Ripple, Securitize Partner to Enable RLUSD Exchange for BlackRock, VanEck Tokenized Funds

BlackRock BUIDL and VanEck VBILL tokenized funds shareholders will now be allowed to exchange their shares for Ripple’s RLUSD, a US dollar-pegged stablecoin, in a new partnership between Securitize and Ripple.

This new feature was announced on September 23 in a press release published on Securitize’s website. Securitize is the company behind BlackRock’s, VanEck’s, and other institutions’ tokenization activities, being a world leader in tokenizing real-world assets with over $4 billion AUM as of May 2025.

Initially, the RLUSD exchange will only be available for BlackRock’s BUIDL, with VanEck’s VBILL integration planned for the “coming days.”

Carlos Domingo, co-founder and CEO of Securitize, also commented on the partnership, saying it is “a major step forward in automating liquidity for tokenized assets.” The company is also integrating with the XRP Ledger, going beyond a simple RLUSD exchange feature.

Tokenized Funds: BlackRock’s BUIDL and VanEck’s VBILL

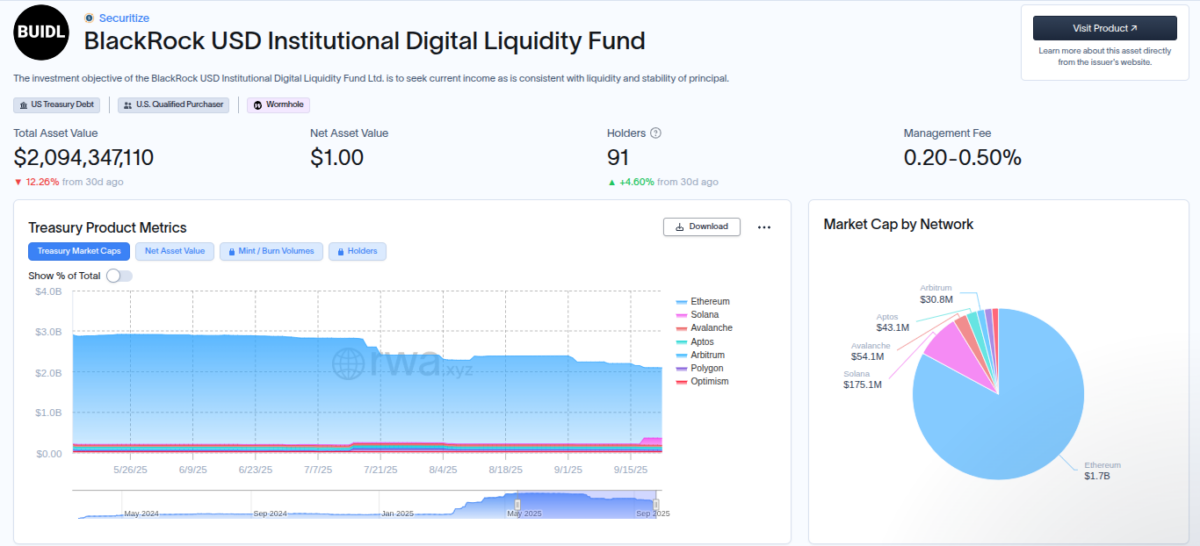

BlackRock launched BUIDL in partnership with Securitize on March 20, 2024. The fund offers exposure to qualified investors to US Treasury, cash, and repurchase agreements, currently with over $2 billion AUM among 91 holders, according to data from RWA.xyz.

BUIDL is available on seven blockchains: Ethereum ETH $4 163 24h volatility: 0.3% Market cap: $502.73 B Vol. 24h: $27.15 B , Solana SOL $216.8 24h volatility: 1.8% Market cap: $117.79 B Vol. 24h: $6.13 B , Avalanche AVAX $34.30 24h volatility: 7.6% Market cap: $14.48 B Vol. 24h: $2.21 B , Aptos APT $4.28 24h volatility: 1.0% Market cap: $3.01 B Vol. 24h: $537.93 M , Arbitrum ARB $0.43 24h volatility: 0.0% Market cap: $2.34 B Vol. 24h: $249.86 M , Polygon, and Optimism OP $0.69 24h volatility: 0.7% Market cap: $1.24 B Vol. 24h: $120.17 M . The fund distributes income daily, charges a management fee of 0.20-0.50%, and has seen monthly transfer volumes of around $425 million, underscoring its appeal for DeFi integrations and stable yield generation.

BlackRock USD Institutional Digital Liquidity Fund | Source: RWAxyz

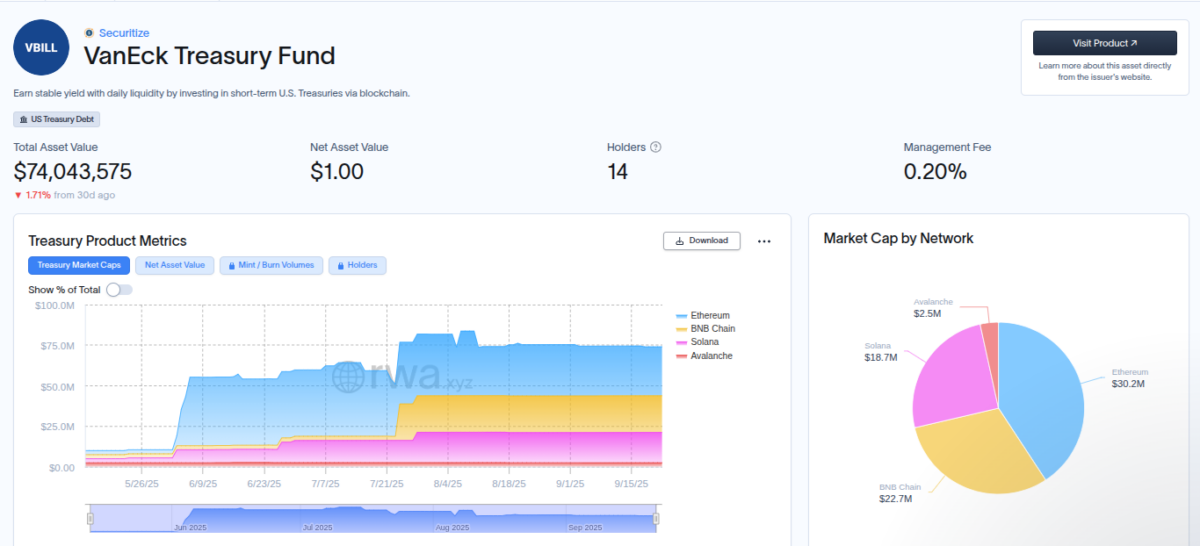

Building on this momentum, VanEck entered the tokenized fund space with its Treasury Fund, VBILL, launched on May 13, 2025, also in collaboration with Securitize. As VanEck’s inaugural tokenized offering, VBILL provides blockchain-based access to short-term US Treasuries, targeting qualified investors with a lower entry point of $100,000.

VBILL currently has 14 holders and a $74 million AUM, available on four blockchains: Ethereum, BNB Chain BNB $1 012 24h volatility: 2.2% Market cap: $141.00 B Vol. 24h: $1.85 B , Solana, and Avalanche.

VanEck Treasury Fund | Source: RWAxyz

The recently added liquidity against RLUSD, promised to work 24 hours a day, seven days a week, could increase the accessibility and demand for both tokenized products—boosting the market’s interest in these real-world asset tokens. Tokenization has become a popular topic on Wall Street and among institutional investors, with Nasdaq already moving to facilitate tokenized stock trading with the Securities and Exchange Commission (SEC), as Coinspeaker reported.

nextThe post Ripple, Securitize Partner to Enable RLUSD Exchange for BlackRock, VanEck Tokenized Funds appeared first on Coinspeaker.

You May Also Like

Intel Spikes 23% on Deal With Nvidia to Develop AI Hardware

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected