Automated Crypto Trading Gains Momentum as Retail and Institutional Investors Seek an Edge

Here’s the thing about crypto markets: they don’t take breaks. Not on weekends. Not on holidays. Not at 3 AM when you’re asleep. They just keep running, 24/7, across hundreds of exchanges scattered around the globe.

Why Bots Are Taking Over – And What It Means for Traders

That’s exhausting if you’re a human. If you’re a bot? No big deal.

It’s no surprise, then, that automated trading has taken off in crypto. Both everyday investors and big institutional players have started leaning heavily on algorithms to do the heavy lifting. By some estimates, bots now handle a huge chunk of daily trading volume—and that number keeps climbing.

The logic is simple. Bots watch markets around the clock. They spot opportunities in milliseconds. They don’t panic sell during a dip or hesitate when they should pull the trigger. In a market where prices can swing wildly in minutes, that kind of discipline pays off.

So What’s Behind This Shift?

A few things came together at once.

Volatility is the obvious one. Bitcoin dropping 8% overnight isn’t unusual. Altcoins can moon or crater within hours. If you’re trying to trade those moves, every second counts. Humans simply can’t compete with software when speed is the game.

The tools have also gotten way better. A few years back, most crypto bots were janky and hard to use. You practically needed a computer science degree to get them running. Now? Platforms offering crypto trading bot development have cleaned things up considerably. The interfaces are friendlier, the strategies are more customizable, and you don’t need to touch any code if you don’t want to.

Then there’s the institutional wave. Hedge funds and trading firms that spent years perfecting algorithms in traditional markets have started applying those same playbooks to crypto. They expect professional-grade tools—and that demand has pushed the whole industry to level up.

Arbitrage: Making Money From Market Quirks

Not every trading strategy is about guessing which way prices will go. Some are about spotting inefficiencies and pouncing before anyone else notices. That’s arbitrage in a nutshell. You find Bitcoin selling for $50,000 on one exchange and $50,150 on another. Buy low, sell high, pocket the difference. Rinse and repeat.

Sounds easy, right? In theory, sure. In practice, those price gaps last seconds—sometimes less. By the time you’ve logged into both exchanges and placed your orders manually, the opportunity has vanished.

This is where a proper crypto arbitrage bot earns its keep. It watches dozens of exchanges at once, factors in every fee and delay, and moves instantly when the numbers line up. No second-guessing. No “I should have clicked faster.”

If you’re someone who hates the stress of predicting market direction, arbitrage might be more your speed. You’re not gambling on price movements—you’re just collecting money from gaps that shouldn’t exist but do. The individual profits are modest, sure. But you’re also not betting the farm on whether some coin pumps or dumps.

Picking the Right Bot (Harder Than It Sounds)

The market is flooded with options now, which is both good and bad. Good because there’s something for everyone. Bad because sorting through the noise takes real effort.

Some bots specialize in one strategy—grid trading, DCA, trend following. Others try to do everything. Some are plug-and-play for beginners. Others assume you already know what you’re doing and give you a million settings to tweak.

Security should be at the top of your checklist. These bots need API access to your exchange accounts. That means you’re trusting them with your money. A sketchy bot—or one with weak security—can get your account drained fast.

If you’re trying to figure out where to start, resources like “What’s the Best Crypto Trading Bot?” break down what actually matters: which exchanges are supported, what strategies are available, how security is handled, what kind of track record the platform has, and how much it’ll cost you.

How Institutions Think About This Stuff

Big money players don’t approach trading bots the same way a retail trader does. Their concerns go way beyond “does this strategy make money?”

Compliance matters. Audit trails matter. Integration with existing portfolio systems matters. They need bots that play nice with cold storage, multi-sig wallets, and prime brokers. The technical bar is much higher.

Plenty of institutional players skip the off-the-shelf stuff completely. They want bots built specifically for them. That means months of security audits, stress tests that simulate the craziest market conditions imaginable, and ongoing refinements as the landscape shifts. Does it cost a lot? Absolutely. But when you’re pushing serious volume, a generic solution isn’t going to cut it—and the potential downside of getting it wrong dwarfs the development costs.

Reality Check: Bots Aren’t Magic

Let’s be clear about something. Automated trading doesn’t guarantee profits. Markets can move in ways that break even the smartest algorithms. Flash crashes happen. Exchanges go offline. Liquidity dries up right when you need it most.

Newcomers love to over-optimize. They tweak and tune until their strategy looks unbeatable in backtesting. The historical returns are insane. Then they go live—and everything falls apart. The problem? They built a system that’s perfect for conditions that already happened. It can’t adapt to anything new. This is called curve fitting, and it catches people all the time. The backtest isn’t lying exactly, but it’s also not telling the whole truth.

Exchange risk is the other thing people forget about until it’s too late. Doesn’t matter if your bot is printing money if the platform holding your funds suddenly freezes withdrawals or gets breached. Your algorithm can’t trade its way out of a hacked exchange. This isn’t some rare hypothetical—it happens, and when it does, people lose everything.

The takeaway here is simple: don’t treat bots like a set-it-and-forget-it goldmine. They’re tools—useful ones, but still just tools. Diversify across exchanges. Run different strategies. Monitor your results. And for your own sake, keep your expectations in check.

Where This Is All Heading

The direction seems pretty clear at this point. Automated trading is going to keep growing its share of crypto markets. The tools will get better. More institutions will pile in. Eventually, running a bot might feel less like an edge and more like table stakes.

For everyday traders, getting started has never been easier. For institutions, the available solutions have never been more sophisticated. And for the market overall, more algorithmic activity could mean tighter spreads and faster price discovery.

Whether you see that as exciting or intimidating probably depends on whether you’re ready to adapt.

This is a partner sponsored article

You May Also Like

Qatar pushes tokenization with launch of QCD money market fund

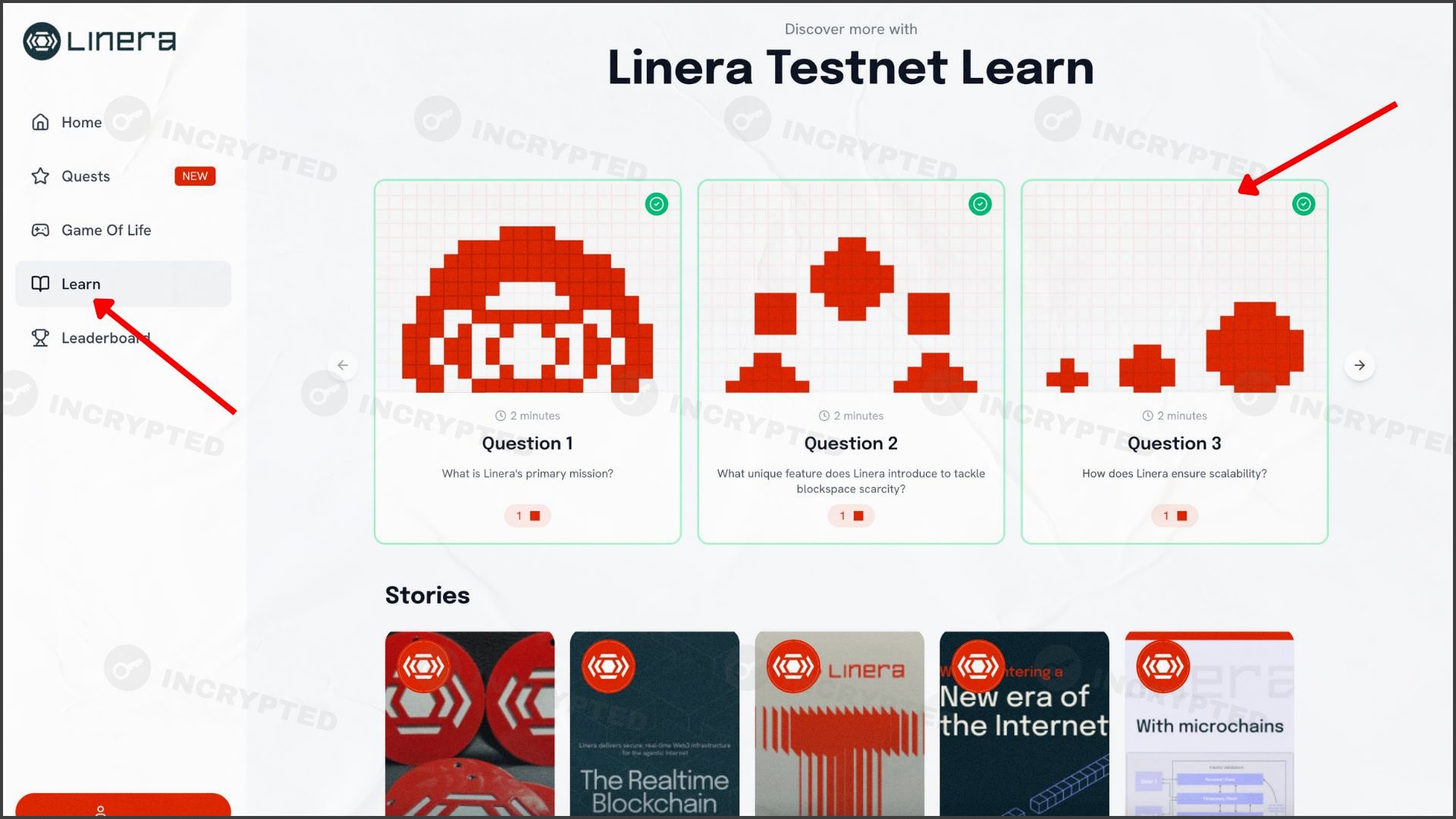

Linera — Testnet Conway