Binance Cleans House: New Listing Criteria Expose Blacklisted “Deal Brokers”

Binance has unveiled a major overhaul of its token listing process, aiming to improve transparency, tighten control, and eliminate fraudulent intermediaries that have plagued the exchange’s listing ecosystem.

The world’s largest cryptocurrency exchange announced third-party “deal brokers” are strictly prohibited from facilitating listings.

The company also released a blacklist of individuals and firms alleged to have misrepresented themselves, including BitABC, Central Research, May/Dannie, Andrew Lee, Suki Yang, Fiona Lee, and Kenny Z, signaling that legal action will be pursued against those engaging in such activity.

New Listing Standards Aim to Boost Visibility and Quality on Binance

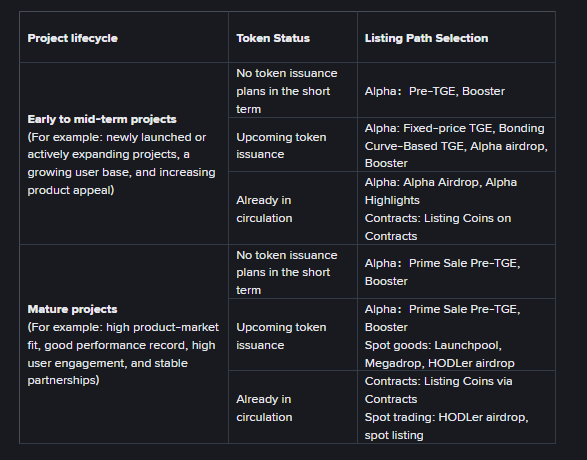

According to Binance, the new listing criteria cover the Alpha, futures, and spot markets and are designed to create a more structured and transparent framework for projects seeking exposure on the platform.

Binance’s Alpha platform targets early-stage tokens, providing distribution opportunities through Pre-TGE, Prime Sale, TGE community events, airdrops, and Booster programs, helping projects gain momentum before full market launches.

Source: Binance

Source: Binance

Binance’s contract platform allows users to access derivatives to hedge positions, establish long or short trades, or manage liquidity, while the spot platform remains the largest venue for direct trading and long-term holding of high-quality crypto assets.

The exchange also provides mechanisms like Launchpool, Megadrop, and HODLer airdrops to increase visibility for new projects, particularly those that have demonstrated progress, strong teams, and active communities.

Binance currently records $11.13 billion in 24-hour trading volume, reflecting a 28.2% decline over the same period. The exchange supports 441 listed coins across 1,638 trading pairs.

Binance Overhauls Listing Process After Criticism of Speculative Tokens

The new standards address several challenges Binance has faced over the past two years.

The exchange had previously announced token listings only hours before trading commenced, a practice that often caused price spikes on decentralized exchanges followed by rapid sell-offs on Binance itself, creating volatility that hurt late entrants.

Binance also confronted criticism for listing speculative or low-quality projects that failed to deliver long-term value, contributing to market losses and investor distrust.

Additionally, third-party intermediaries claiming to guarantee listings had become a major source of scams, misleading project teams and creating confusion around the legitimate application process.

These changes follow longstanding concerns expressed by Binance founder Changpeng Zhao, who in February 2025 described the listing process as flawed.

Zhao noted that the short interval between listing announcements and actual trading created opportunities for rapid price manipulation and undermined confidence in the process.

Binance has since moved to introduce more structured due diligence, community co-governance voting for listing and delisting tokens, and a monitoring zone for projects that fail to meet ongoing reporting or activity requirements.

Community members can vote on whether projects should remain listed, adding a layer of public oversight.

Crypto Founders Raise Concerns About Binance’s Listing Requirements

The overhaul also comes amid high-profile controversies surrounding listing practices.

In October, CJ Hetherington, founder of the prediction market startup Limitless, claimed that Binance demanded 8% of his project’s token supply plus $2 million in additional payments to secure a listing and alleged that the exchange engaged in token “dumping” post-listing.

Binance initially responded with threats of legal action, labeling Hetherington’s posts “false and defamatory,” though the company later acknowledged some of the details regarding token allocations.

Binance maintains that it does not profit directly from listing fees, asserting that allocated tokens are used for marketing, airdrops, and other initiatives that benefit users, rather than the exchange itself.

Despite the controversies, many crypto founders still view a Binance listing as highly desirable, given the exposure and liquidity the platform provides, though some have criticized the process as “predatory” or overly complex.

You May Also Like

JPMorgan’s Sobering Reality Check On The $1 Trillion Dream

Will XRP Price Increase In September 2025?