaper liquidity and a friendlier backdrop for risk assets.

The push for rate cuts comes as labor market data softens. Job creation has slowed, unemployment claims are climbing, and recession fears are back in focus.

Meanwhile, inflation has cooled from its peak but remains above the Fed’s 2% target. This mix of weaker hiring and sticky inflation makes rate cuts a widely expected policy tool.

By 2026, markets are already betting on rates near 3.00–3.25%, with odds of additional easing later in the year. Against this backdrop, Bitcoin has surged above $116,000, regaining traction as traders price in looser monetary conditions.

Bitcoin Tops $116K as Inflation Data Softens

Bitcoin crossed $116,000 for the first time in four weeks after U.S. Producer Price Index data showed inflation cooling more than expected. The August PPI print came in at 2.6% year-over-year, below forecasts of 3.3%. Core PPI also slowed to 2.8%. On a monthly basis, the index even fell by 0.1%, reinforcing the idea that inflationary pressures are easing.

The data strengthened bets that the Fed will act more aggressively. Traders on Kalshi markets now see a higher chance of three rate cuts this year instead of two.

Political pressure has also intensified, with President Trump calling for immediate and larger cuts. Together, softer inflation and growing policy pressure have fueled Bitcoin’s recovery, with forecasts pointing to $120,000–$200,000 by year-end.

MAGACOIN FINANCE: Best Altcoin to Buy Before $120K Breakout

With Bitcoin’s march toward $120K in motion, traders looking for the best altcoins to buy are turning to MAGACOIN FINANCE. Priced under $0.0005, this new altcoin is still in its early phase, giving it room to cancel two zeros as price activity grows by the hour.

Analysts say Bitcoin may double on its way to $200K, but MAGACOIN FINANCE could move 25x faster, fueled by capital rotation from larger assets into smaller, high-upside names.

With over 18,000 investors already involved and listings expected soon, there is clear FOMO building around this project. Its legitimacy and safety record add to the attraction, making it one of the best crypto to buy now before Bitcoin’s next breakout.

What Traders Should Do Now

Bitcoin’s push toward $120K is setting the stage for one of the biggest runs of 2025. For those asking which are the best altcoins to buy, rotating into smaller projects like MAGACOIN FINANCE before wider exchange listings could be a smart move. Don’t wait until the breakout is fully underway — now is the time to position:

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

The post Bitcoin Jumps on Fed Rate Cut Odds at 96% — Best Altcoins to Buy Before $120K BTC Breakout appeared first on Blockonomi.

You May Also Like

Why Everyone Is Talking About Saga, Cosmos, and Mars Protocol

CME Group to Launch Solana and XRP Futures Options