Building the Infrastructure for Digital Payments

The partnership aims to make international payments faster, cheaper, and more accessible for merchants and digital platforms operating across global markets.

The collaboration will focus on evaluating how USDC, Circle’s dollar-pegged stablecoin, can support more efficient transactions in high-volume international payment flows. Both companies plan to modernize treasury and settlement processes to reduce friction in cross-border payments while improving reliability for merchants operating across multiple jurisdictions.

Building the Infrastructure for Digital Payments

The partnership brings together Circle’s digital currency technology with LianLian Global’s expertise in cross-border payment services. Circle Internet Group, which went public on the New York Stock Exchange in June 2025 raising $1.1 billion, issues USDC, the second-largest stablecoin with approximately $73.7 billion in circulation as of the third quarter of 2025.

LianLian Global, a licensed cross-border payments provider based in Hangzhou, China, serves approximately 7.9 million customers worldwide. The company holds over 65 regulatory approvals and licenses globally, including money transmitter licenses across all 50 U.S. states and a Major Payment Institution license from Singapore’s Monetary Authority.

The partnership will explore using Circle’s Arc blockchain to support future payment use cases across LianLian Global’s network. Arc is a layer-1 blockchain purpose-built specifically for stablecoins and financial services, with its public testnet launched in October 2025.

Source: @circle

Interestingly, LianLian Global already participated in Arc’s public testnet alongside over 100 companies, including Goldman Sachs, BlackRock, and Visa, demonstrating the relationship between the two companies predates this formal partnership announcement.

Solving Real Cross-Border Payment Problems

Traditional cross-border payments remain slow and expensive despite technological advances. According to the World Bank, these transactions still frequently take over one business day to complete and cost more than 6% in fees. These inefficiencies particularly impact emerging markets and limit their global competitiveness.

Stablecoins offer a potential solution. By using digital currencies backed by real-world assets like U.S. dollars, businesses can settle transactions in seconds rather than days. Industry reports indicate stablecoin adoption for cross-border payments is accelerating, driven by cost savings under 1% and near-instant settlement capabilities.

The partnership will assess how stablecoin rails can simplify payment flows, allowing near real-time settlement and improved transparency. The companies also plan to identify opportunities in emerging markets where digital payment solutions can expand access and economic participation.

“This collaboration with LianLian Global reflects our continued commitment to advancing open and interoperable financial infrastructure that is built for the needs of the modern economy in Asia and beyond,” said Yam Ki Chan, Vice President of Asia Pacific at Circle.

Circle Payments Network Gains Momentum

This partnership fits into Circle’s broader strategy of connecting financial institutions through its Circle Payments Network (CPN), which launched in May 2025. CPN enables banks, payment service providers, and digital wallets to settle cross-border payments in real-time using regulated stablecoins.

The network currently operates in eight countries with 29 financial institutions enrolled. Another 55 institutions are going through eligibility reviews, while 500 more sit in the pipeline. Since launching just five months ago, the payments network achieved annualized transaction volume of $3.4 billion based on trailing 30-day activity as of November 7, 2025.

The partnership will explore how CPN could support interoperability between traditional payment rails and blockchain-native infrastructure. This would enable near real-time settlement and support always-on global commerce.

Major banks including Banco Santander, Deutsche Bank, Société Générale, and Standard Chartered are helping shape CPN to meet the demands of complex global payment systems. Design partners also include payment providers like BVNK, Flutterwave, and Coins.ph.

LianLian Global’s Growing Stablecoin Strategy

This partnership marks another step in LianLian Global’s growing involvement with stablecoin payments. In June 2025, LianLian partnered with BVNK, a stablecoin payments infrastructure provider, to enable merchants to use major stablecoins to fund cross-border transactions.

Through that partnership, merchants deposit stablecoins, BVNK automatically converts them to U.S. dollars, and LianLian Global routes those dollars through its global network. This capability reduces settlement times from days to minutes, particularly valuable for businesses operating in regions where traditional banking rails face limitations.

LianLian Global also partnered with UnionPay International in September 2025 to deliver faster cross-border remittance solutions, particularly for customers sending funds to mainland China. The company offers a wide range of solutions including cross-border payments, worldwide merchant acquisition, fund distribution, and foreign exchange services across more than 100 countries.

Regulatory Clarity Driving Stablecoin Adoption

The timing of this partnership comes as regulatory clarity around stablecoins improves globally. The GENIUS Act, passed in 2025, created the first federal framework for payment stablecoins in the United States. This legislation has encouraged more companies to explore blockchain-based payment solutions.

Circle achieved compliance with Europe’s Markets in Crypto-Assets (MiCA) regulations in July 2024, becoming the first major global stablecoin issuer to meet these requirements. The company also received federal banking charter approval from the Office of the Comptroller of the Currency on December 12, 2025.

