Tether Gold (XAUT) bridges the gap between traditional gold investment and decentralized finance (DeFi), providing investors with opportunities to utilize gold-backed digital assets within blockchain ecosystems. As of 11 November 2025, understanding XAUT’s integration in DeFi protocols is crucial for leveraging liquidity, yield, and portfolio efficiency.

What Is DeFi Integration for XAUT?

DeFi integration allows XAUT tokens to be used in decentralized applications, lending platforms, and liquidity pools. This enables investors to earn returns, participate in automated trading strategies, or utilize gold-backed tokens as collateral without converting them to fiat currency.

Benefits of Using XAUT in DeFi

Enhanced Liquidity

Tokens can be deployed in smart contracts, increasing circulation and market activity.Yield Opportunities

Participating in DeFi protocols allows investors to earn interest or rewards on XAUT holdings.Portfolio Flexibility

XAUT can serve multiple roles, from collateral for loans to liquidity provision, diversifying use beyond simple storage of value.

Security Considerations

While DeFi integration expands utility, investors must be aware of potential risks:

Smart Contract Vulnerabilities

Protocols should be audited to prevent exploits or loss of tokens.Platform Reliability

Selecting reputable DeFi applications reduces operational and counterparty risk.Network Fees

Transactions within DeFi may incur blockchain network fees that impact net returns.

Trading and Liquidity Management

MEXC provides a secure environment for spot trading XAUT before deploying tokens to DeFi protocols. Real-time pricing allows investors to determine optimal entry points for DeFi participation:

https://www.mexc.com/price/XAUT

Spot trading on MEXC ensures liquidity and flexibility for adjusting positions:

https://www.mexc.com/exchange/XAUT_USDT

Strategic Use Cases

Collateral for Loans

XAUT can be used as a secure, gold-backed asset in lending protocols.Liquidity Provision

Investors can supply XAUT to liquidity pools to earn rewards.Yield Farming

Combining XAUT with other digital assets can generate compound returns while retaining gold exposure.

Tracking and Managing DeFi Positions

Monitoring positions is essential to manage risk and maximize returns. Investors should track interest rates, token valuation, and protocol security. Integrating XAUT with DeFi requires ongoing attention but provides significant opportunities for portfolio optimization.

Conclusion

Tether Gold’s integration in DeFi protocols extends its utility beyond traditional investment, allowing gold-backed digital assets to generate returns, serve as collateral, and participate in decentralized financial strategies. As of 11 November 2025, XAUT combines gold’s stability with blockchain efficiency, offering investors both security and dynamic opportunities within modern digital finance.

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact [email protected] for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Learn More About DeFi

View More

The Role of USDT in Decentralized Finance (DeFi) Yield Farming

The Evolution of Tether: From RealCoin to Global Stablecoin Dominance

BONE & LEASH Tokens Explained: Your Complete Guide to the Shiba Inu Ecosystem

Latest Updates on DeFi

View MoreInternational DeFi Outlook: Growth or Slowdown?

Block Sec Arena Taps Conflux to Boost Web3 Security and Adoption

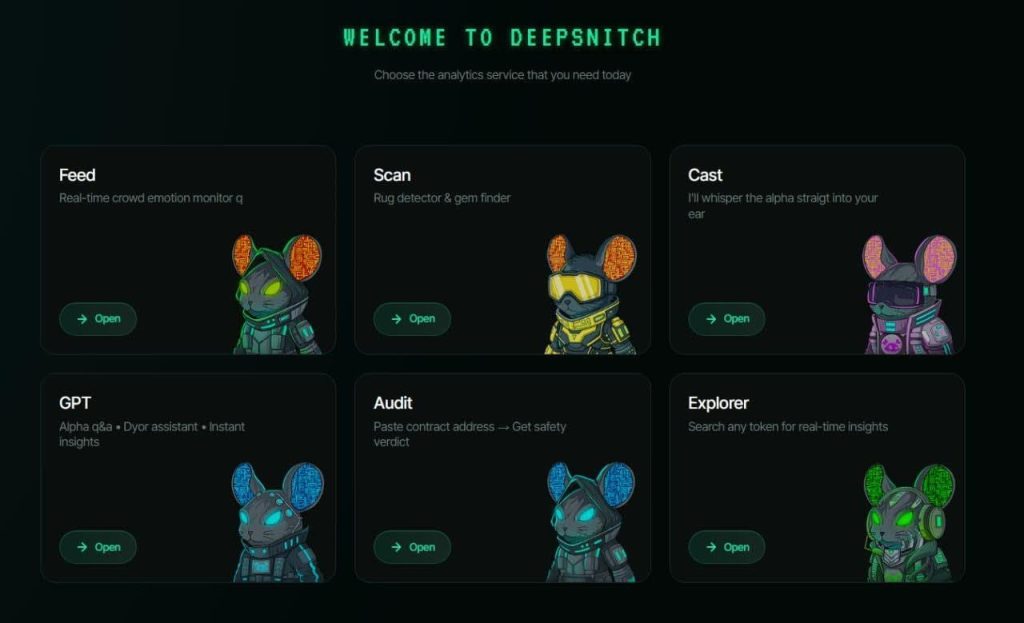

BlockDAG Price Prediction Withers in the Face of Hard Questions in 2026 as Toncoin Pulls Through and DeepSnitch AI Readies for Upcoming Moonshot Launch

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading