Ethereum(ETH) Price Prediction: Falling Wedge Signals $4.4K Breakout

TLDR

- Ethereum price defends key $2,800–$2,845 support after sharp correction

- Liquidation flush reduces leverage, signaling a sentiment reset

- Falling wedge pattern suggests weakening bearish momentum

- Breakout above resistance could open a move toward the $4.4K target

Ethereum price is navigating a critical consolidation phase after an extended correction from its mid-2025 peak. Recent technical structures, liquidation data, and chart patterns suggest downside pressure is easing near key support. Analysts are now assessing whether Ethereum price can stabilize and set up a recovery toward higher resistance zones, with $4,400 emerging as a longer-term technical objective.

Ethereum Price Holds Critical $2,800 Support Zone

According to analyst Ted, the daily ETH chart shows Ethereum price consolidating after a sharp decline from highs above $4,800. Price is currently range-bound, with strong buyer defense visible around the $2,800–$2,845 support zone. This area aligns with prior swing lows and historical high-volume accumulation levels, reinforcing its technical importance.

Recent candles show higher lows forming within this support band following a brief downside wick, while sell volume has gradually declined. This behavior suggests demand is absorbing supply rather than aggressive distribution taking place. As long as Ethereum price remains above this zone, the broader higher-timeframe structure retains a constructive bias.

Overhead, resistance remains clearly defined between $3,300 and $3,700, with an additional barrier near $4,000. Ted notes that a decisive daily close above $2,950 would be an early signal of renewed upside momentum. Conversely, a failure to hold $2,800 could expose Ethereum price to a deeper retracement toward the $2,500 region.

Liquidation Data Signals Sentiment Reset After Sell-Off

Meanwhile, liquidation data shared by analyst CW highlights a significant shift in Ethereum’s derivatives landscape. The liquidation heatmap shows heavy clusters of long liquidations between $3,300 and $3,400 during the December sell-off. These cascading events accelerated downside moves and cleared a large portion of leveraged positions from the market.

SOURCE: X

At current levels, liquidation intensity has faded notably. This reduction suggests leverage has been flushed, often a sign of sentiment reset following corrective phases. Historically, such conditions reduce forced selling risk and can precede periods of price stabilization or recovery, particularly when aligned with strong technical support.

CW noted that while some liquidation clusters remain below $2,700, the bulk of overextended long exposure has already been removed. This creates a cleaner technical environment, where price movements are more likely to reflect spot demand rather than liquidation-driven volatility. As a result, Ethereum price may now be better positioned to respond to broader market cues.

Wedge Pattern Points to ETH Price Upside Expansion

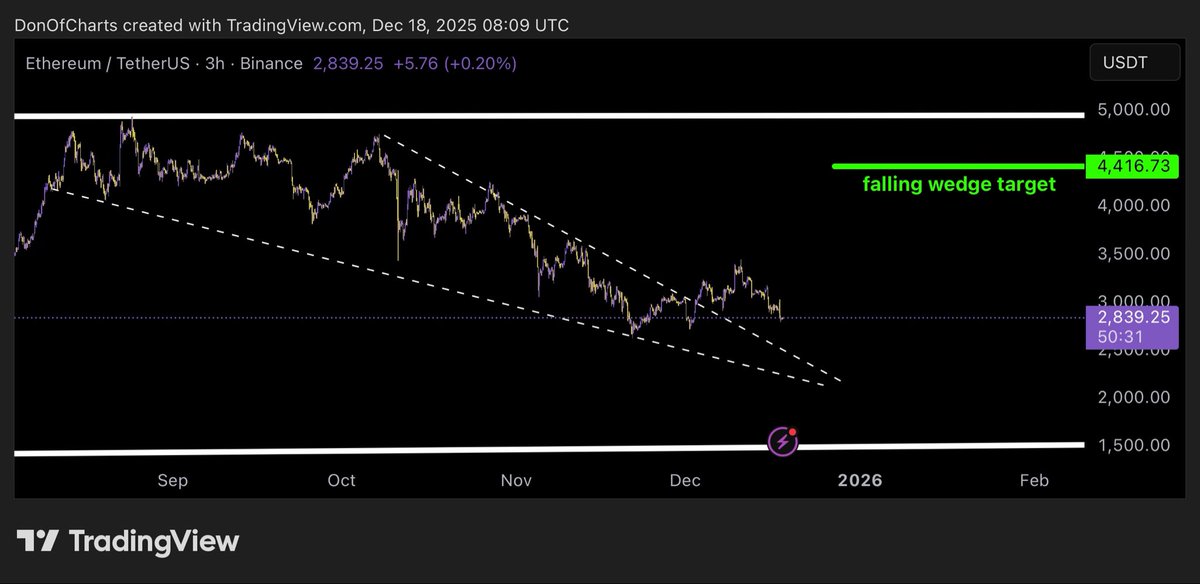

In addition, analyst Don highlights a developing falling wedge pattern on the 3-hour ETH/USDT chart. This structure has been forming since September 2025, marked by lower highs and lower lows with contracting volume. Such formations often signal weakening bearish momentum as price approaches the wedge apex.

Ethereum price continues to respect wedge support around the $2,600–$2,700 region, while repeated rejections near $2,900 define the upper boundary. The compression suggests an imminent resolution, with early bullish divergence appearing on lower-timeframe momentum indicators. These signals indicate sellers may be losing control.

According to Don, a confirmed breakout above the wedge’s upper trendline could trigger a rapid upside move. The measured projection from this pattern targets approximately $4,416, aligning with prior resistance zones highlighted on higher timeframes. Invalidation remains below wedge support, but the pattern’s historical reliability favors an upside resolution.

Ethereum price remains at a technically sensitive juncture, where strong support, reduced leverage, and compression patterns converge. Confirmation will depend on sustained strength above near-term resistance, as traders continue to monitor volatility expansion signals closely.

The post Ethereum(ETH) Price Prediction: Falling Wedge Signals $4.4K Breakout appeared first on CoinCentral.

You May Also Like

Unleashing A New Era Of Seller Empowerment

Foreigner’s Lou Gramm Revisits The Band’s Classic ‘4’ Album, Now Reissued