Sberbank Tests Crypto Lending With Russia’s First Bitcoin-Backed Loan

Russia’s largest bank has issued the country’s first loan secured by crypto, signalling a cautious shift toward digital finance. Sberbank provided the pilot facility to Intelion Data, a major Bitcoin mining firm, testing how crypto-backed credit could function within Russia’s tightly controlled financial system.

Sberbank also confirmed that Intelion Data’s mined cryptocurrency secured the loan. The bank did not reveal the amount, time period, or value of security of the loan. According to executives, the absence of disclosure indicates the experimental nature of the transaction and risk evaluation in progress.

Sberbank Tests Crypto-Backed Lending With Internal Risk Controls

To secure itself, the crypto collateral was deposited into its own custody system, Rutoken. The site safeguards the digital assets until the borrower fully repays the loan. According to bank officials, this system lowers exposure and dependency on outside custodians.

The lender said that this was a pilot program and not a complete launch of the product. Sberbank claimed that it desires to examine the behavior of crypto-backed lending under actual market conditions. The test will also aid the bank in assessing the legal, technical, and operational challenges associated with digital collateral.

Also Read: Sberbank Explores Cryptocurrency-Backed Loans in Russia’s Growing Digital Market

Bank officials indicated that the model had the potential to grow as long as performance is good. The future loans could aim at firms that have digital assets in their balance sheets. Sberbank emphasized that any growth would rely on the guidance of the regulators and their capacity to control price volatility.

Mining Industry and Regulators Respond to Crypto Loan Deal

Intelion Data viewed the deal as a positive sign for the mining industry. Chief executive Timofey Semanov confirmed that the loan indicates the growing institutional trust in digital assets. He noted that the availability of bank credit would facilitate growth and stability in Russia’s mining industry.

Deputy chairman of Sberbank, Anatoly Popov, stated that digital asset regulation in Russia is developing. He observed that the bank will be ready to collaborate with the central bank. This is aimed at coming up with clear rules, technical standards, and protection of digital asset services.

Sberbank revealed earlier this month that it is also experimenting with decentralized finance tools. The bank backs a slow and regulated way of digital asset adoption. Meanwhile, the central bank has pointed out that it can tolerate limited retail digital asset trading with strict yearly restrictions.

Also Read: Galaxy Research Predicts BTC Volatility, Solana Shift, and Stablecoin Surge in 2026

You May Also Like

Bitcoin Needs 6% Rally to Close 2025 in Green, Analyst Warns

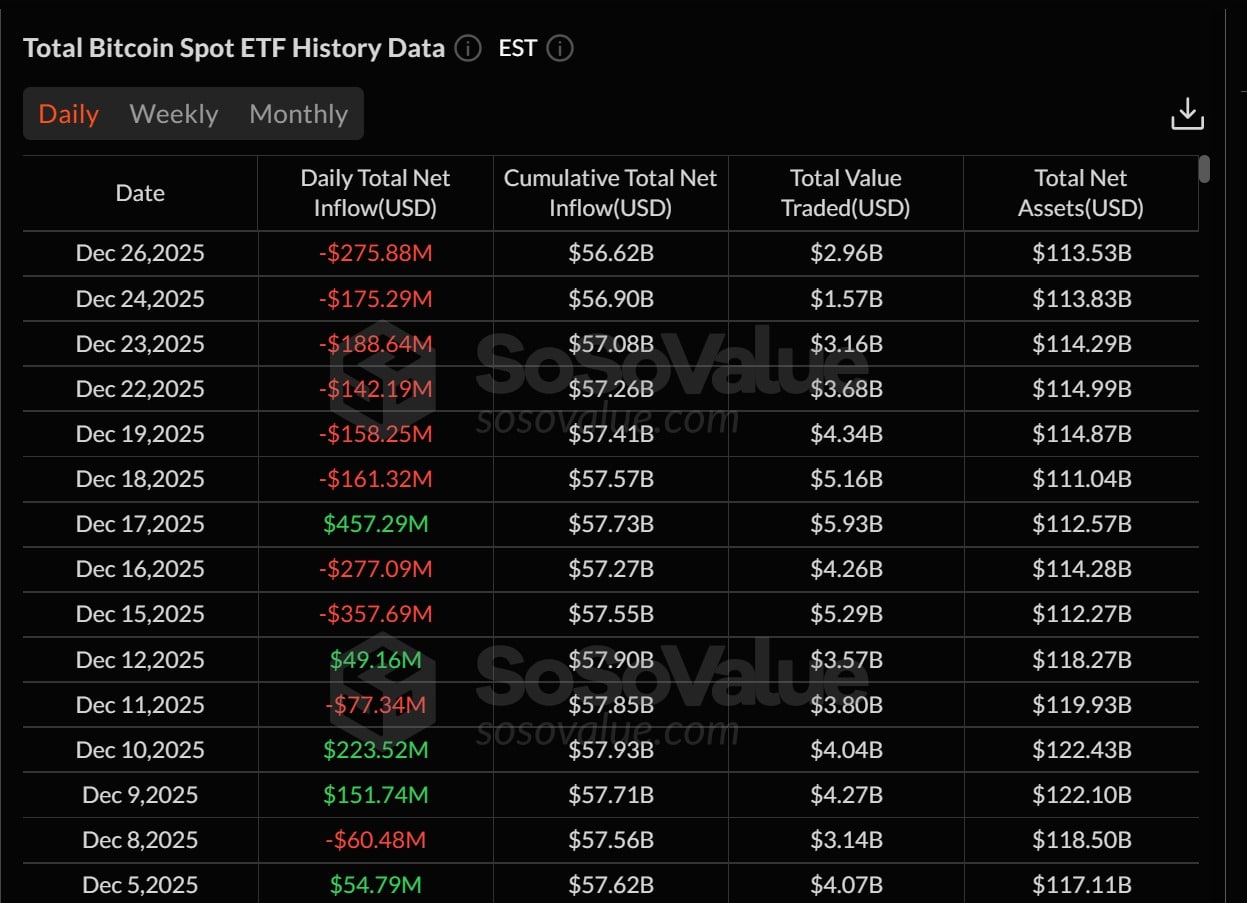

Bitcoin Price Gains 1% Despite US-listed Spot ETFs Seeing $782 Million In Outflows During Christmas Week