Circle’s recent financial performance demonstrates growing demand for stablecoin infrastructure. In the third quarter of 2025, the company reported revenue of $740 million, marking a 66% increase from the same period in 2024. Net income reached $214 million, up 202% year-over-year.

USDC’s market share has steadily increased throughout 2025. The stablecoin’s share of total stablecoin circulation grew from 23% in the third quarter of 2024 to 29% in the third quarter of 2025. Its share of transaction volumes jumped even more dramatically, from 30% to 40% during the same period.

The Road Ahead

The partnership between Circle and LianLian Global focuses on exploration and assessment rather than immediate product launches. Both companies will evaluate technical integration possibilities, test use cases, and identify the most promising opportunities for serving merchants in fast-growing markets.

As stablecoins become more embedded within global financial systems, partnerships between established payment providers and blockchain infrastructure companies will likely increase. The success of initiatives like this could determine whether stablecoins achieve mainstream adoption for everyday business payments or remain primarily a tool for crypto-native users.

You May Also Like

Qatar pushes tokenization with launch of QCD money market fund

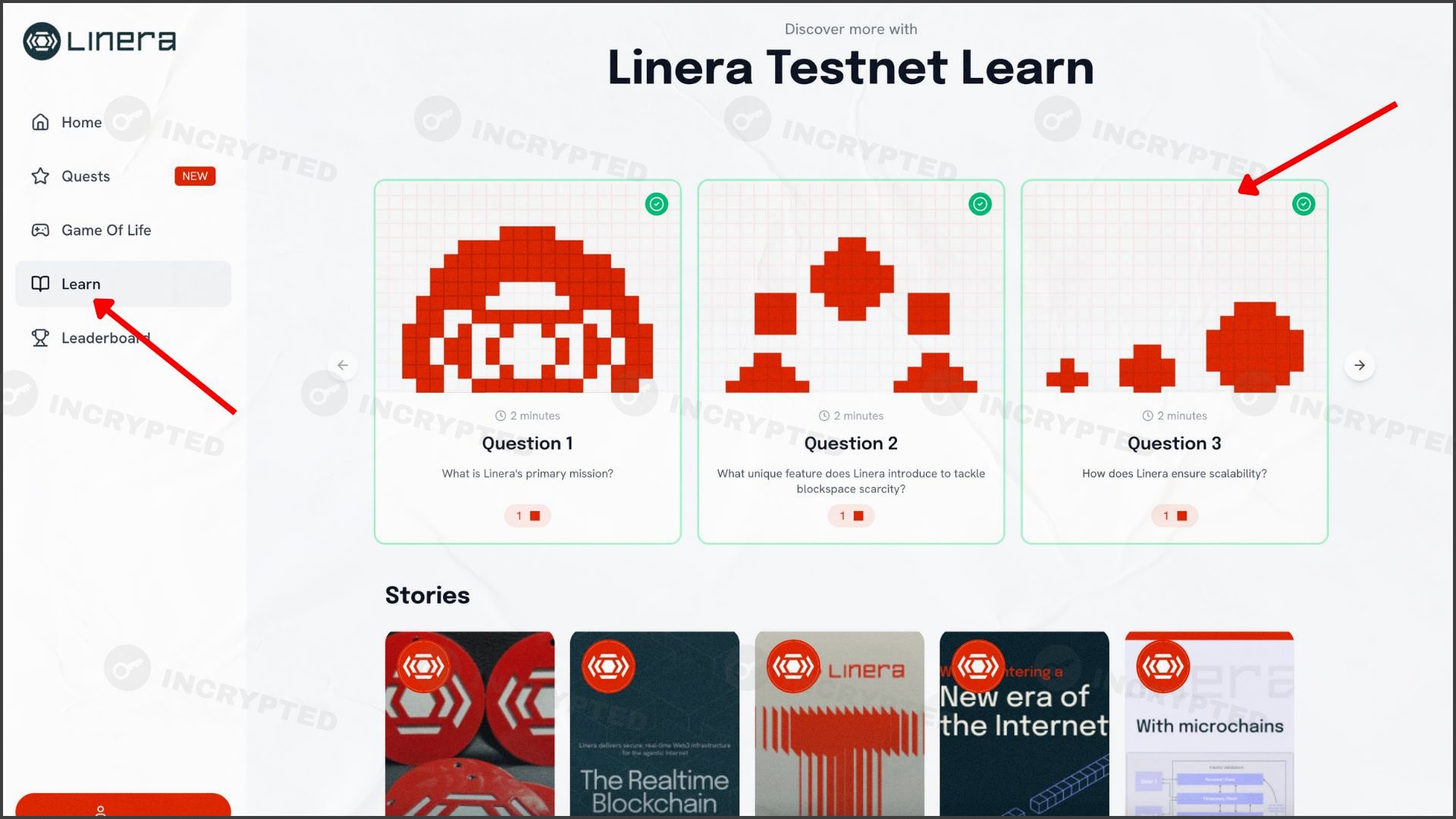

Linera — Testnet Conway