BCH price charts giant double bottom reversal, could whale buying spark a breakout?

BCH was up over 7% on Friday, backed by renewed whale buying. It has formed a multi-year double bottom pattern that, if confirmed, could push gains of up to 65% for the token.

- BCH price is up 7% over the past day.

- Whales have shown renewed interest in the token lately.

- A multi-year double bottom pattern has been forming on the weekly chart.

According to data from crypto.news, Bitcoin Cash (BCH) rallied 7.1% over the past 24 hours to an intraday high of $585 at the time of writing. At this price, it is up 28% from its November low and 118% above its lowest point this year.

BCH stood as the leading gainer among the top 100 crypto assets by market cap today, while the broader crypto market stood relatively still after the Bank of Japan revealed it had increased its interest rate by 0.25% to 0.75%, marking its highest in 30 years, just weeks after the U.S. Federal Reserve cut rates.

BCH price rallied amid renewed accumulation from whales and large investors, as noted by multiple analysts. Whale buying often spurs demand among retail investors, which can lead to further gains in the short term.

Derivative traders also played a key role in supporting BCH’s gains today. Data from CoinGlass shows that Bitcoin Cash futures open interest rose by 20% over the past 24 hours to $766.6 million, while the weighted funding rate slipped into negative territory.

If BCH sees further gains, it could trigger a short squeeze as bearish positions get liquidated and potentially lead to more upside for the token.

Meanwhile, BCH has also broken out of a multi-week downtrend channel, as highlighted by pseudonymous analyst CryptoBoss. See below.

Traders typically view such breakouts as a strong bullish signal that indicates a potential trend reversal or the start of an upward move.

Additionally, as Bitcoin Cash is a hard fork of Bitcoin, investors often see it as a cheaper asset to invest in, especially when Bitcoin price action remains largely muted over long periods. BCH advocates believe the network better aligns with Satoshi Nakamoto’s original vision primarily because it functions as a peer-to-peer electronic cash system rather than just a store of value.

BCH price analysis

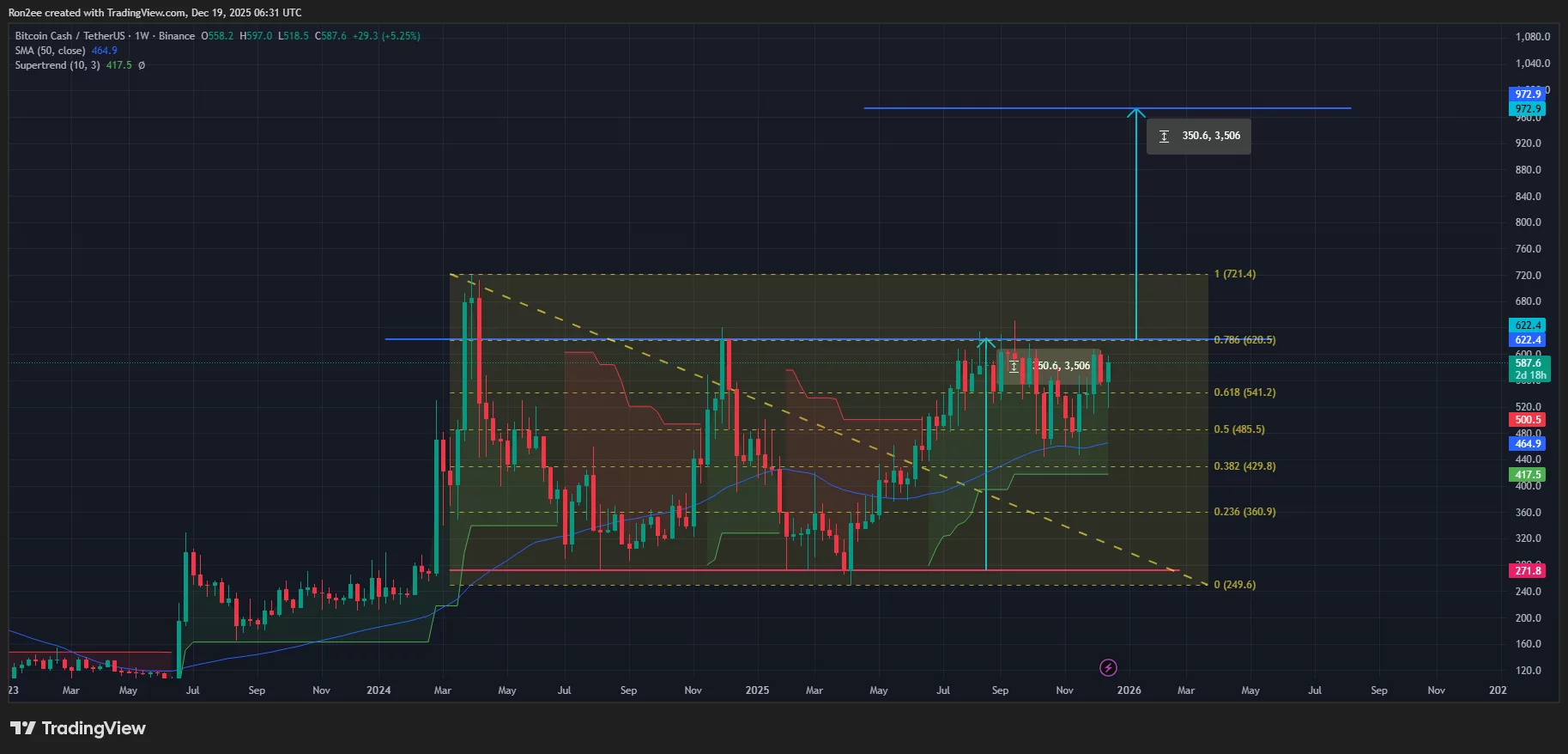

On the weekly chart, BCH price has been forming a giant double bottom pattern since its April high in 2024. The bottoms lie at around $272, while the neckline lies at $622.4.

At its current price, BCH lies just 6% below a potential breakout from the pattern. A sharp breakout from it would act as a springboard that could potentially push the price up to as high as $972, up 65% from the current price.

BCH price has moved above the 50-day moving average and the Supertrend line, which has turned green, both telltale signs of buying pressure overpowering the sellers.

However, traders should keep an eye on the $541 support, as failure to hold it could redirect the trend back into a downtrend.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

You May Also Like

Thyroid Eye Disease (TED) Treatments Market Nears $4.3 Billion by 2032: Emerging Small Molecule Therapies Targeting Orbital Fibroblasts Drive Revenue Growth – ResearchAndMarkets.com

Virtus Equity & Convertible Income Fund Announces Special Year-End Distribution and Discloses Sources of Distribution – Section 19(a) Notice